Columbus Muscogee County Property Records Search

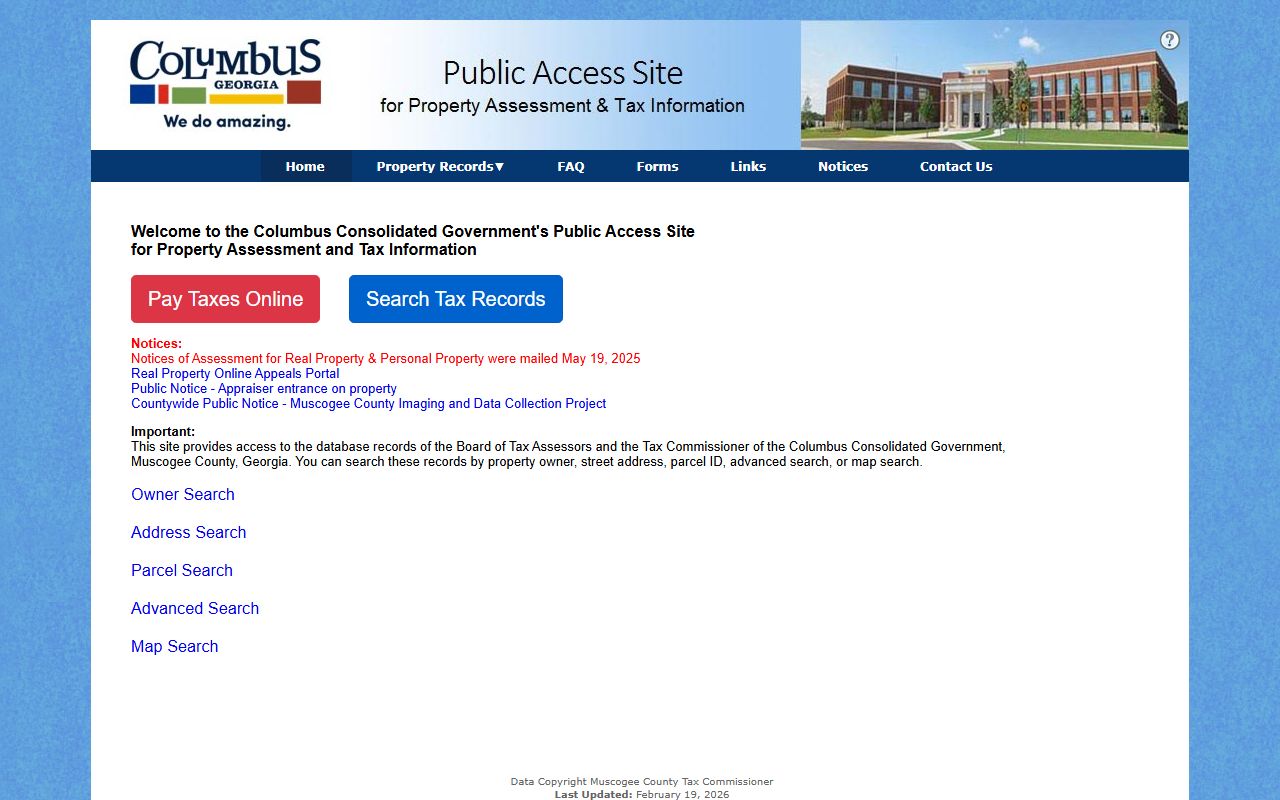

Columbus operates as a consolidated government with Muscogee County. This unified system simplifies property record searches. One department handles assessments and taxes. The public access portal provides comprehensive data. You can search Columbus property records by owner, address, or parcel ID. Online tools make research fast and easy.

Where to Find Columbus Property Records

The Columbus Consolidated Government manages property assessments. Their office is at 100 10th Street. The Tax Assessor's Office handles valuations. Real property staff can be reached at (706) 653-4398. Personal property uses (706) 653-4013.

The public access portal is the main search tool. It covers assessment and tax information. You can search multiple ways. Owner name searches work well. Address searches find properties quickly. Parcel ID searches give exact matches.

The Clerk of Superior Court maintains deed records. Their office is at 100 10th Street. Phone (706) 653-4370. Hours are 8:30 AM to 5:00 PM weekdays. Records are also on GSCCCA statewide.

Note: Assessment notices for real and personal property typically mail in mid-May each year.

How to Search Columbus Real Estate Records Online

The Columbus public access site offers multiple search options. You can search by property owner name. Street address searches are available. Parcel ID finds specific properties. Advanced search combines criteria. Map search shows geographic locations.

Assessment notices contain important information. They show fair market value for your property. The assessed value is 40% of this. Notices include appeal rights. You have limited time to file an appeal.

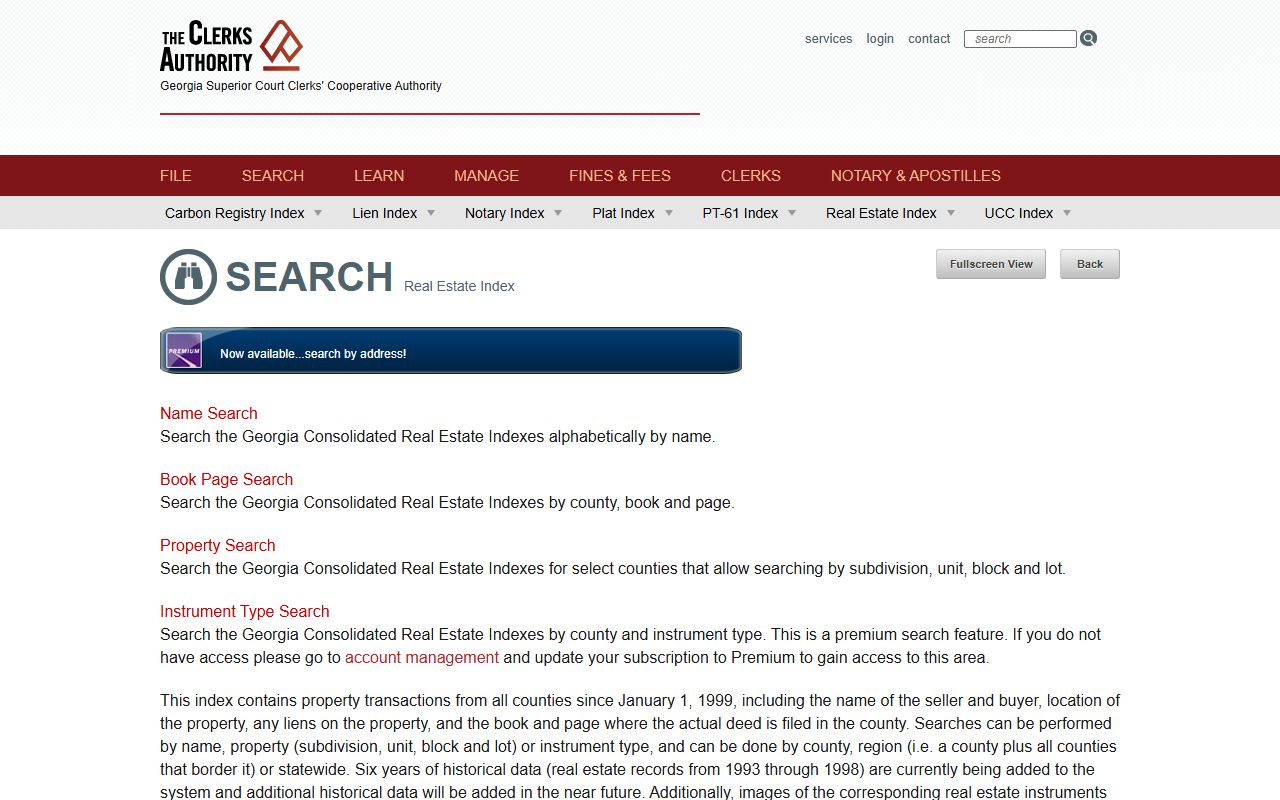

The GSCCCA portal supplements local searches. It covers deeds from all Georgia counties. Columbus transactions appear here. The index goes back to 1999. You can search by grantor or grantee name.

Use these methods for effective Columbus searches:

- Public access portal for assessments and taxes

- GSCCCA for deed and transaction history

- Clerk of Court office for recorded documents

- Tax Assessor for valuation questions

Types of Columbus Property Records Available

Columbus maintains several property record types. Real property records cover land and buildings. Personal property includes business equipment. Mobile homes have separate records. Each type has different search methods.

Deed records prove ownership transfers. Warranty deeds offer title guarantees. Quitclaim deeds transfer interests as-is. Security deeds secure mortgage loans. All require recording with the Clerk.

Assessment records show property values. The Tax Assessor determines fair market value. This follows Georgia legal standards. Values update based on market sales. New construction is reviewed promptly.

Tax records track payments and amounts due. The consolidated government collects taxes. Bills go out annually. Due dates are clearly stated. Penalties apply to late payments.

Muscogee County Offices for Columbus Property Searches

The Columbus Consolidated Government Tax Assessor's Office serves property owners. They provide public access to records. Their website offers online search tools. You can view property details instantly. Maps show parcel boundaries clearly.

Real property assessments are their main duty. They value land and improvements. Personal property is assessed too. Business inventory and equipment count. All tangible property is taxable.

The online appeals portal is available. Property owners can file appeals electronically. This saves time and travel. You still need supporting evidence. Comparable sales strengthen your case.

The Clerk of Superior Court records documents. Real estate filings happen here. UCC documents file electronically. GSCCCA handles these filings. This is required by state law.

Columbus Property Assessment Appeals Process

Property owners in Columbus can appeal assessments. Notices mail in May each year. The appeal period follows state guidelines. You have 45 days from the notice date. Check your notice for the exact deadline.

The real property online appeals portal is convenient. You can file from home. Upload supporting documents. Include comparable sales data. Photos help illustrate your points.

Appeals are heard by the Board of Equalization. This independent board reviews cases. They consider evidence from both sides. Fair market value is the standard. The board issues written decisions.

Other appeal options may be available. Arbitration is one choice. Hearing officers provide another option. Each has different procedures. All protect your rights as a property owner.

Note: The Columbus Consolidated Government provides online tools for appeals and property searches.

Georgia State Resources for Columbus Property Searches

State databases complement Columbus local records. The GSCCCA real estate index is essential. It covers deeds from all counties. Muscogee County is fully included. Searches are free with registration.

FANS protects Columbus property owners. This free service monitors your name. You get alerts about new filings. Fraud prevention is the goal. Sign up takes minutes.

HB 1952 changed filing requirements. All documents must file electronically. Deeds, plats, and UCCs use eFiling. This applies statewide including Columbus. The effective date was January 1, 2025.

The Georgia Department of Revenue provides guidance. They oversee assessment practices statewide. Counties follow their regulations. Uniform standards ensure fairness. Their website has helpful resources.

Related Columbus Property Record Resources

Muscogee County and Columbus share a consolidated government. State resources provide additional search capabilities. Together they offer complete record access.