Augusta Richmond County Property Records Search

Augusta operates under a consolidated city-county government with Richmond County. This means one office handles property records for both jurisdictions. The Richmond County Board of Assessors manages property valuations. The consolidated government streamlines record searches. You can access Augusta property records through a single portal. Most documents are available online.

Where to Find Augusta Property Records

The Richmond County Board of Assessors maintains Augusta property valuations. Their office is at 535 Telfair Street Suite 120. They assess all property at fair market value. Georgia law requires 40% assessment ratios. You can search records on their website.

The Augusta Richmond County Tax Commissioner handles tax collection. Their office is in the Municipal Building. They process tax payments and issue bills. Tax bills are due November 30th each year. Early payment earns a 1% discount.

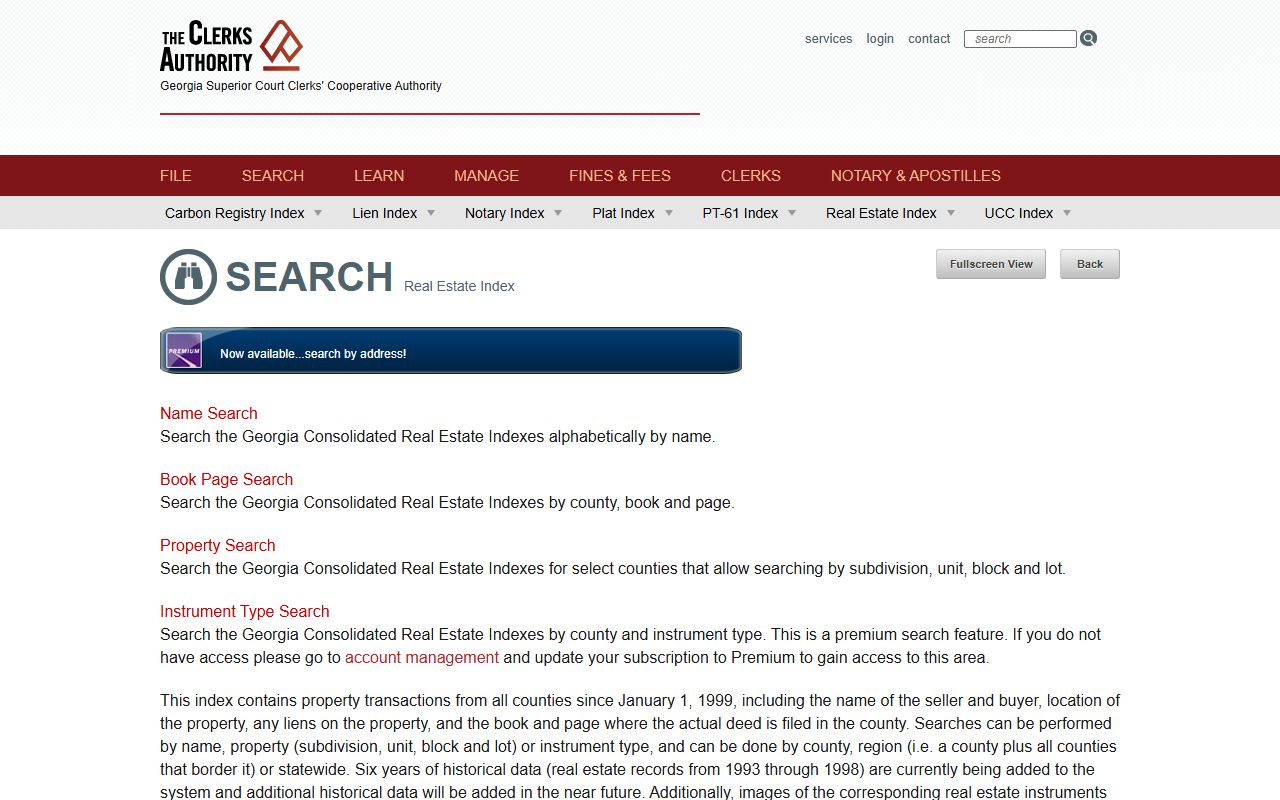

Real estate deeds are recorded with the Clerk of Superior Court. You can access these through GSCCCA. The statewide portal covers Richmond County transactions. Records date back many years. Certified copies are available for a fee.

Note: Augusta is one of few Georgia counties offering a 1% discount for early tax payments.

How to Search Augusta Real Estate Records Online

The Augusta Richmond County Tax Assessor provides online search tools. You can look up property by owner name. Address searches work too. Parcel identification numbers give direct access. Search results show current assessments and tax details.

The GSCCCA portal covers Augusta deed records. You can search statewide from one website. Name searches find buyers and sellers. Property searches use subdivision data. The index includes transactions since 1999.

Richmond County provides assessment notices each year. These mail in late June. Notices show your property's fair market value. They include estimated tax amounts. You have 45 days to appeal if needed.

Follow these steps to search Augusta records:

- Visit the Richmond County Tax Assessor website

- Enter property address or owner name

- Review assessment and tax details

- Use GSCCCA for deed and transaction history

- Contact the Tax Commissioner for payment questions

Types of Augusta Property Records Available

Augusta property records cover several categories. Deed records show ownership changes. These include warranty deeds and quitclaim deeds. Security deeds represent mortgage liens. All are filed with the Clerk of Superior Court. Copies are available online or in person.

Assessment records contain property valuations. The Board of Assessors determines fair market value. This value reflects what buyers would pay. Assessments follow Georgia standards. Appeals are allowed under state law.

Tax records show amounts owed and payment status. The Tax Commissioner maintains these files. Tax bills include county and city levies. School taxes are separate. You can view current and historical tax data.

Liens and encumbrances affect Augusta properties. Tax liens come from unpaid bills. Mechanics liens secure construction debts. Hospital liens attach to injury settlements. These records are public and searchable.

Richmond County Offices for Augusta Property Searches

The Richmond County Board of Assessors serves Augusta property owners. Their mission is fair and uniform valuations. They defend these values when appealed. The board generates an equitable tax digest. They work with the Tax Commissioner closely.

Their office phone is (706) 821-1765. Hours are 8:00 AM to 5:00 PM weekdays. Staff conduct field checks regularly. They verify property characteristics. All staff carry county identification badges.

The Augusta Richmond County Tax Commissioner collects taxes. Their phone is 706-821-2391. Payment phone is (706) 252-9080. Bills are due November 30th. A 10% penalty applies December 20th.

Board of Assessors members serve staggered terms. The chairman is Renee D'Antignac. Other members represent different districts. They meet regularly to review assessments. The public may attend these meetings.

Augusta Property Assessment Appeals Information

Property owners in Augusta can appeal assessments. Annual notices mail in June. The appeal deadline is August 4, 2025. This is 45 days from the notice date. Mark your calendar to avoid missing this window.

Appeals go before the Board of Equalization. This independent panel hears cases. You present evidence supporting your position. Comparable sales are important proof. Photos showing property condition help.

Online appeals may be available. Check the assessor website for options. Some cases qualify for arbitration. Others use hearing officers. All follow Georgia appeal procedures.

The assessment process follows strict guidelines. Values reflect market conditions. Sales data from comparable properties matters. The board reviews all appeals carefully. Fair treatment is guaranteed by law.

Note: Richmond County staff may visit your property for field reviews with proper identification.

Georgia State Resources for Augusta Property Searches

State agencies support Augusta record keeping. The Georgia Department of Revenue provides oversight. They ensure uniform assessment practices. Guidelines come from this agency. Counties must follow state standards.

The GSCCCA portal includes Richmond County records. You can search deeds statewide. The real estate index is comprehensive. It covers Augusta transactions back to 1999. Searches are by name or property.

FANS protects Augusta homeowners. This free monitoring system alerts you to filings. Any document with your name triggers notice. You catch potential fraud early. Registration is simple and free.

Electronic filing is now required. HB 1952 mandates eFiling for deeds. All documents file through GSCCCA. This applies to Augusta and all Georgia. The change took effect January 1, 2025.

Related Augusta Property Record Resources

Richmond County encompasses Augusta completely. State resources supplement local records. Together they provide complete property information.