Douglasville Real Estate and Property Records

Douglasville property records are maintained by Douglas County. The city serves as the county seat. Residents can access assessments, deeds, and tax records online. The Appraisal Department handles all property valuations.

Douglasville Property Records Quick Facts

Douglasville Property Assessment Records

The Douglas County Appraisal Department values all Douglasville real estate. They produce annual assessment notices. Property owners receive these notices by mail. The 2025 notices were mailed on May 30.

Douglasville property records can be searched online. The portal is at douglasnv-search.gsacorp.io. This system shows parcel details and assessments. You can view ownership and property characteristics.

The Appraisal Department has two locations. The mailing address is 8700 Hospital Drive in Douglasville. In-person visits go to 6200 Fairburn Road, 2nd Floor. Both addresses are in Douglasville, GA 30134.

The main phone number is 770-920-7228. Staff can answer assessment questions. They also help with exemptions and appeals. Office hours are Monday through Friday.

Douglasville Property Appeals Process

Property owners in Douglasville can appeal their assessments. The 2025 appeal deadline was July 14. Appeals can be filed online, by mail, or in person. The online option is new for 2025.

The Douglas County Appraisal Department accepts appeals three ways. Online filing is available through the property search links. Mail appeals go to the Assessors office. In-person appeals can be filed at the Fairburn Road location.

Important restrictions apply to Douglasville appeals. Appeals are NOT accepted by fax. Email submissions are also not accepted. A letter of authorization is needed if you represent the owner. No extensions are granted for deadlines.

Steps to appeal your Douglasville assessment:

- Review your assessment notice carefully

- Gather supporting evidence like comparable sales

- File before the deadline passes

- Include all required documentation

Note: The deadline to appeal 2025 assessments was July 14, 2025.

Douglasville Property Field Reviews

Douglas County appraisal staff routinely check Douglasville properties. They review building permit status. Properties are also reviewed for other reasons. This follows Georgia law O.C.G.A. 48-5-264.1.

Notice is given to Douglasville property owners and occupants. Appraisers and data collectors may visit. They carry photo identification badges. Staff drive appropriately marked county vehicles.

The field review process ensures accurate Douglasville property records. Appraisers verify property characteristics. They note changes and improvements. This data supports fair assessments for all.

If an appraiser visits your Douglasville property, ask for identification. All staff carry county badges with photos. They should be in marked vehicles. Contact the office if you have concerns.

Douglasville Property Tax Records

The Douglas County Tax Commissioner handles billing for Douglasville properties. Tax bills are mailed in early autumn. Payments are due 60 days after mailing. The Tax Commissioner manages collections.

Douglasville residents can pay taxes through douglastax.org. The website accepts online payments. You can view tax bills and account history. Multiple payment options are available.

Exemption applications are due by April 1. Property owners may apply year-round. But the deadline is April 1 for that tax year. Qualification age and ownership must be met as of January 1.

If property changes ownership during the year, taxes must be worked out. Buyers and sellers negotiate who pays owed taxes. The tax records show the owner of record as of January 1.

Douglasville Deed and Lien Records

The Douglas County Clerk of Superior Court maintains Douglasville real estate records. Deeds, mortgages, and liens are recorded here. These documents establish ownership. They also show financial claims against properties.

Douglasville property transactions must be recorded. The Clerk of Court office handles this. Recording fees apply to all documents. Electronic filing is now required.

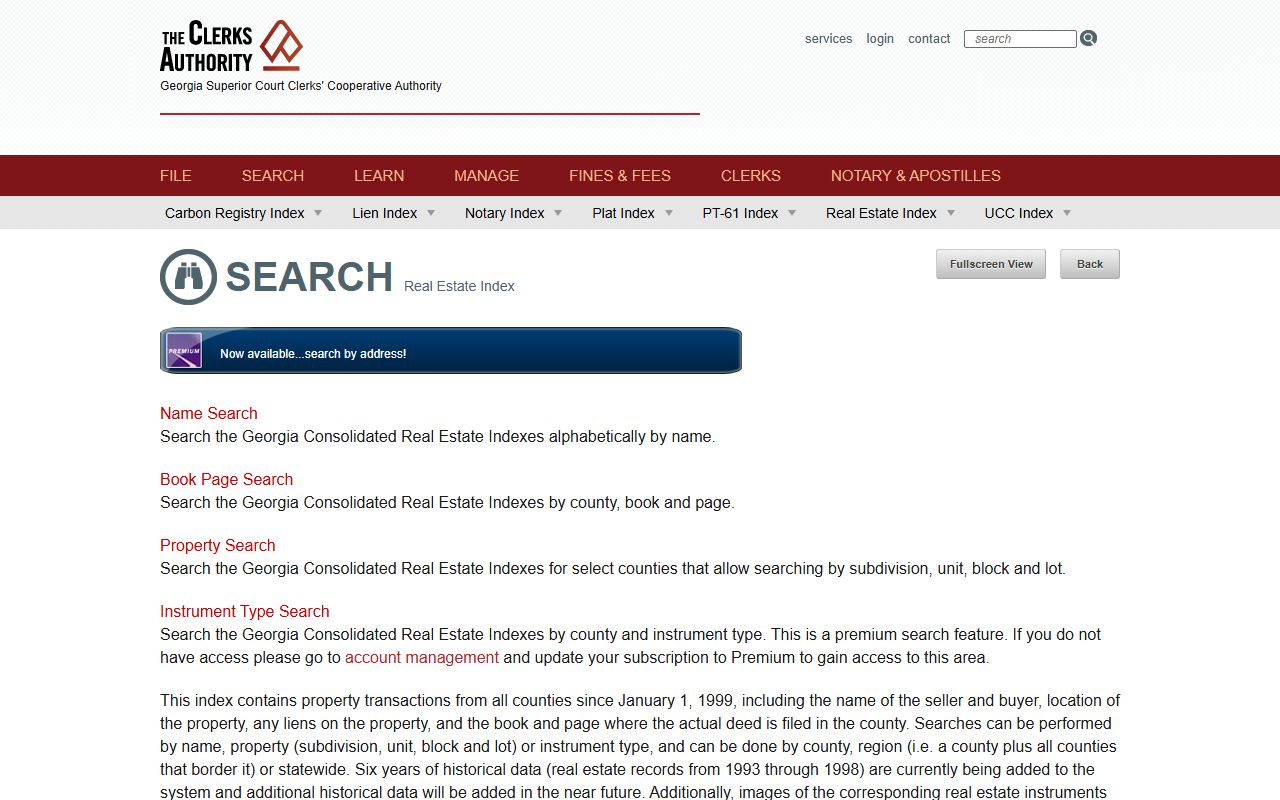

You can search Douglasville deed records through GSCCCA. This statewide system covers all Georgia counties. Records date back to January 1, 1999. Search by name, property, or instrument type.

As of January 1, 2025, all documents must be filed electronically. This requirement comes from House Bill 1952. Deeds, liens, UCCs, and plats all use eFiling.

How to Search Douglasville Property Records

Finding Douglasville property records starts with the right tools. Douglas County offers online assessment searches. GSCCCA provides statewide deed access. Both systems work 24 hours a day.

For Douglasville assessments, use the county property search. Enter an address or parcel number. Results show ownership, values, and property details. You can also file appeals online.

For Douglasville deeds, check the GSCCCA database. Search by grantor or grantee name. Book and page searches find specific documents. The system covers all counties from 1999 forward.

Douglasville property records typically include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and due dates

- Deed references and recording dates

- Lien and mortgage information

The FANS system protects against deed fraud. Register at fans.gsccca.org. You get alerts when documents are filed with your name or address.

Nearby Property Records

These counties border Douglas County. You may need to search them for properties near the county line.