Macon Bibb County Property Records Search

Macon and Bibb County operate as a consolidated government. This unified system serves all property owners in the area. The Macon-Bibb County Tax Assessors' Office handles valuations. The Tax Commissioner manages tax collection. You can search Macon property records through QPublic. Online access makes research convenient.

Where to Find Macon Property Records

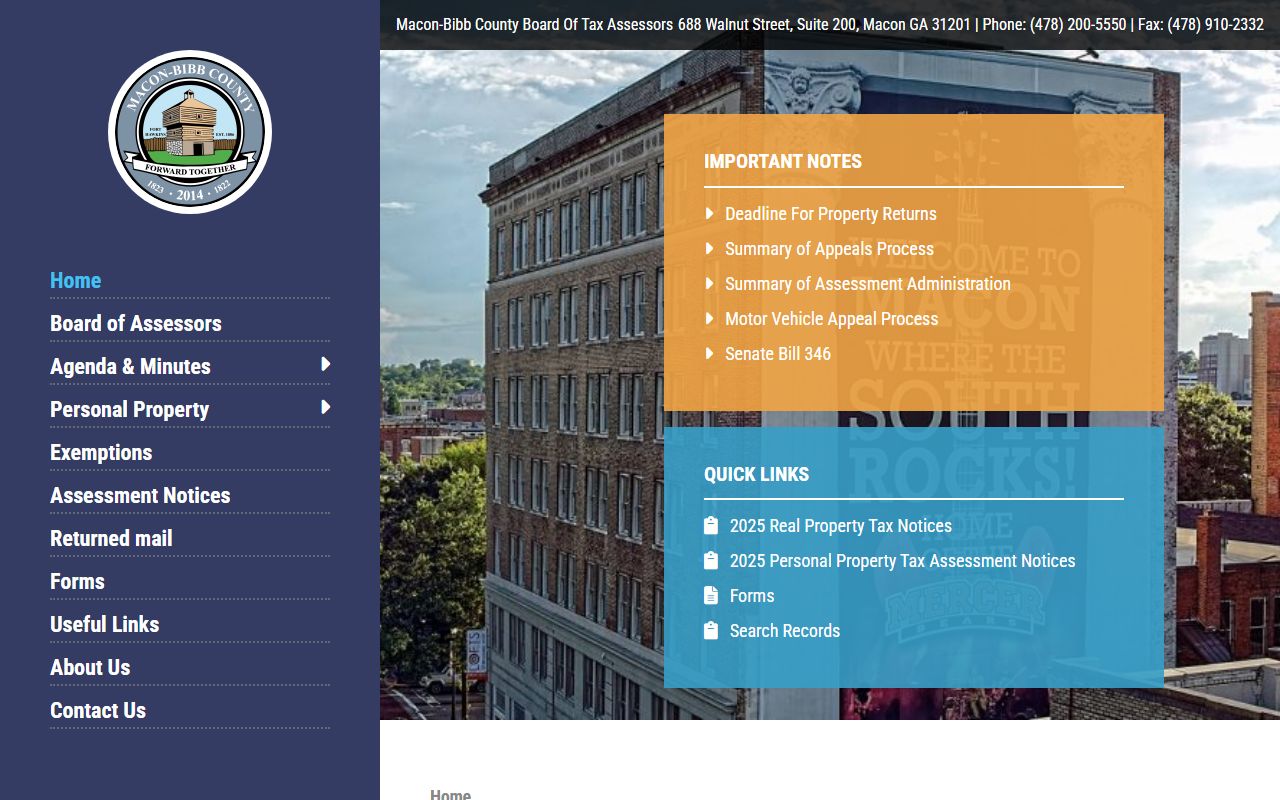

The Macon-Bibb County Tax Assessors' Office maintains property valuations. They appraise all real and personal property. Their mission is fair market value assessment. They use uniform methods for all properties. Records are available through their website.

The Macon-Bibb County Tax Commissioner collects taxes. Their office is at https://www.maconbibbtax.us/. Tax statements mail September 15 each year. First installments are due October 15. Second installments are due November 15.

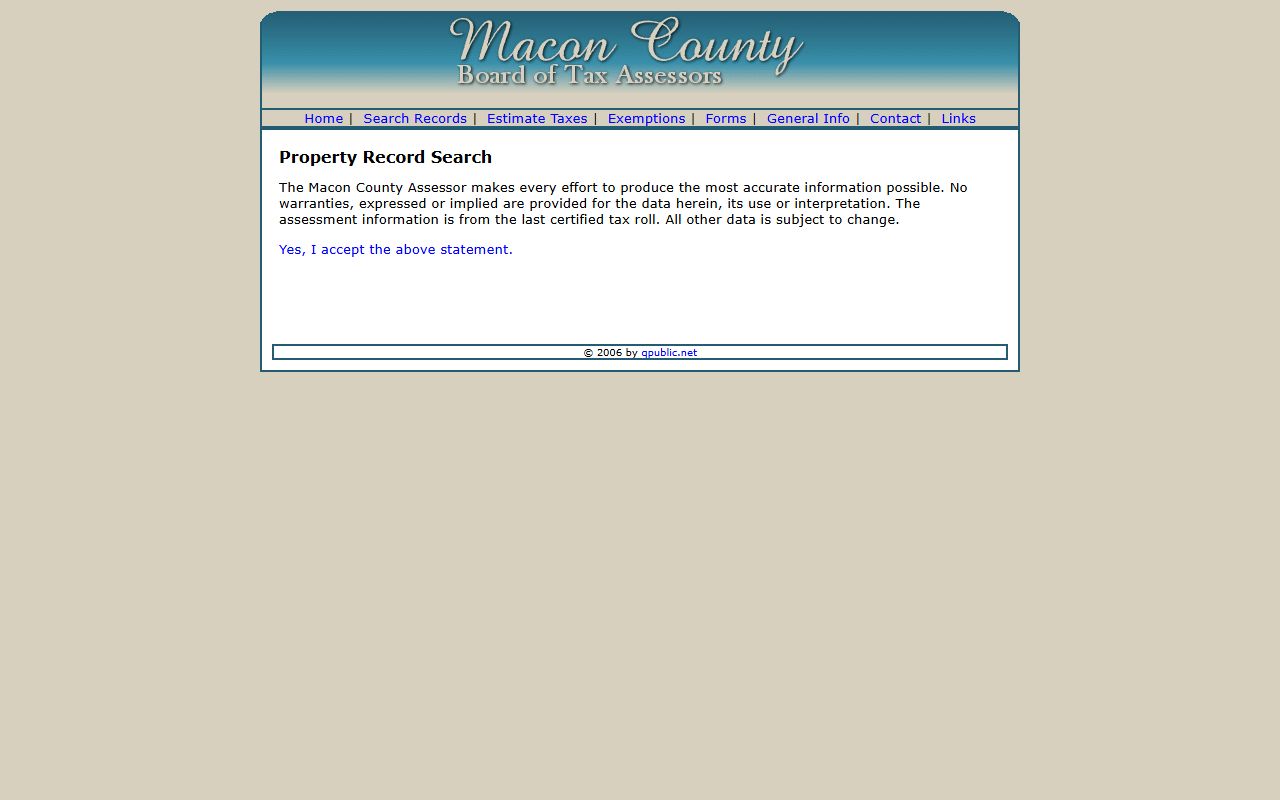

QPublic hosts the online property search. This portal covers many Georgia counties. Macon-Bibb is fully included. You can search by owner or address. Parcel IDs work for direct lookup.

Note: Tax statements for Macon-Bibb County typically mail on September 15 each year.

How to Search Macon Real Estate Records Online

The QPublic portal provides Macon property searches. Enter an address to find records. Owner name searches work too. Parcel numbers give exact results. The system shows assessments and tax details.

Tax calculation follows Georgia standards. Fair market value is determined first. Assessed value equals 40% of that. Exemptions reduce taxable value. Millage rates apply to the remainder.

Mobile homes have special rules in Macon. They require current year decals. Decals must be visibly posted. Taxes are due April 1 for mobile homes. Late payment brings 10% penalties.

Search Macon records using these approaches:

- QPublic for assessments and basic property data

- Tax Commissioner website for tax bills and payments

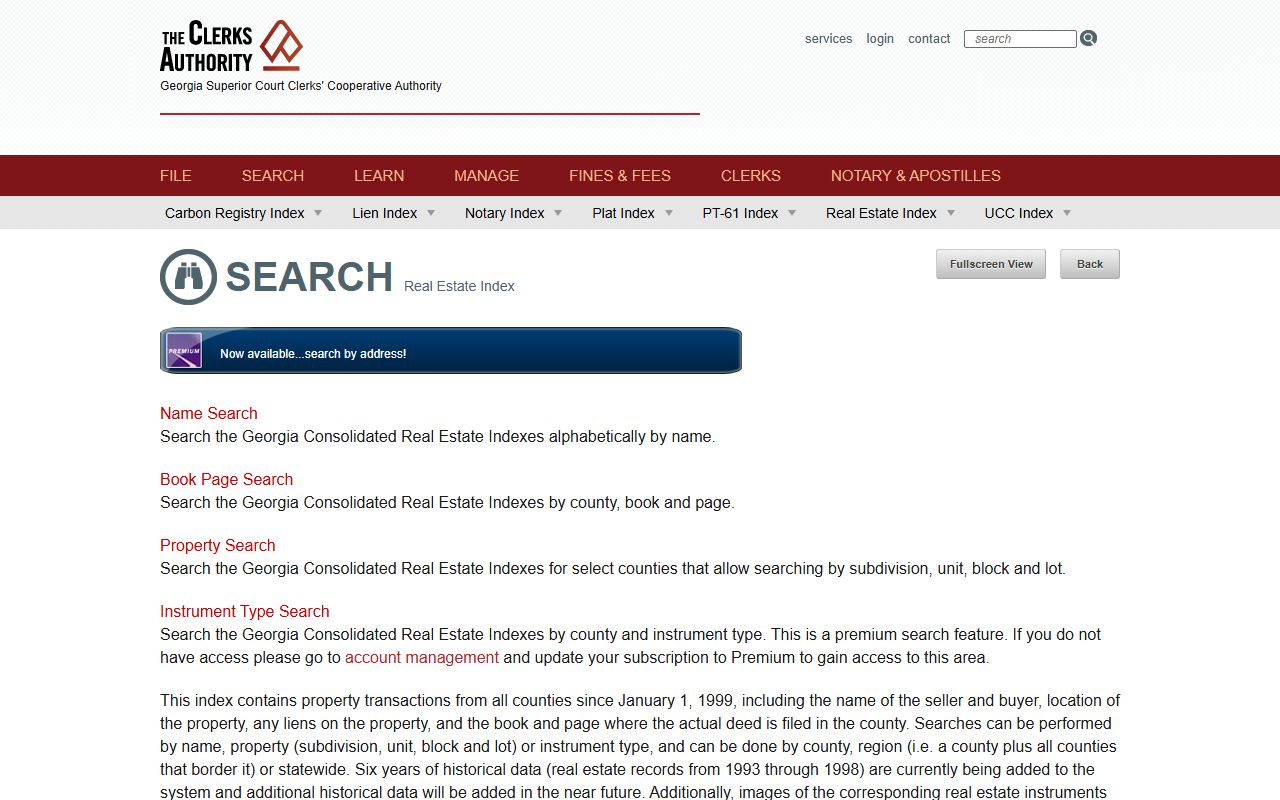

- GSCCCA for deed and transaction history

- Direct office contact for complex questions

Types of Macon Property Records Available

Macon-Bibb maintains comprehensive property records. Real property covers land and buildings. Personal property includes business assets. Mobile homes are tracked separately. Each category has specific search methods.

Deed records show ownership history. Transfers are recorded with the Clerk. Warranty deeds provide title protection. Quitclaim deeds transfer existing interests. Security deeds secure mortgage loans.

Assessment records contain valuation data. Fair market value is the standard. This equals what buyers would pay. Assessors review properties regularly. New construction is added promptly.

Tax records track bills and payments. Two installment options exist. October and November due dates apply. Mobile homes use April dates. Penalties accrue after deadlines.

Bibb County Offices for Macon Property Searches

The Macon-Bibb County Tax Assessors' Office provides customer service. Their website offers online tools. You can search properties anytime. Contact them for complex issues. Staff can explain valuation methods.

Homestead exemptions save homeowners money. They apply to primary residences. Applications have deadlines. April 1 is the cutoff date. File on time to receive benefits.

Personal property returns are required. Business owners must file annually. Returns cover equipment and inventory. Forms are available online. The filing period is January 1 to April 1.

Field staff may visit your property. They collect accurate data. Proper ID is always carried. Visits happen during business hours. This follows Georgia law O.C.G.A. 48-5-264.1.

Macon Property Assessment Appeals Information

Macon-Bibb property owners can appeal assessments. Annual notices inform you of values. Appeals must be filed timely. Check your notice for deadlines. Do not miss the window.

The appeal process protects your rights. You can present evidence. Comparable sales support your position. Property condition photos help. Professional appraisals strengthen cases.

Board of Equalization hears appeals. This independent panel reviews evidence. They issue written decisions. You can accept or continue appealing. Further options exist under Georgia law.

Tax bills reflect final assessments. Pay while appealing if advised. Refunds may be issued later. Consult the Tax Commissioner. They explain payment options.

Note: Property tax returns for personal property must be filed between January 1 and April 1 each year.

Georgia State Resources for Macon Property Searches

State resources enhance Macon record searches. GSCCCA provides statewide deed access. Bibb County records are included. The index covers 1999 to present. Searches are flexible and free.

FANS offers fraud protection. This free service monitors filings. You receive email alerts quickly. Unknown activity is flagged fast. Protect your Macon property today.

HB 1952 requires electronic filing. All deeds must file through GSCCCA. This started January 1, 2025. The change affects all Georgia counties. Macon-Bibb follows this requirement.

The Georgia Department of Revenue provides oversight. They ensure uniform assessments statewide. Guidelines come from this agency. Their website has helpful information. County assessors follow their rules.

Related Macon Property Record Resources

Bibb County and Macon share consolidated government services. State databases complement local records. Together they provide complete coverage.