Peachtree City Real Estate and Ownership Records

Peachtree City property records are maintained by Fayette County. The county seat is Fayetteville. Residents can access assessments, deeds, and tax records online. The Board of Tax Assessors values all property in Peachtree City and the county.

Peachtree City Property Records Quick Facts

Peachtree City Property Assessment Records

The Fayette County Board of Tax Assessors values all Peachtree City property. They maintain assessment records for tax purposes. Fair market value is set according to Georgia law. Property is assessed at 40% of fair market value.

Peachtree City property records can be searched through QPublic. This portal shows parcel details and ownership. You can view assessed values and property characteristics. Sales history is also available.

The Tax Assessors office works from Fayetteville. The county seat houses all assessment functions. Staff can help with searches and exemptions. They also handle appeals and property returns.

Peachtree City residents can apply for homestead exemptions. These reduce taxable value for primary residences. Applications must be filed by April 1. You can apply online or in person.

Peachtree City Property Tax Records

The Fayette County Tax Commissioner handles billing for Peachtree City. They mail tax bills based on assessments. Payments can be made online or in person. The Tax Commissioner also manages collections.

Peachtree City residents can view tax records through county portals. The system shows current and past bills. You can check payment status online. Tax amounts depend on assessed values and millage rates.

Assessment notices go out each May. Property owners have 45 days to appeal. Tax bills follow after the appeal period ends. Payments are due according to the county schedule.

Key dates for Peachtree City property taxes:

- January 1: Assessment date

- April 1: Exemption application deadline

- May: Assessment notices mailed

- 45 days: Appeal period from notice

Note: The Tax Commissioner sets specific due dates for tax payments each year.

Peachtree City Deed and Lien Records

The Fayette County Clerk of Superior Court maintains Peachtree City real estate records. Deeds, mortgages, and liens are recorded here. These documents date back to the county's founding. All records are public and searchable.

Peachtree City property transactions must be recorded. The Clerk of Court office handles this function. Recording fees apply to all documents. Standard recordings cost $25 per document.

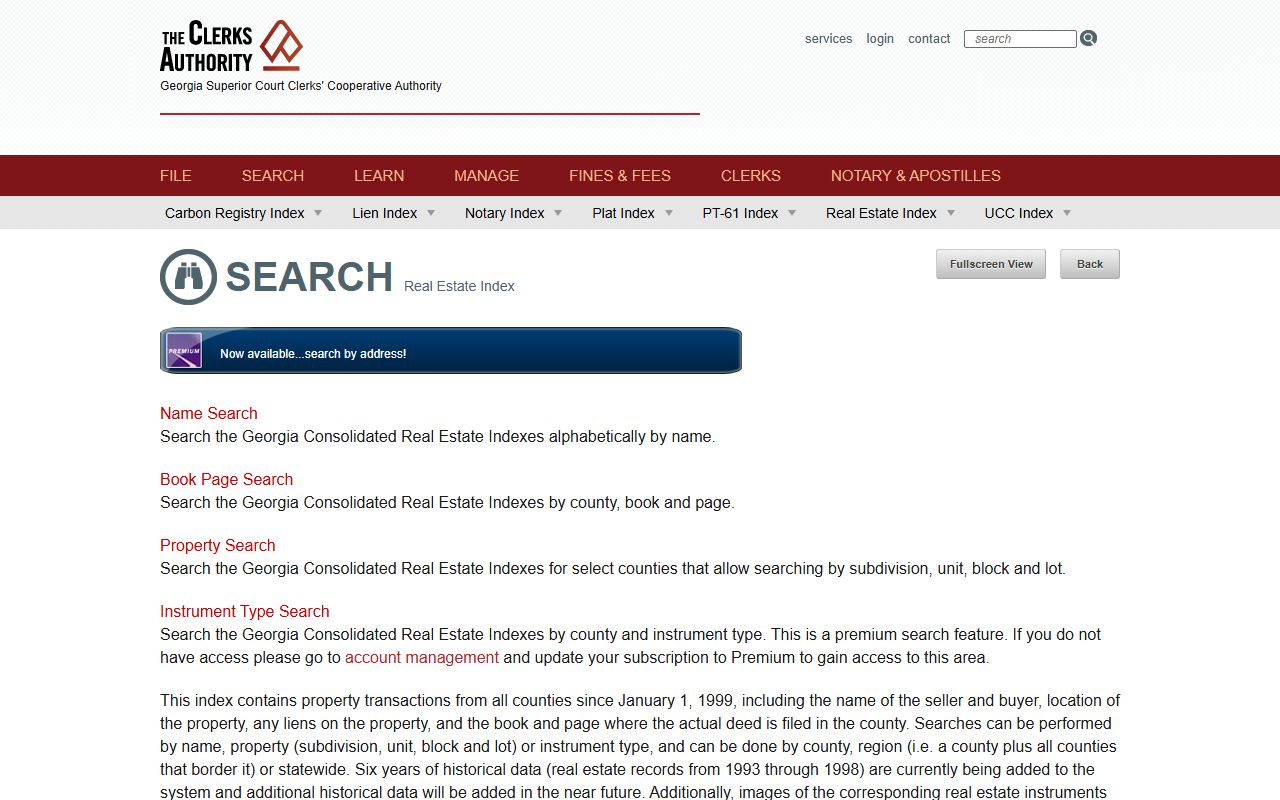

You can search Peachtree City deed records through the Clerk's website. The real estate index allows name and property searches. You can also use the GSCCCA statewide system. This covers all Georgia counties.

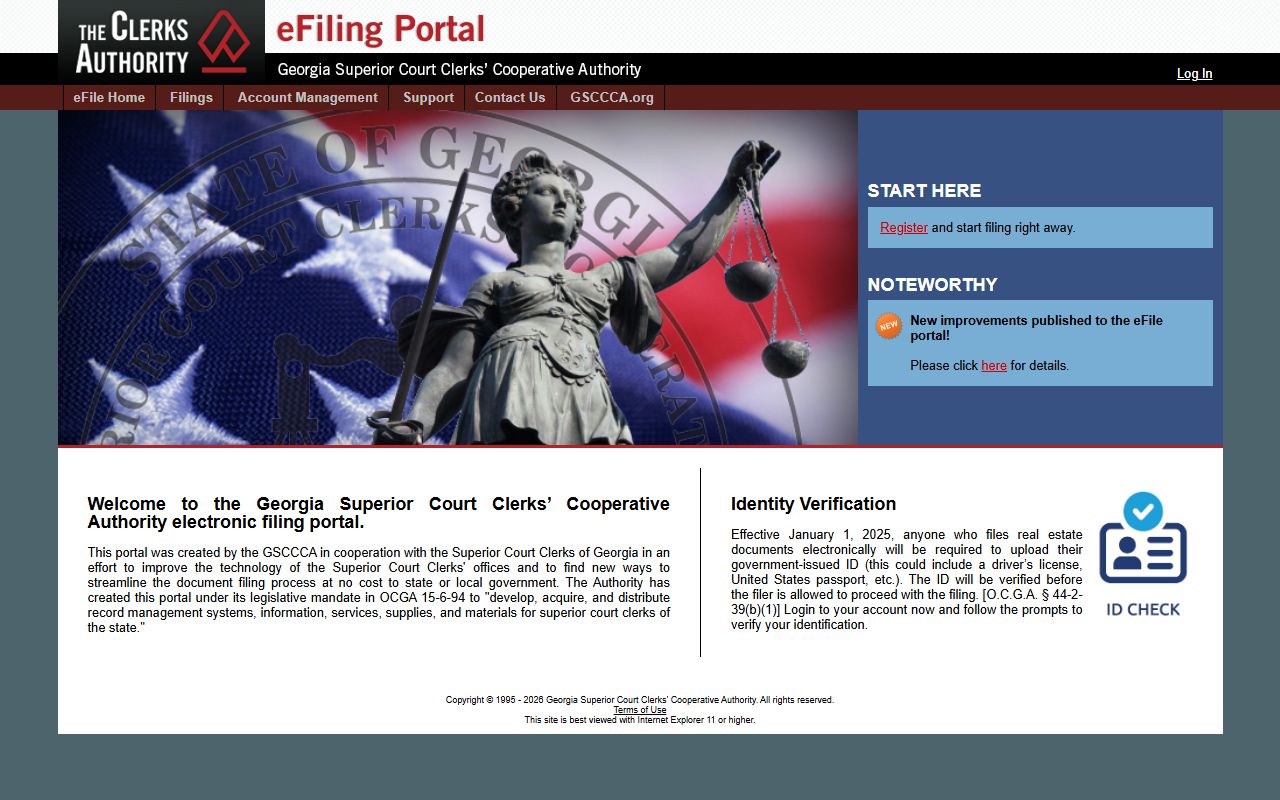

Electronic filing is required as of January 1, 2025. All documents must be filed through GSCCCA. This includes deeds, liens, UCCs, and plats. House Bill 1952 mandates this change.

How to Search Peachtree City Property Records

Finding Peachtree City property records requires the right approach. Fayette County offers online access through QPublic. GSCCCA provides statewide deed searches. Both systems are available anytime.

For Peachtree City assessments, visit qpublic.net/ga/fayette. Enter an address or owner name. Results show parcel maps and values. You can view sales history too.

For Peachtree City deeds, use the Clerk of Court Real Estate Index. Search by grantor or grantee name. Book and page searches find specific documents. Copies are available for a fee.

The GSCCCA system also covers Peachtree City. It has data since 1999. You can set up FANS alerts for free. This monitors filings on your property.

Peachtree City property records include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and payment status

- Deed references and dates

- Lien and mortgage information

State Resources for Peachtree City Property Records

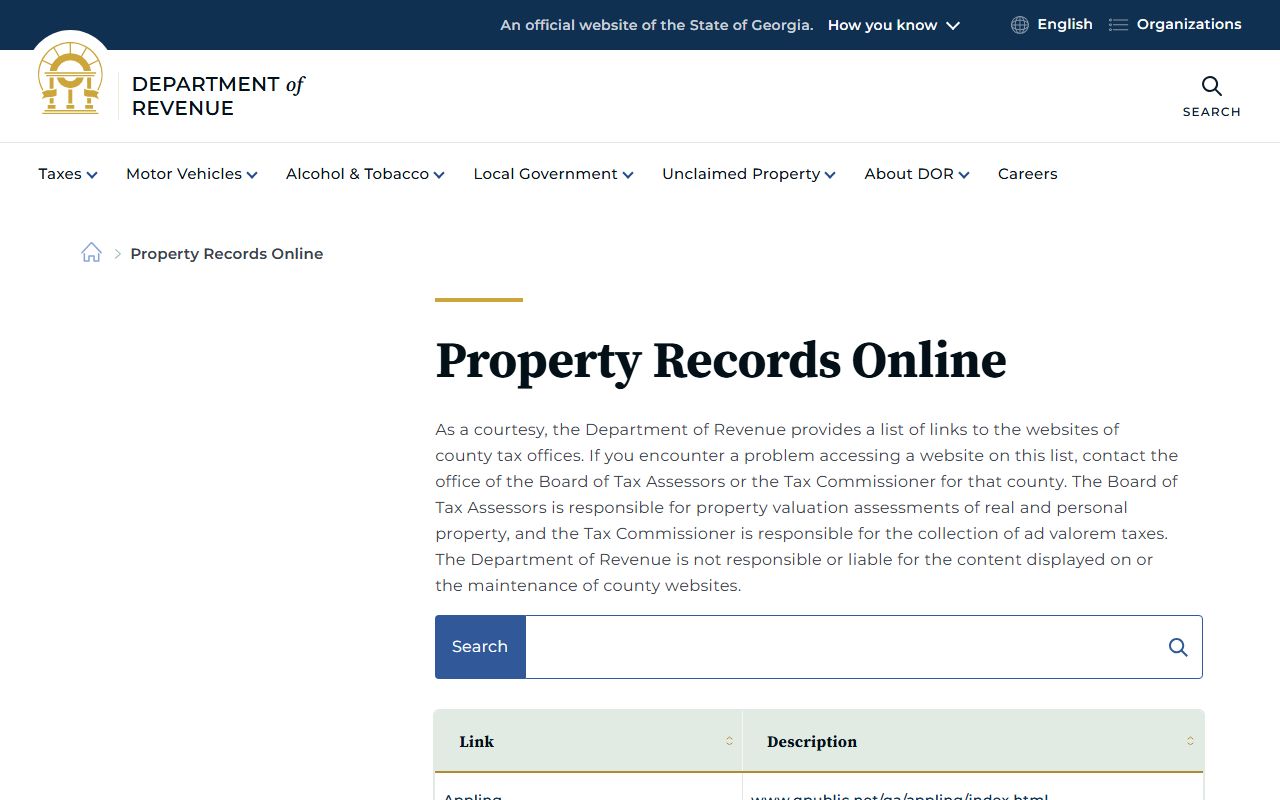

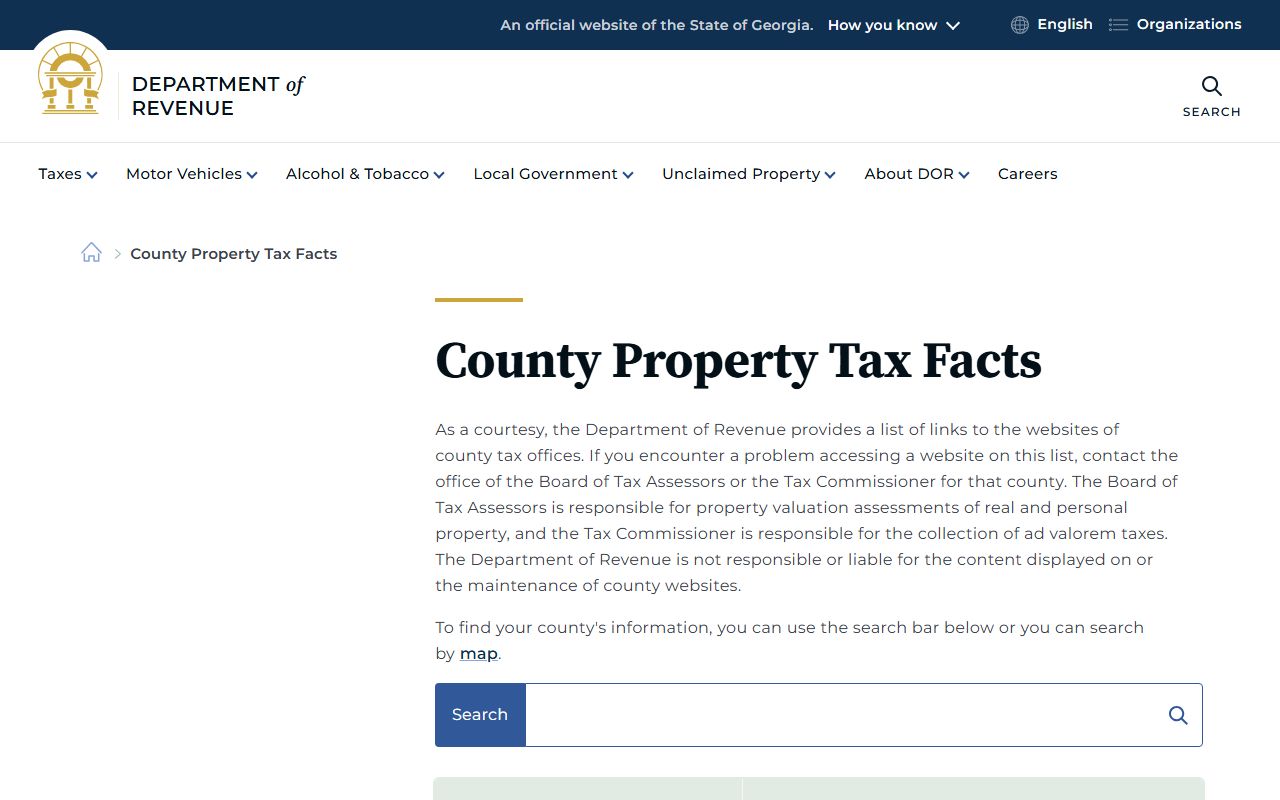

Georgia provides statewide tools for property records. These help Peachtree City residents and researchers. The Department of Revenue lists county tax offices. They explain Georgia tax laws.

GSCCCA manages the real estate database for all counties. This includes Fayette County and Peachtree City. Their eFile system is now required. Electronic filing started January 1, 2025.

GSCCCA accounts offer two service levels. Regular accounts cost $14.95 monthly. Premium accounts cost $29.95 monthly. Both charge $0.50 per page for copies. Premium adds instrument type searches.

Key state resources for Peachtree City:

- GSCCCA Real Estate Search: Statewide deed index

- Georgia DOR: Tax rules and county contacts

- FANS: Free alerts for property filings

- eCert: Digital certified copies

Nearby Property Records

These counties border Fayette County. Properties near the county line may need searches in multiple jurisdictions.