Savannah Chatham County Property Records Search

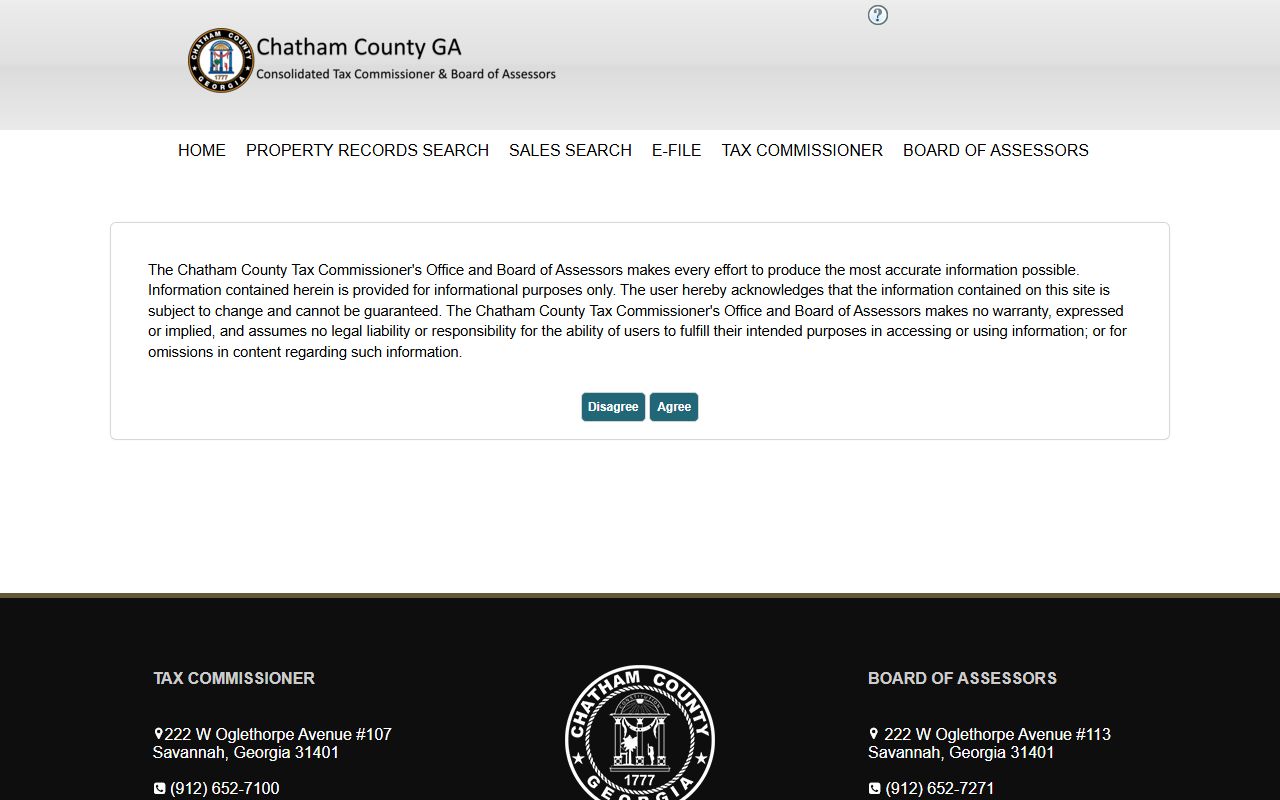

Savannah property records are maintained by Chatham County offices. The Board of Assessors handles property valuations for the city. The Tax Commissioner manages tax collection. These offices work together to serve property owners. You can search Savannah property records through the county's QPublic portal. Online access provides quick results for research needs.

Where to Find Savannah Property Records

The Chatham County Board of Assessors serves Savannah. Their office is at 222 W Oglethorpe Avenue Suite 113. They assess property at fair market value. Georgia law requires uniform standards. Their goal is superior customer service.

The Chatham County Tax Commissioner collects taxes. Their office is at Suite 107 in the same building. Phone (912) 652-7100. Email tax@chathamcounty.org. Hours are 8:30 AM to 5:00 PM weekdays.

QPublic provides online property searches. This portal covers Chatham County completely. You can search by owner name. Address searches find properties fast. Parcel IDs give direct access.

Note: Recent legislation including HB 581 and HB 92 have introduced changes to property tax notices and rollback rates in Chatham County.

How to Search Savannah Real Estate Records Online

The Chatham County QPublic portal offers comprehensive searches. Enter property address to begin. Owner name searches work well too. The system displays assessment details. Tax information appears alongside.

Assessment notices have a new format. Recent legislation changed the layout. HB 581 and HB 92 made updates. Rollback rates are now calculated. These appear on your notice.

A rollback rate maintains tax revenue. When values increase, rates may drop. This keeps collections level. Cities and counties calculate these. School systems participate too.

Homestead exemptions have new rules. HB 92 extended the application window. You can apply during the appeal period. Even if you missed April 1. Visit the office in person to apply.

Search Savannah records effectively:

- QPublic portal for assessments and parcel data

- Tax Commissioner website for bills and payments

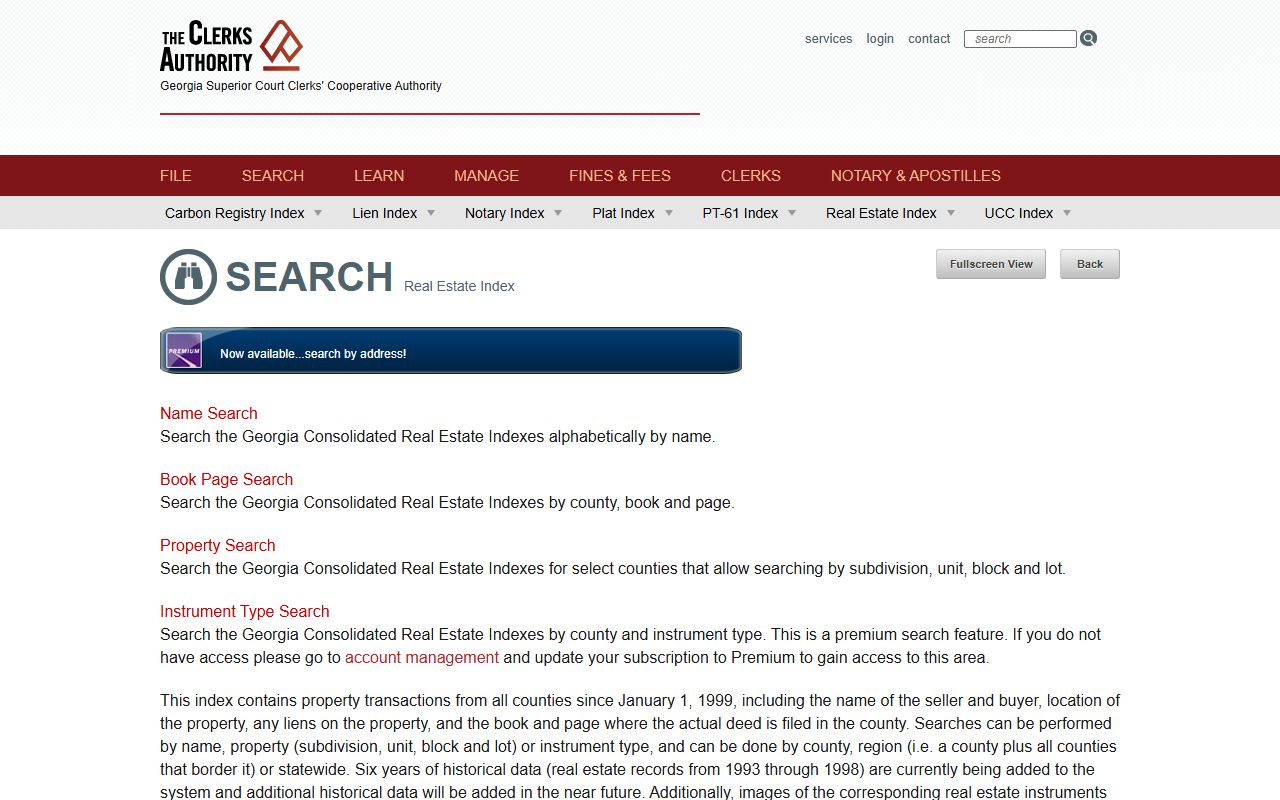

- GSCCCA for deed history statewide

- Board of Assessors for exemption applications

Types of Savannah Property Records Available

Savannah property records cover several categories. Real property includes land and structures. Personal property covers business equipment. Both are taxable under Georgia law. Exemptions may apply in some cases.

Deed records prove ownership. The Clerk of Superior Court maintains these. Warranty deeds guarantee clear title. Quitclaim deeds transfer existing rights. All deeds are public records.

Assessment records show property values. Fair market value is the standard. Assessors use comparable sales data. Values reflect market conditions. Appeals are allowed by law.

Tax records track bills and payments. The Tax Commissioner manages these. Due dates are clearly stated. Penalties apply to late payments. Installment options may be available.

Chatham County Offices for Savannah Property Searches

The Chatham County Board of Assessors educates taxpayers. They notify the public of law changes. Recent legislative updates are explained. HB 206, HB 1267, and others affected taxes. They help owners understand impacts.

Board members are appointed officials. They serve staggered terms. Meetings are open to the public. Policies are set at these meetings. Staff carry out daily operations.

Staff may visit properties for review. They carry photo identification badges. Vehicles are marked with county logos. This follows Georgia law requirements. Owners are notified of visits.

The Tax Commissioner provides payment services. Online payments are accepted. Various payment methods work. Questions about bills are answered. They work with taxpayers on issues.

Savannah Property Assessment Appeals Process

Chatham County property owners can appeal. Annual notices start the process. You have 45 days to respond. The deadline is on your notice. Do not miss this date.

The Board of Equalization hears appeals. This independent body reviews cases. Evidence is presented by both sides. Fair market value is debated. Written decisions follow hearings.

Homestead applications can be filed late. This is new under HB 92. The 45-day appeal window applies. Visit the office in person. Bring required documentation.

Rollback rates affect your taxes. These appear on new notices. They show potential rate changes. Higher values may mean lower rates. This keeps revenue neutral.

Note: Under Georgia HB 92, you can apply for homestead exemptions during the 45-day appeal window even if you missed the April 1 deadline.

Georgia State Resources for Savannah Property Searches

State databases support Savannah searches. GSCCCA covers all Georgia counties. Chatham County is fully included. The real estate index is comprehensive. Records date to 1999.

FANS offers free monitoring. Property owners in Savannah can register. You receive alerts about filings. Fraud is detected early. Peace of mind is valuable.

HB 1952 changed filing rules. Electronic filing is now mandatory. All Georgia counties follow this. Chatham County included. The change took effect January 1, 2025.

The Department of Revenue provides resources. They list all county tax offices. Chatham County appears on their site. Property tax facts are explained. State guidelines are published.

Related Savannah Property Record Resources

Chatham County includes Savannah and surrounding areas. State resources add to local options. Complete record access is available.