Peachtree Corners Real Estate and Tax Records

Peachtree Corners property records are maintained by Gwinnett County. The county seat is Lawrenceville. Residents can access assessments and tax records online. The Board of Assessors values all property in Peachtree Corners.

Peachtree Corners Property Records Quick Facts

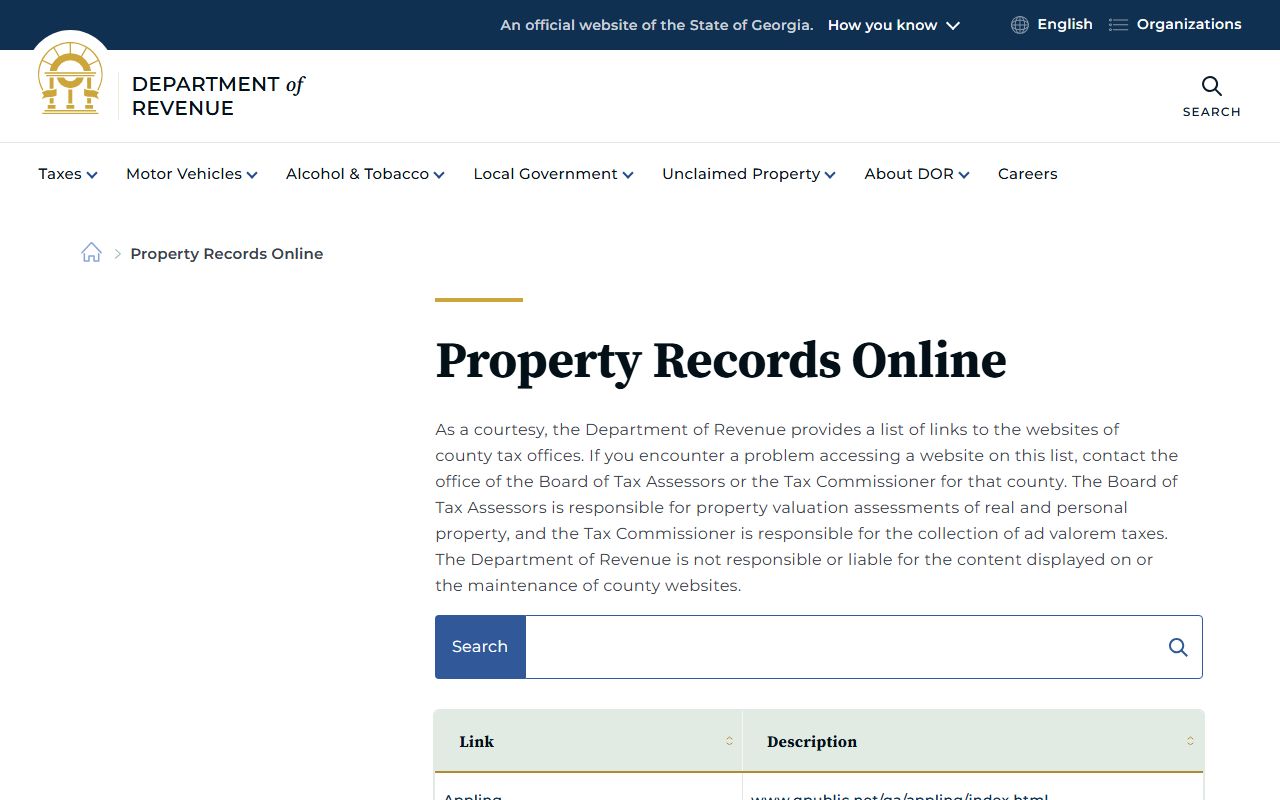

Peachtree Corners Property Assessment Records

The Gwinnett County Board of Assessors values all Peachtree Corners property. Their mission is to fairly apply Georgia tax code. They produce an annual property tax digest. This digest must be acceptable to state authorities.

Peachtree Corners property records are available through Gwinnett County. Fair market value is the amount a knowledgeable buyer would pay. A willing seller would accept this amount at an arm's length sale. This definition guides all assessments.

The Assessors office is at 75 Langley Drive in Lawrenceville. The phone number is 770-822-8800. Email questions to Tax@GwinnettCounty.com. Meagean Diaz serves as the Open Records Officer.

Property taxes fund essential Gwinnett County services. More than one-third of operating revenue comes from property taxes. Nearly three-quarters of tax-related funds use property tax revenue. Fair assessments ensure everyone pays their share.

Peachtree Corners Property Tax Calculation

Property taxes in Peachtree Corners follow a simple formula. First, determine the fair market value. This is what the property would sell for. Then calculate assessed value at 40% of fair market value.

The annual property tax equals assessed value minus exemptions. Multiply this by the millage rate. The result is your tax bill. Different authorities set different millage rates.

Peachtree Corners homeowners may qualify for the Regular Homestead Exemption. This gives $10,000 off assessed value for county taxes. Recreation taxes are reduced by $7,000. School taxes get a $4,000 reduction.

The Value Offset Exemption helps Peachtree Corners residents. It applies automatically with Regular Homestead. This exemption holds taxable value constant for county taxes. Even if property value increases, your taxable value stays the same.

Key formula for Peachtree Corners property taxes:

- Fair Market Value: Sale price in open market

- Assessed Value: 40% of Fair Market Value

- Taxable Value: Assessed Value minus Exemptions

- Annual Tax: Taxable Value times Millage Rate

Note: Contact the Assessors office at 770-822-8712 for open records requests.

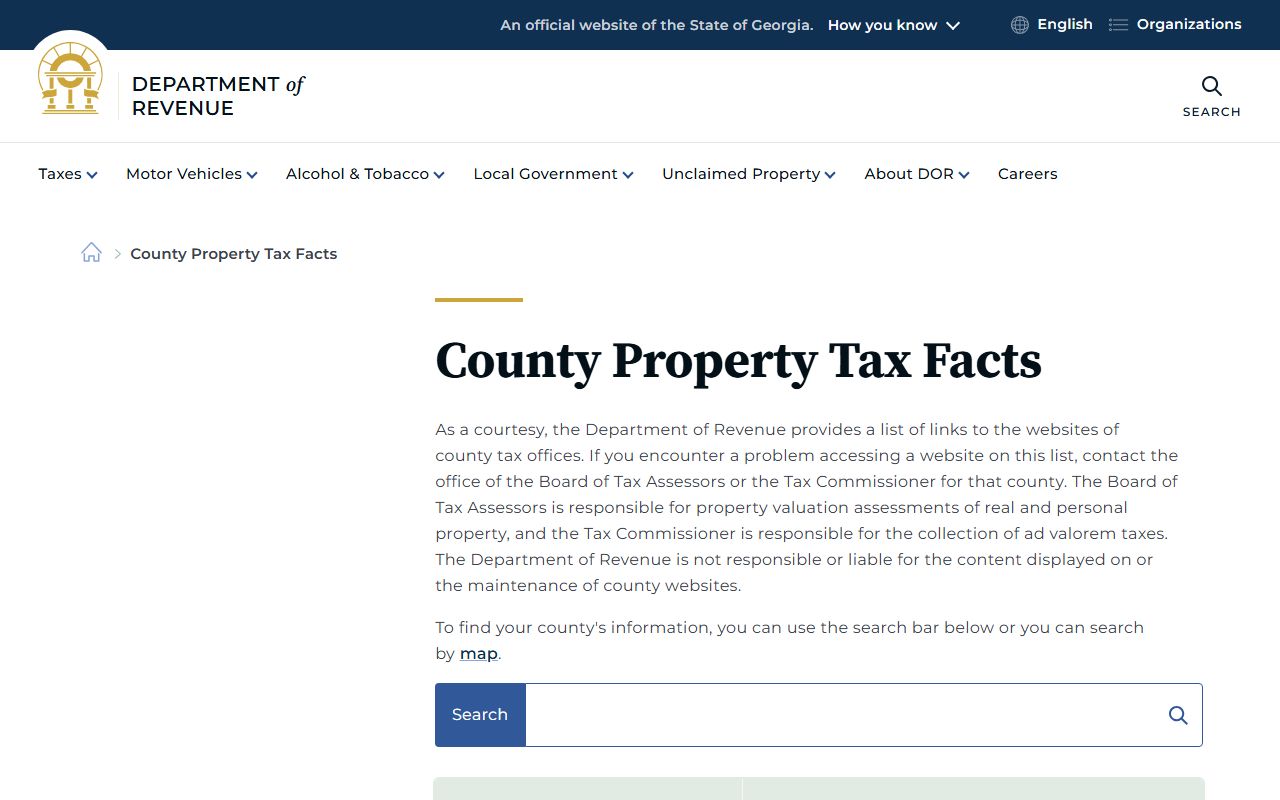

Peachtree Corners Property Tax Records

The Gwinnett County Tax Commissioner collects taxes for Peachtree Corners. They mail bills based on assessed values. The Tax Commissioner accepts various payment methods. Online payment is available.

Peachtree Corners residents can access tax information online. Visit gwinnetttaxcommissioner.com. The portal shows current and past tax bills. You can also view payment history.

The Tax Commissioner office is at 75 Langley Drive. This is the same location as the Assessors office. Hours are Monday through Friday during business times. Call 770-822-8800 for assistance.

Delinquent taxes may result in tax sales. The Tax Commissioner follows state procedures. Notices are sent before any sale occurs. Owners can redeem properties before the sale date.

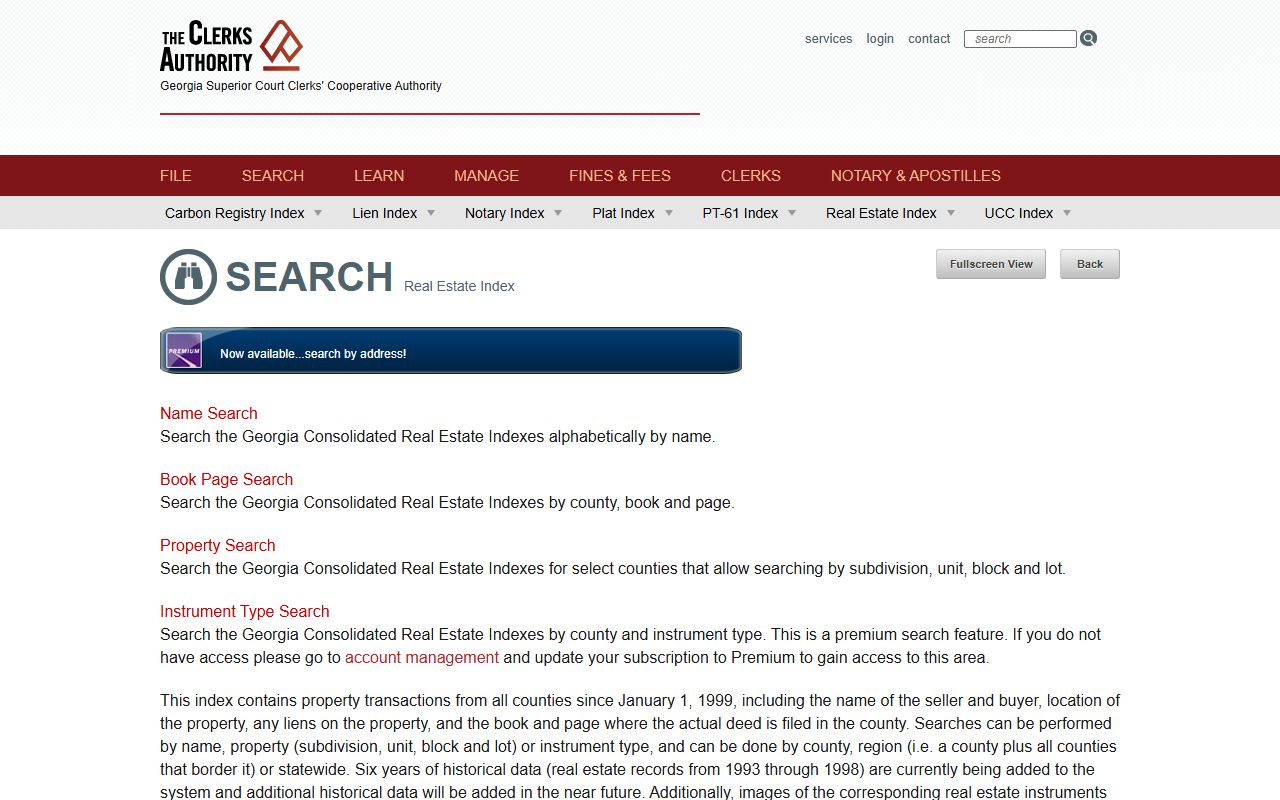

Peachtree Corners Deed and Lien Records

The Gwinnett County Clerk of Superior Court maintains Peachtree Corners real estate records. This includes deeds, mortgages, and liens. These documents establish ownership. They also show financial claims against property.

Peachtree Corners property transactions must be recorded. The Clerk of Court office handles this. Recording fees apply to all documents. Standard recordings cost $25 under current law.

You can search Peachtree Corners deed records through GSCCCA. This statewide system covers all counties. Records date back to January 1, 1999. Search by name, property, or instrument type.

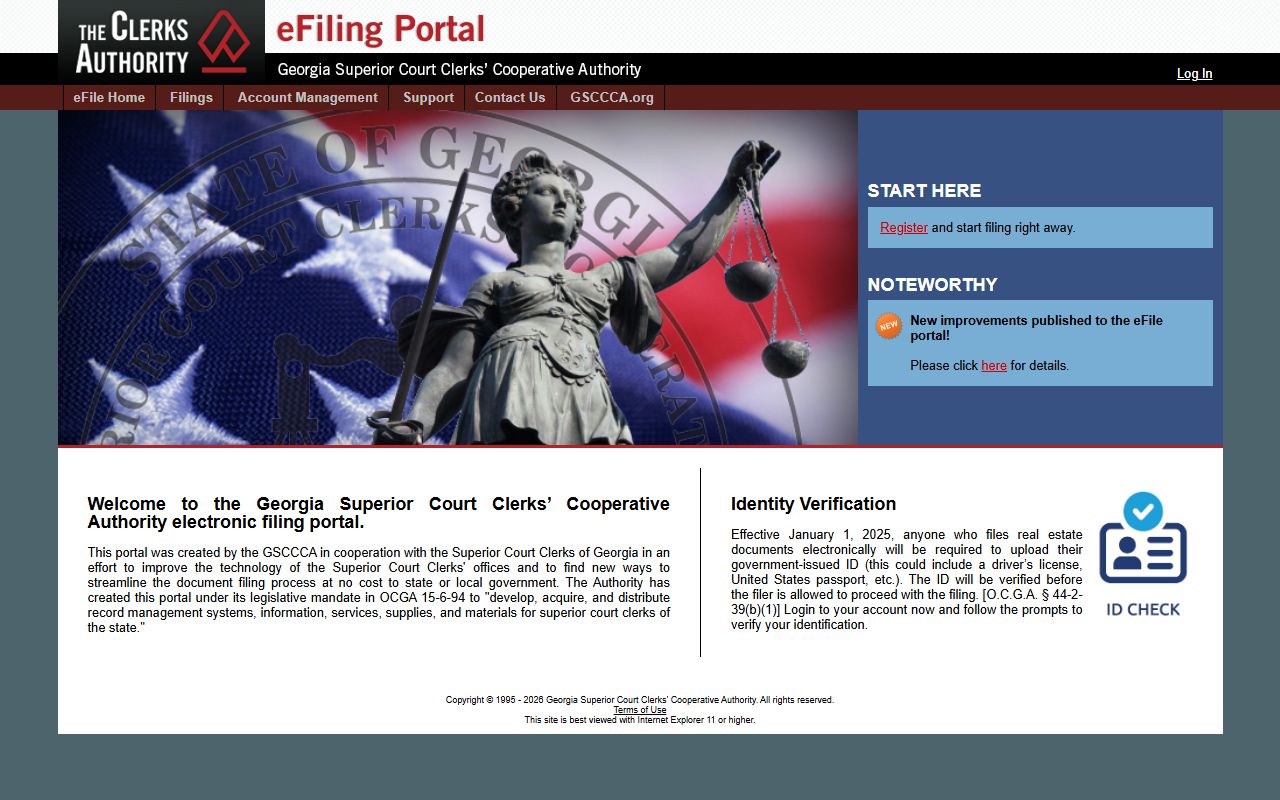

Electronic filing is mandatory as of January 1, 2025. All documents must be filed through GSCCCA. This requirement comes from House Bill 1952. Deeds, liens, UCCs, and plats all use the eFile system.

How to Search Peachtree Corners Property Records

Finding Peachtree Corners property records requires the right approach. Gwinnett County offers online access to assessments. GSCCCA provides statewide deed searches. Both are available anytime.

For Peachtree Corners assessments, visit the Gwinnett County website. Search by address or parcel number. Results show ownership, values, and exemptions. You can also download property data.

For Peachtree Corners deeds, use the GSCCCA portal. Search by grantor or grantee name. Book and page searches find specific documents. The system covers all Georgia counties.

Peachtree Corners property records include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and payment status

- Deed references and dates

- Lien and mortgage information

The FANS system offers fraud protection. Register at fans.gsccca.org. You receive alerts when documents are filed with your name or address.

Peachtree Corners Property Appeals

Property owners in Peachtree Corners can appeal assessments. The appeal period starts when notices are mailed. You have 45 days to file an appeal. This ensures fair valuations for all.

To appeal your Peachtree Corners assessment, contact the Board of Assessors. Include supporting evidence like comparable sales. Appeals can be filed online, by mail, or in person. The process may go to the Board of Equalization.

The Board of Assessors reviews all appeals. They may adjust values based on evidence. If you disagree with the decision, further appeal options exist. These include hearings and arbitration.

Key points about Peachtree Corners appeals:

- File within 45 days of notice

- Provide supporting documentation

- Multiple appeal levels available

- Final decisions can go to court

Nearby Property Records

These counties border Gwinnett County. Properties near the county line may need searches in multiple jurisdictions.