Walton County Property Assessment and Tax Records

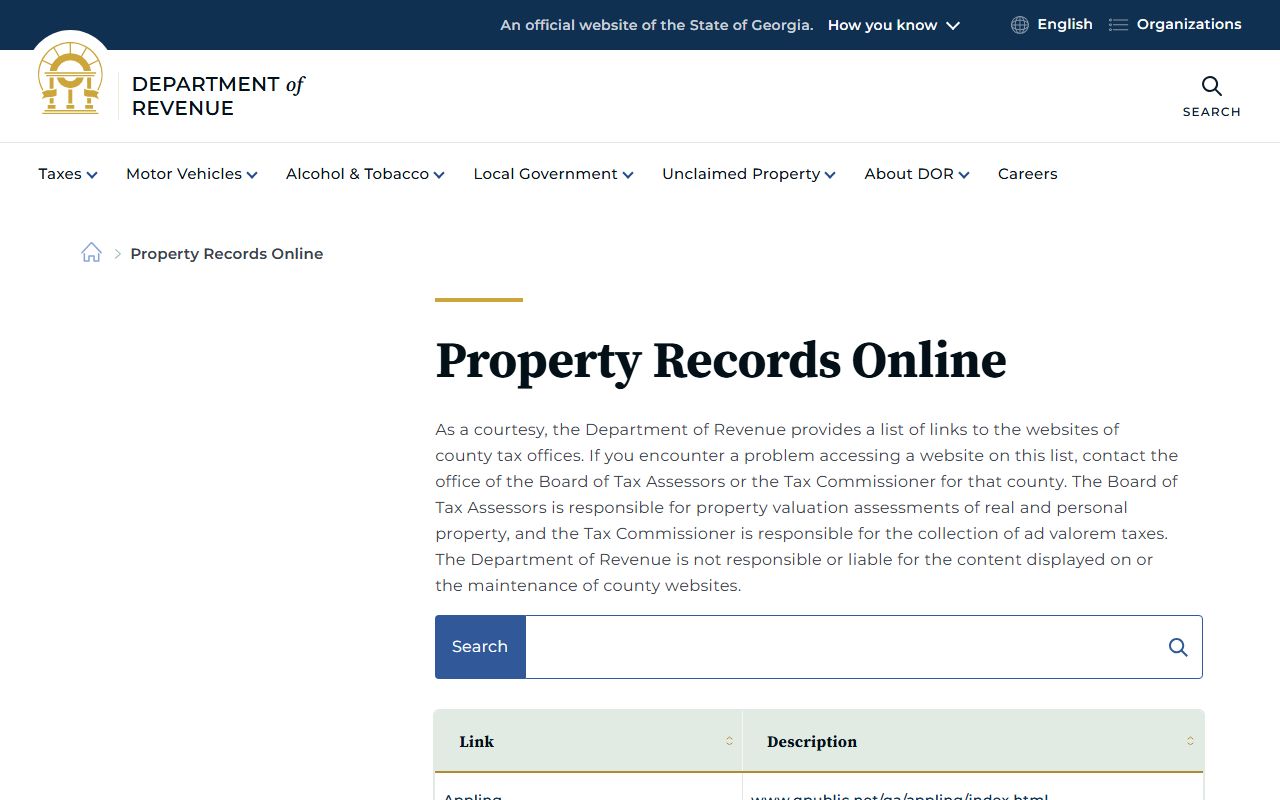

Walton County property records are maintained by the Board of Tax Assessors and Tax Commissioner. The county seat is Monroe. The Tax Assessor office is on South Hammond Drive. Chief Appraiser Tommy Knight leads the team. Records are available online through QPublic and the county tax portal.

Walton County Property Records Quick Facts

Walton County Tax Assessor Property Records

The Walton County Board of Tax Assessors values all taxable property. They use uniform methods. Their goal is fair and equal assessments. The office is in Monroe on South Hammond Drive.

Walton County follows Georgia law for assessments. Property is valued at fair market value. The assessment level is 40% of that. Appeals are handled by the Board.

You can search Walton County property records online. Use QPublic at qpublic.net/ga/walton. Search by owner name or address. View parcel details and maps. The service is free.

Law enforcement officers can request non-disclosure. Senate Bill 215 allows this. Personal information is removed from public records. Contact the Tax Assessor for details.

Walton County Specialized Property Assessment Programs

Walton County offers several special assessment types. These can lower your tax bill. Each has its own rules. Apply by April 1 each year.

Preferential assessment helps some properties. Rehabilitated historic properties qualify. Landmark historic properties are included. Residential transitional property may apply.

Conservation use is for undeveloped land. It is valued at current use. Not fair market value. This saves owners money. The land must stay undeveloped.

Brownfield properties get special treatment. Contaminated land may qualify. Values can be frozen. Forest land has its own category. Contact the Walton County Tax Assessor for more info.

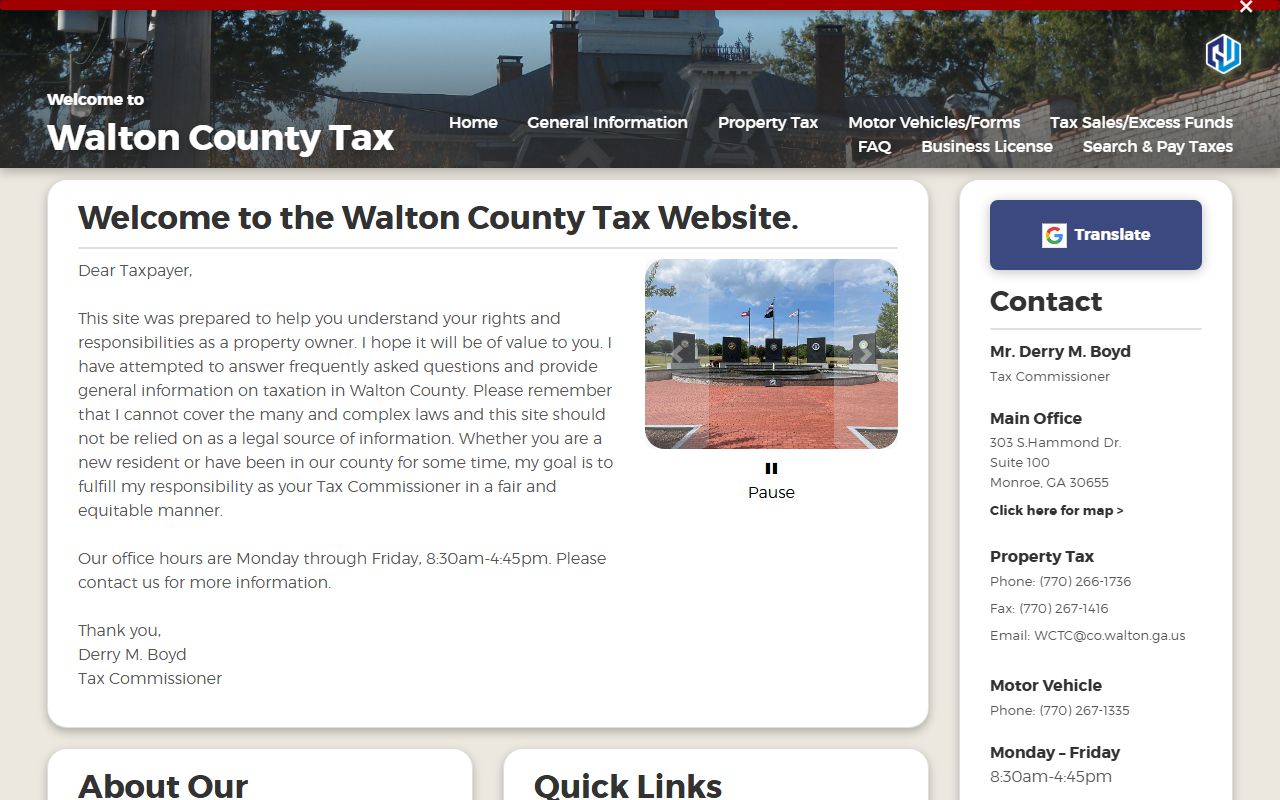

Walton County Tax Commissioner Records

The Walton County Tax Commissioner is on South Hammond Drive. They send tax bills each year. Bills go out in late August. Payment is due November 15.

Walton County tax records show what you owe. They include your assessed value. They list all exemptions you get. The millage rate is shown too.

Interest applies after the due date. It is Prime plus 3% per month. Penalties are 5% every 120 days. The maximum penalty is 20%.

Fi.Fa. fees apply to delinquent taxes. Bills under $100 cost $20.50. Bills over $100 cost $30.50. The lien stays for seven years. It may affect your credit.

Walton County Delinquent Tax Records

Walton County accepts partial payments on delinquent taxes. This helps owners catch up. Contact the Tax Commissioner to set up a plan.

Tax sales happen monthly. They are on the first Tuesday. Not every month has a sale. Check with the office for dates.

Properties for sale are advertised. The Walton Tribune runs notices. They appear for four weeks. This gives owners time to pay.

Important Walton County tax dates:

- January 1 - April 1: File tax returns

- April 1: Exemption deadline

- Late August: Tax bills mailed

- November 15: Payment due date

Walton County Real Estate Deed Records

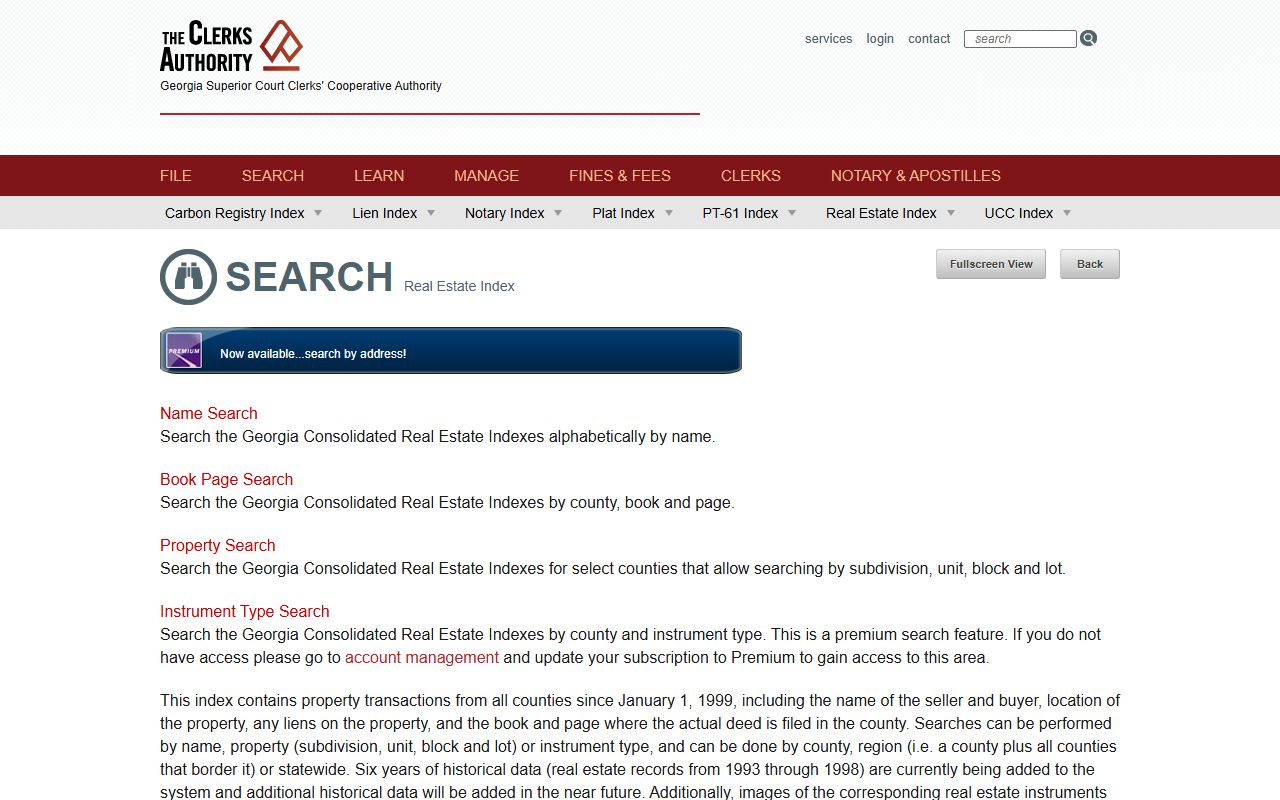

The Walton County Clerk of Superior Court records deeds. All transfers must be filed. This makes them public record. The Clerk's office is at the courthouse.

As of 2025, all filings are electronic. Use the GSCCCA eFile system. This is required by state law. Paper documents are not accepted.

You can search Walton County deeds through GSCCCA. This state system has records since 1999. Search by name or property. Get copies online.

How to Search Walton County Property Records

Finding Walton County records is simple. Use online tools for most searches. Visit offices for certified copies.

For assessments, use QPublic. It has parcel data and values. Search by name or address. View maps and sales.

For taxes, use the Tax Commissioner portal. It is at tax.waltoncountypay.com. Look up bills and pay online. See your account history.

For deeds, use GSCCCA. It covers all Georgia counties. Search statewide or by county. Get document copies.

Nearby Counties

These counties border Walton County. You may need to search them for properties near county lines.