Access Chatham County Property Records

Chatham County property records are available through the Board of Assessors and Tax Commissioner in Savannah. The county provides online property searches, assessment notices, and tax payment options. Residents can access deeds and real estate records through the Superior Court Clerk or GSCCCA.

Chatham County Board of Assessors

The Chatham County Board of Assessors maintains a superior level of customer service. The Board notifies the public of changes in property tax law. Georgia lawmakers pass new legislation each year that may affect taxpayers in Chatham County.

The Board of Assessors office is located at 222 W Oglethorpe Avenue, Suite 113, Savannah, GA 31401. The phone number is (912) 652-7271. The fax number is (912) 652-7301. Email inquiries can be sent to boa@chathamcounty.org. Office hours are Monday through Friday from 8:00 AM to 5:00 PM.

Visit boa.chathamcountyga.gov for online property searches and assessment information. The website provides tools for reviewing property values and filing exemption applications.

During the 2024 legislative season, Georgia lawmakers passed HB 206, HB 1267, HB 1292, SB 420, SB 496, SB 324, SB 508, HB 581, and HB 808. These bills make changes to property tax law. During the 2025 legislative season, lawmakers passed HB 92 which affects taxpayers in Chatham County.

Note: The Board of Assessors and Tax Commissioner are separate offices with different functions.

Chatham County Tax Commissioner

The Chatham County Tax Commissioner collects property taxes and provides motor vehicle services. This office mails tax bills based on assessments from the Board of Assessors. The Tax Commissioner accepts payments online, by mail, and in person.

The Tax Commissioner office is located at 222 W Oglethorpe Avenue, Suite 107, Savannah, GA 31401. The phone number is (912) 652-7100. The fax number is (912) 652-7101. Email inquiries can be sent to tax@chathamcounty.org. Office hours are Monday through Friday from 8:30 AM to 5:00 PM.

Visit chathamtax.org for online tax payments and property tax searches. The website provides access to current tax bills and payment history. The portal at tax.chathamcountyga.gov offers additional online services.

Tax bills are mailed based on assessments provided by the Board of Assessors. Property owners can pay taxes online through the secure payment system.

Chatham County Assessment Notice Changes

New legislation has changed the appearance of assessment notices in Chatham County. Georgia HB 581 and HB 92 introduced a revised state-wide notice format. Cities, counties, and school systems must now calculate and report their estimated rollback tax rates.

A rollback rate is the property tax rate that levying authorities may adopt when values increase. This rate collects the same amount of tax revenue as the prior year. The new notices show this information to help taxpayers understand their tax bills.

The revised notices still show property values and assessment information. Taxpayers should review their notices carefully each year. The 45-day appeal period begins when notices are mailed.

Property owners with questions about their notices can contact the Board of Assessors office in Savannah. Staff can explain the information shown on the notice and the appeal process.

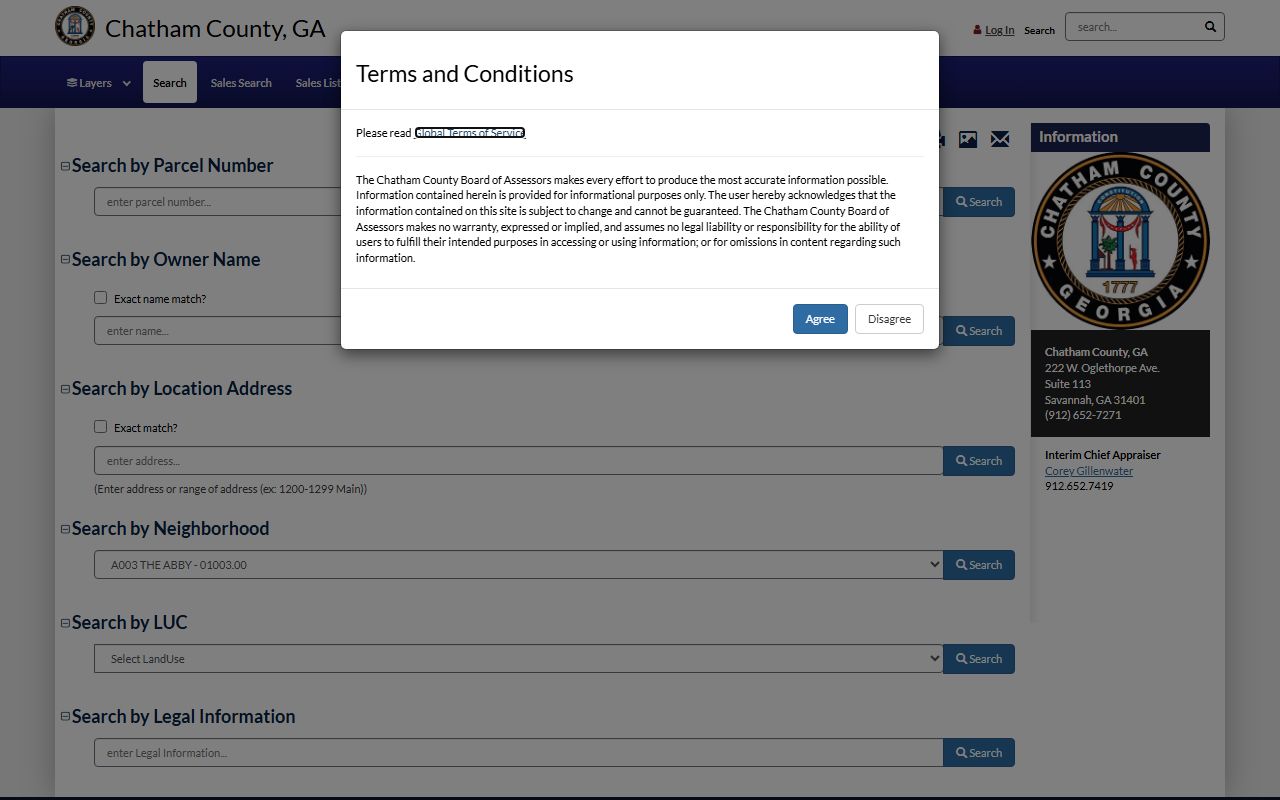

Chatham County Property Search

Chatham County provides online property search tools through QPublic. The system allows searches by property address, owner name, or parcel ID. Users can view assessment values, property characteristics, and tax information.

Access the online property search at qpublic.schneidercorp.com. The system displays current assessed values, exemptions, and property details.

The QPublic system is available 24 hours a day for property searches. No account registration is required to view basic property information. The database updates regularly to reflect assessment changes.

Chatham County property records include:

- Property owner name and mailing address

- Property address and legal description

- Current assessed value and fair market value

- Homestead exemptions applied

- Property characteristics and improvements

- Sales history and comparable data

Property owners can verify their assessment information before filing an appeal.

Chatham County Homestead Exemptions

Chatham County offers homestead exemptions for property owners who occupy their homes as primary residences. These exemptions reduce the taxable value of the property. Lower taxable values result in lower tax bills.

The standard deadline for homestead exemption applications is April 1 each year. Under Georgia HB 92, taxpayers can apply during the 45-day appeal window even if they missed the original deadline. Applications must be submitted in person during this time.

Property owners must occupy their home as of January 1 to qualify for that tax year. The home must be the owner's primary residence. Exemptions renew automatically each year once granted.

Contact the Board of Assessors office for information about available exemptions. Staff can explain qualification requirements and application procedures.

Chatham County Real Estate Records

Real estate records for Chatham County are maintained by the Superior Court Clerk. Deeds, mortgages, liens, and plats are recorded at the courthouse. These documents establish ownership and identify claims against property.

Chatham County real estate records are available online through the Georgia Superior Court Clerks' Cooperative Authority. The GSCCCA system provides access to records from 1999 to present. Visit search.gsccca.org/RealEstate to search statewide.

Effective January 1, 2025, all documents must be filed electronically through GSCCCA per House Bill 1952. This electronic filing requirement applies to all deeds, liens, UCCs, and plats.

The GSCCCA database shows property transactions from all Georgia counties. Search by grantor or grantee name, property description, or instrument type. The system displays the book and page reference for recorded documents.

Chatham County Property Records Contact

Chatham County residents can contact the appropriate office for property record assistance. The Board of Assessors handles assessments at (912) 652-7271. The Tax Commissioner manages tax bills at (912) 652-7100. Both offices are located on West Oglethorpe Avenue in Savannah.

Visit boa.chathamcountyga.gov for assessment information. Visit chathamtax.org for tax payment options.

The Savannah location provides convenient access to county services in the historic downtown area. Parking is available near the government offices.