Search Georgia Property Records

Georgia property records are public documents. You can search them online. The Georgia Superior Court Clerks' Cooperative Authority maintains a statewide real estate index. County tax assessors keep property valuation records. These records show who owns land, what it is worth, and if any liens exist. You can access most Georgia property records from your home computer today.

Georgia Property Records Quick Facts

Where to Find Georgia Property Records

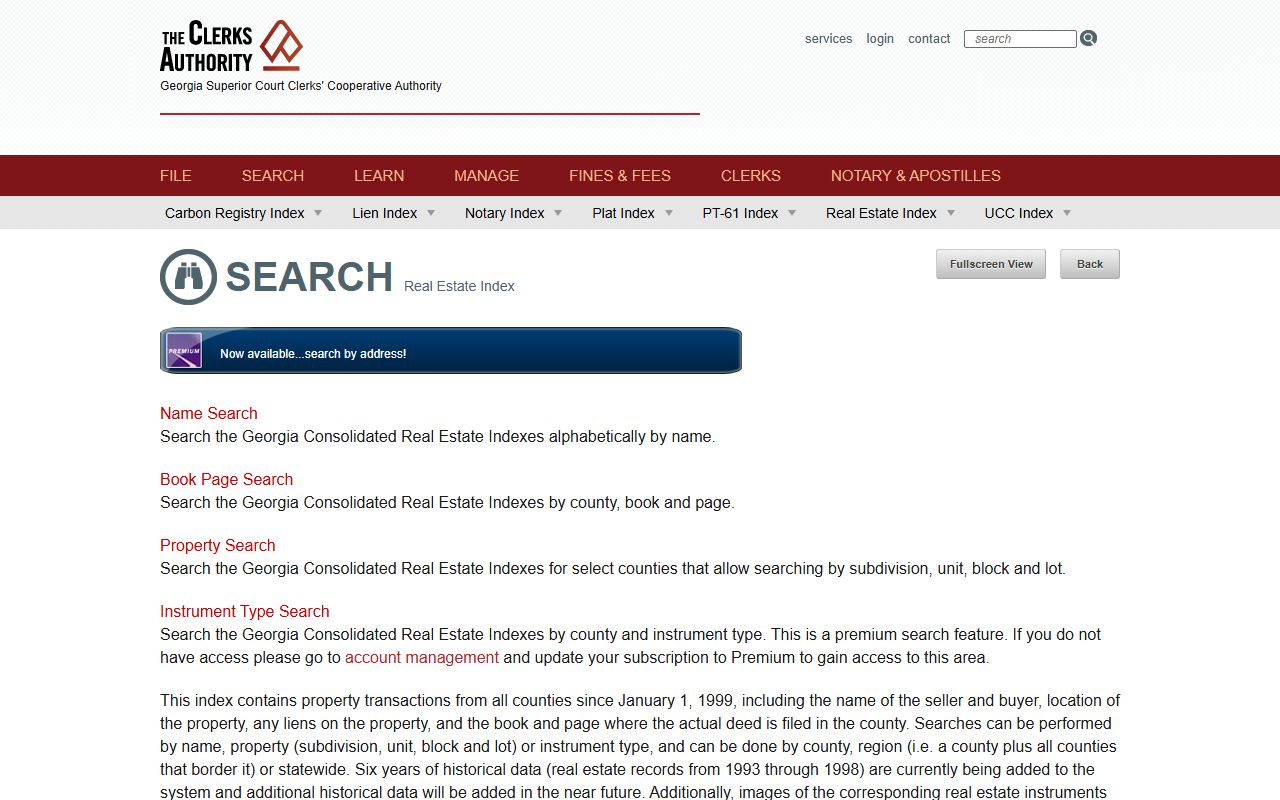

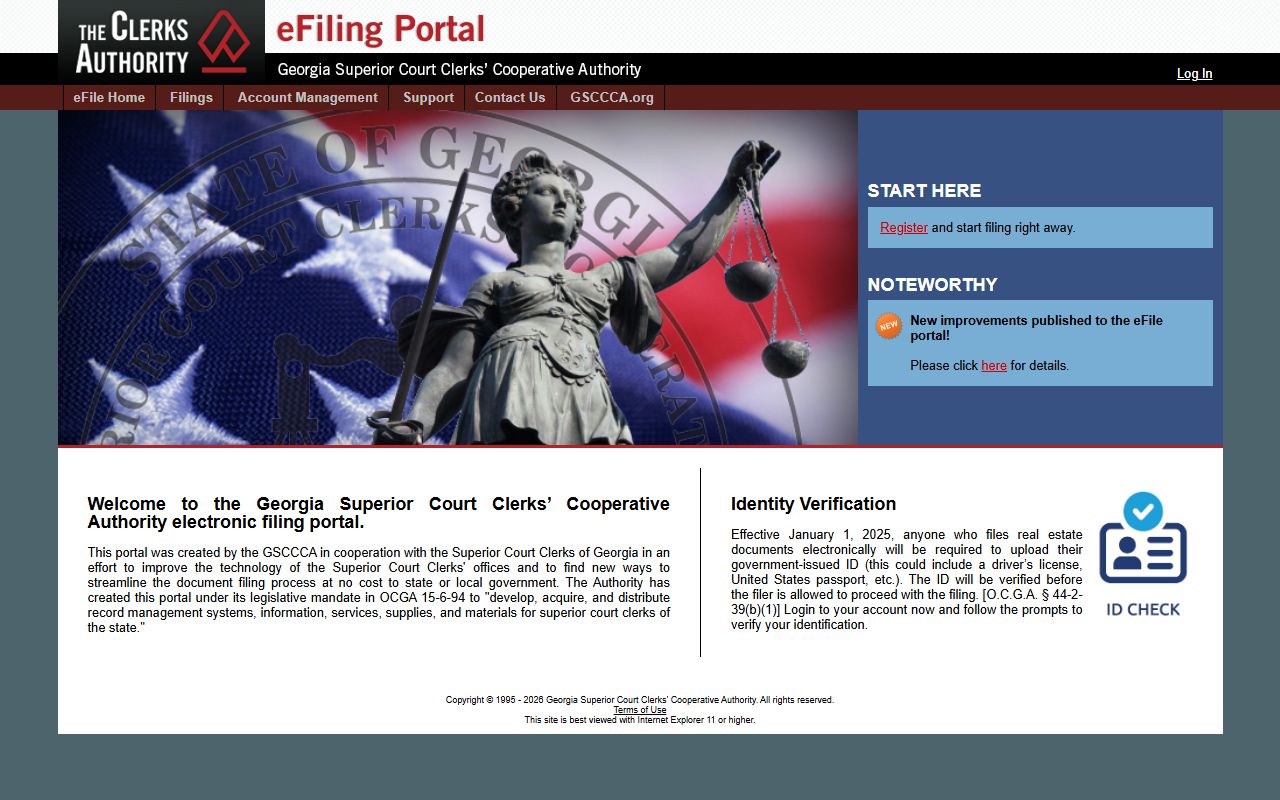

You have several options for finding property records in Georgia. The best source depends on what you need. The GSCCCA real estate index holds deed records from all counties. You can search by name, property, or instrument type. This database covers transactions since January 1, 1999. It includes the name of sellers and buyers, property location, and any liens. The book and page numbers show where deeds are filed.

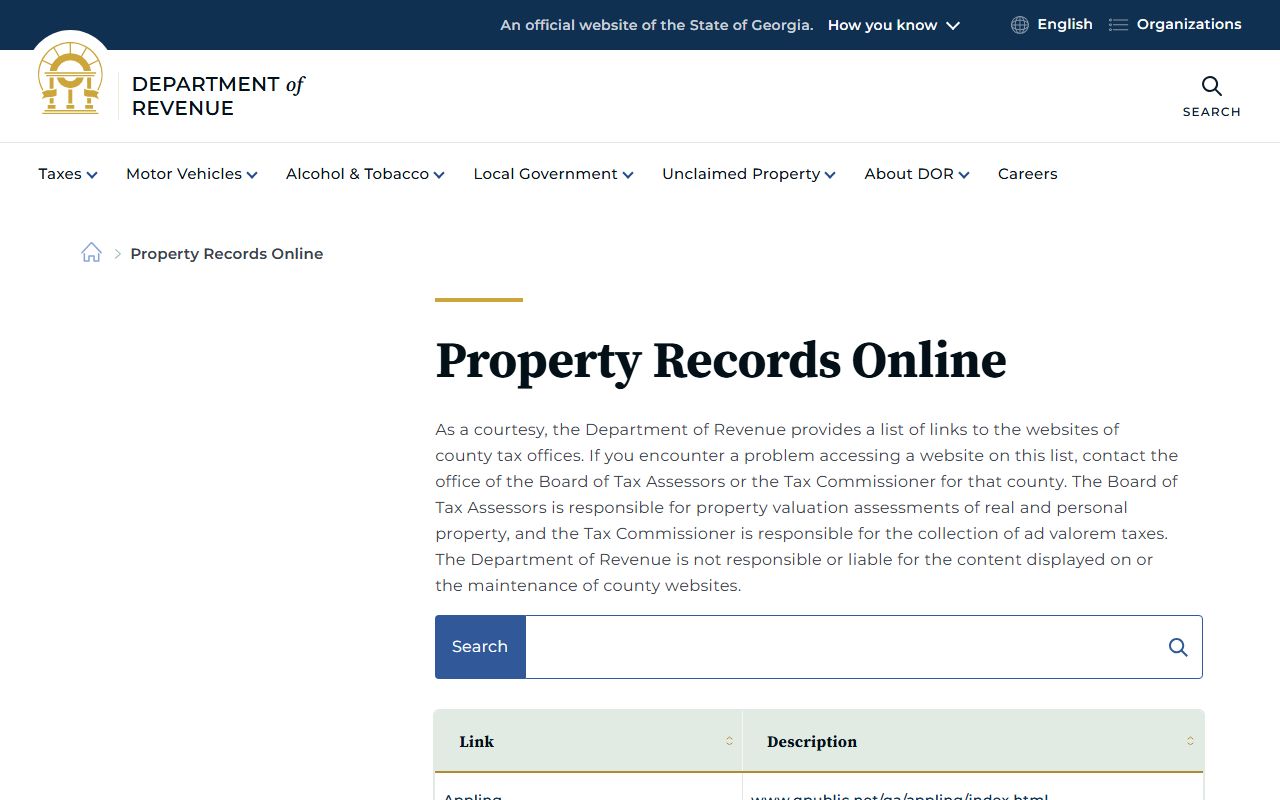

County tax assessors maintain property valuation records. They set the value for tax purposes. The Board of Tax Assessors places a fair value on all taxable property. Georgia law requires property to be assessed at 40% of fair market value under O.C.G.A. § 48-5-7. You can search these records through county websites or the QPublic portal. Many counties offer online access to parcel data and tax information.

The Georgia Department of Revenue provides a courtesy list of county tax office links. You can find your local assessor through their website. Property tax returns must be filed between January 1 and April 1 each year. The Tax Commissioner collects ad valorem taxes based on these assessed values.

Note: All real and personal property is taxable unless exempted by law under O.C.G.A. § 48-5-3.

How to Search Property Records in Georgia

Georgia makes it easy to search property records. You can use state and county websites. The GSCCCA portal lets you search statewide. You need a name, address, or parcel number. You can also search by subdivision, unit, block, and lot in select counties. The system shows property transactions from all 159 counties.

County assessor websites offer local property searches. Most use the QPublic system. You can look up parcels by owner name or address. These sites show assessed values, exemptions, and tax bills. Some counties have their own portals with more detail.

To search property records effectively, you will need:

- Owner name or parcel identification number

- Property address or legal description

- County where the property is located

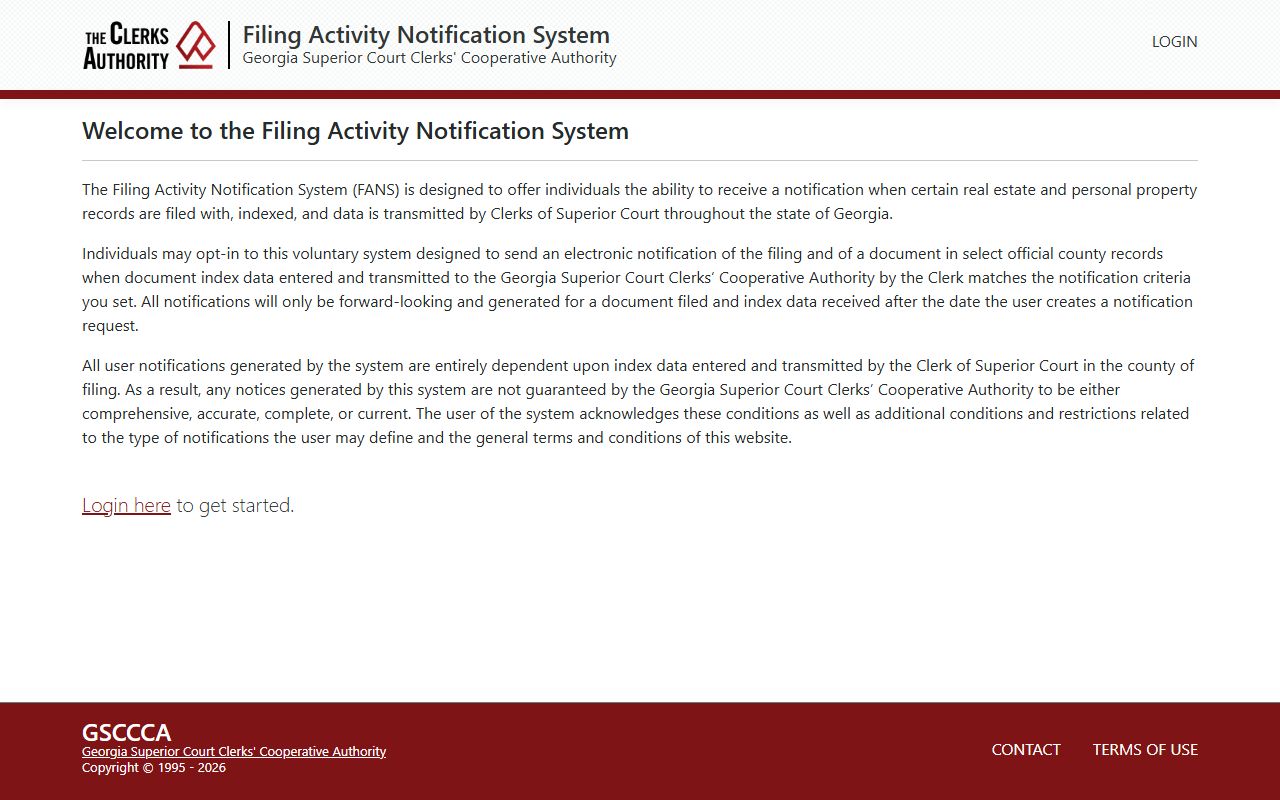

The GSCCCA real estate index accepts various search methods. You can search by grantor or grantee name. Book and page searches find specific documents. Property searches work by subdivision and lot. Premium accounts add instrument type searches. FANS lets you monitor filings on your property for free.

Types of Georgia Property Records

Georgia property records include many document types. Deeds show property transfers. The warranty deed guarantees clear title. The quitclaim deed transfers whatever interest the grantor has. Security deeds act as mortgages. These records are at the Clerk of Superior Court.

Tax records show property values and taxes owed. The assessment notice states your property's fair market value. Georgia defines this as what a willing buyer would pay. The assessed value is 40% of that amount under O.C.G.A. § 48-5-2. Tax bills come from the Tax Commissioner.

Liens affect property titles. Tax liens come from unpaid property taxes. Mechanics liens come from unpaid construction work. Hospital liens attach to personal injury settlements. UCC filings secure personal property loans. These records are public and searchable.

Georgia property records typically include these details:

- Current owner name and mailing address

- Legal description and parcel boundaries

- Assessed value and fair market value

- Tax amount and payment status

- Deed book and page references

- Outstanding liens or encumbrances

- Zoning and land use information

Plats show property surveys and subdivisions. These maps define lot boundaries. They are recorded with the Clerk of Superior Court. You can search them through GSCCCA or county offices.

Georgia Property Records State Agencies

Several state agencies handle property records. The Georgia Superior Court Clerks' Cooperative Authority runs the main database. Their real estate index covers all counties. You can access it at search.gsccca.org. They also offer eFiling for deeds and plats. As of January 1, 2025, HB 1952 requires electronic filing.

The Georgia Department of Revenue oversees property tax assessment. They provide guidance to county assessors. Their website lists all county tax offices. You can find assessment rules and appeal procedures there. Visit dor.georgia.gov for county links.

The State Properties Commission manages state-owned land. Their BLLIP system tracks government property. You can search state leases and buildings. This helps if you need records about public land.

The Georgia Archives preserves historical tax records. They hold county tax digests from 1783 to 2002. Most years from 1872 to 2002 are complete. These records show who owned property and what taxes they paid. Visit georgiaarchives.org for more info.

Georgia Property Records Filing and Fees

Filing property documents requires following state rules. Deeds must be notarized. They need witness signatures. The first page needs a three-inch top margin. Other margins must be one inch. You must include a return address and legal description. Property transfers need a PT-61 transfer tax form.

Recording fees vary by document type. Standard recordings cost $25 per document under HB 288. Cancellations and releases cost $25 each. Plat recordings cost $10 per page. Tax liens have different fees. Check with your county Clerk of Superior Court for current rates under O.C.G.A. § 15-6-98.

GSCCCA offers premium services for frequent users. Premium accounts cost $29.95 per month plus $0.50 per page. Regular accounts cost $14.95 per month plus $0.50 per page. Certified copies cost extra. UCC certified searches cost $15 per debtor name.

Property tax returns are free to file. You must file between January 1 and April 1. This applies to personal property and real property changes. Late filings may face penalties. Appeals must follow strict deadlines under O.C.G.A. § 48-5-311.

Protect Your Georgia Property Records

Property fraud is a growing concern. Georgia offers tools to protect your property. The Filing Activity Notification System is free. It alerts you when documents are filed with your name or address. You can sign up at fans.gsccca.org. This helps catch fraudulent deeds early.

Check your property records regularly. Look for unknown deeds or liens. Review your annual assessment notice. Make sure the owner information is correct. Report errors to your county assessor quickly.

Some records can be kept private. Georgia law lets certain people hide their address. Law enforcement officers can request non-disclosure. This removes personal information from public records under Senate Bill 215. Contact your county assessor to apply.

Note: The intent of Georgia tax law is to assess property at fair market value for cash sales, not forced sales, under O.C.G.A. § 48-5-1.

Are Georgia Property Records Public

Yes, most property records are public in Georgia. The Georgia Open Records Act guarantees access. O.C.G.A. § 50-18-72 covers property records. You can inspect and copy most documents. You do not need to give a reason for your request.

Some limits apply. Real estate purchase locations can be hidden. This applies while the state is buying land. After the purchase, records become public. Personal information may be redacted. This protects privacy for certain individuals.

Sealed records are rare in Georgia. Courts can seal records for good cause. This requires a hearing. The person asking must show strong reasons. Most property records stay open to the public.

Browse Georgia Property Records by County

Each of Georgia's 159 counties maintains property records. Select a county to find local assessor information and search resources.

Property Records in Major Georgia Cities

Georgia cities fall under county jurisdiction for property records. Pick a city to learn about local property search options.