Find Cobb County Property Records

Cobb County property records are available through the Board of Assessors and Tax Commissioner in Marietta. The county provides online property searches, tax bill payments, and assessment information. Residents can access deeds and real estate records through the Clerk of Superior Court.

Cobb County Board of Assessors

The mission of the Cobb County Board of Assessors is to produce an annual tax digest that conforms to the requirements of Georgia Law and the rules of the Georgia Department of Revenue. The Board places a fair and equalized value on all taxable property in Cobb County.

The Board of Assessors office is located at 736 Whitlock Avenue NW, Suite 200, Marietta, GA 30064. The phone number is 770-528-3100. Email inquiries can be sent to cobbtaxassessor@cobbcounty.gov. Visit assessor.cobbcounty.gov for online services.

January 1 of each year is the assessment date in Georgia. All property must be valued for ad valorem taxes based on its condition and use as of January 1. The Board reviews properties annually to ensure fair and accurate valuations.

The Board of Commissioners sets the millage rate for the county. The Tax Commissioner handles billing and collection. These three offices work together to administer the property tax system in Cobb County.

Note: The Board of Assessors is an independent body appointed by the Board of Commissioners.

Cobb County Tax Commissioner

The Cobb County Tax Commissioner collects property taxes and issues motor vehicle tags. This office mails tax bills based on assessments from the Board of Assessors. The Tax Commissioner accepts payments online, by mail, or in person.

The Tax Commissioner office is located at 736 Whitlock Avenue NW, Marietta, GA 30064. The phone number is 770-528-8600. Email inquiries can be sent to tags@cobbtax.gov. Visit cobbtax.gov for online tax payments and property searches.

Property tax bills are typically mailed in the fall. Payments are due by the date specified on the bill. Late payments incur penalties and interest. The Tax Commissioner offers various payment methods for convenience.

The online property search at cobbtax.gov/property allows users to view tax bills and payment history. Search by address, owner name, or parcel ID to access property information.

Cobb County Property Search

Cobb County provides online tools for searching property records. The Tax Commissioner website offers property lookup by address, owner name, or parcel identification number. This system displays current tax bills and payment status.

The property search system shows assessed values, exemptions, and tax calculations. Users can view property details including land and building values. The system also provides sales data for comparable properties in the area.

Online property searches are free and available 24 hours a day. No account is required to view basic property information. The database updates regularly to reflect new assessments and ownership changes.

Cobb County property records include the following details:

- Property owner name and mailing address

- Property address and legal description

- Current assessed value and fair market value

- Homestead and other exemptions

- Tax bill amount and due date

- Payment history and current balance

Property owners should review their records annually to ensure accuracy.

Cobb County Clerk of Superior Court

The Cobb County Clerk of Superior Court maintains real estate records for the county. Deeds, mortgages, liens, and other property documents are recorded and stored at the courthouse. These records establish ownership and identify claims against properties.

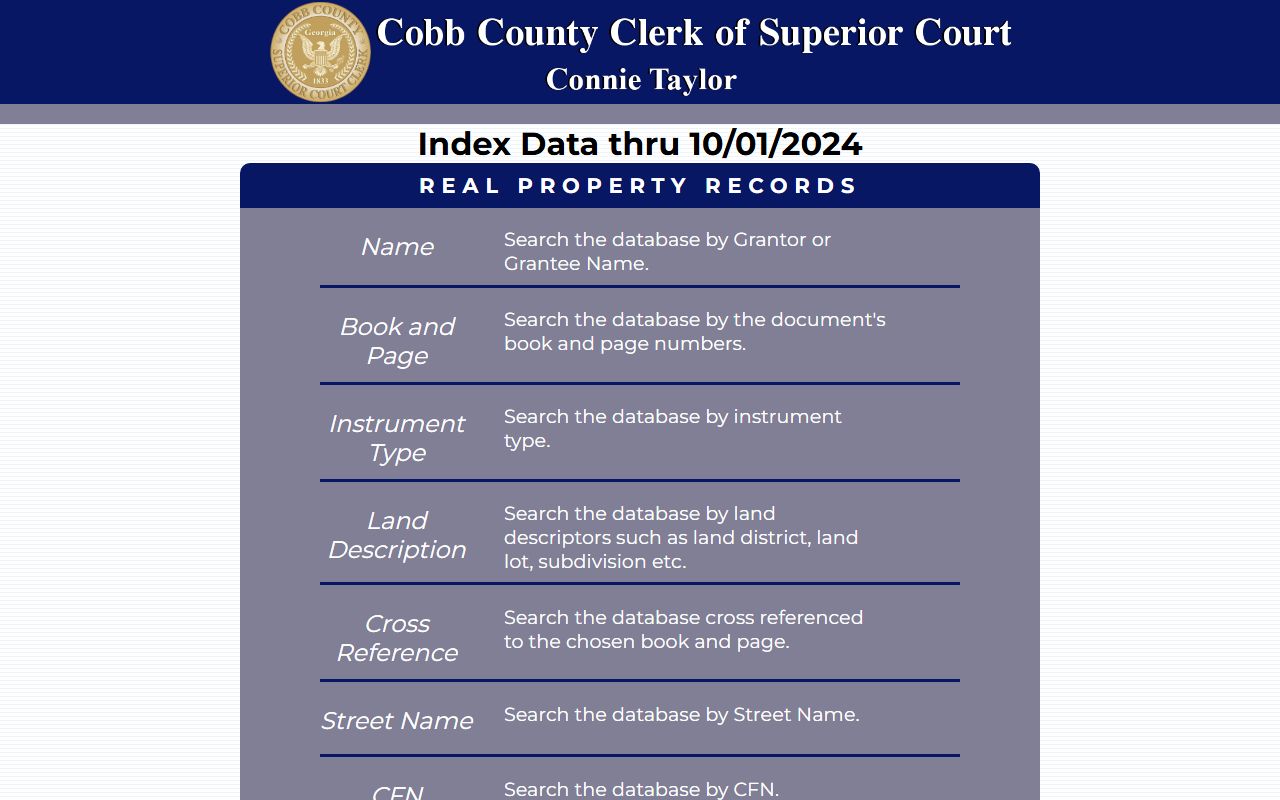

The Cobb County Superior Court Clerk provides online real estate searches through a dedicated research portal. Visit research.cobbsuperiorcourtclerk.com to search recorded documents. The system allows searches by name, property description, or document type.

The online system provides access to recorded documents from recent years. Older records may require an in-person visit to the courthouse. The Clerk's office can provide certified copies of documents for legal purposes.

Real estate records are essential for property transactions. Title companies and attorneys search these records to verify ownership and identify liens before closings.

Statewide Real Estate Records for Cobb County

The Georgia Superior Court Clerks' Cooperative Authority (GSCCCA) provides statewide access to real estate records. This system includes Cobb County property transactions from January 1, 1999 to present. The database shows property transfers, mortgages, and other recorded instruments.

Access the GSCCCA real estate search at search.gsccca.org/RealEstate. Search by grantor or grantee name across all Georgia counties. The system displays the book and page reference for each recorded document.

GSCCCA offers both free basic accounts and premium subscription services. Premium accounts provide advanced search features including instrument type searches. Document copies are available for a fee per page.

The Filing Activity Notification System (FANS) alerts property owners to new filings. Register at fans.gsccca.org to receive notifications when documents match your registered name or address.

Cobb County Property Appeals

Property owners in Cobb County have the right to appeal their assessments. The appeal period begins when assessment notices are mailed each year. Property owners have 45 days from the notice date to file an appeal.

To appeal, complete the appeal form included with your assessment notice. Submit the form to the Board of Assessors by mail or in person. Include any supporting documentation such as comparable sales or appraisal reports.

The Board of Assessors reviews appeals and may adjust values based on evidence. Appeals not resolved at this level may proceed to the Board of Equalization. Property owners may also choose arbitration or Superior Court as appeal options.

The appeal process ensures fair and equitable assessments across Cobb County. All property owners have equal rights to challenge their valuations.

Cobb County Property Records Contact Information

Cobb County residents can contact the appropriate office for property record assistance. The Board of Assessors handles assessments at 770-528-3100. The Tax Commissioner manages tax bills at 770-528-8600. Both offices are located at 736 Whitlock Avenue NW in Marietta.

Visit assessor.cobbcounty.gov for assessment information and exemption applications. Visit cobbtax.gov for tax payments and property lookups.

The Marietta location serves as the primary office for both departments. The historic courthouse district provides convenient access to county services. Parking is available near the government buildings.