Fayette County Real Estate and Tax Records

Fayette County property records are kept by the Board of Tax Assessors and the Clerk of Superior Court. The county seat is Fayetteville. Residents can search property assessments, deeds, and tax records online. The QPublic portal provides access to parcel data and valuations. Real estate transactions are recorded at the Clerk of Court office in Fayetteville.

Fayette County Property Records Quick Facts

Fayette County Property Assessment Records

The Fayette County Board of Tax Assessors maintains all property assessment records. This office values real and personal property for tax purposes. They use fair market value as set by Georgia law. The assessment date is January 1 each year. Property in Fayette County is assessed at 40% of fair market value.

You can search Fayette County property records online through QPublic. This portal shows parcel details, ownership, and assessed values. The system is free to use. You can search by owner name, address, or parcel ID. The Fayette County property records include sales history and property characteristics.

The Fayette County Tax Assessor also handles homestead exemptions. These reduce your tax bill if you live in the home. Applications must be filed by April 1. You can apply online or in person. The office is in Fayetteville near the courthouse.

Fayette County Deed and Lien Records

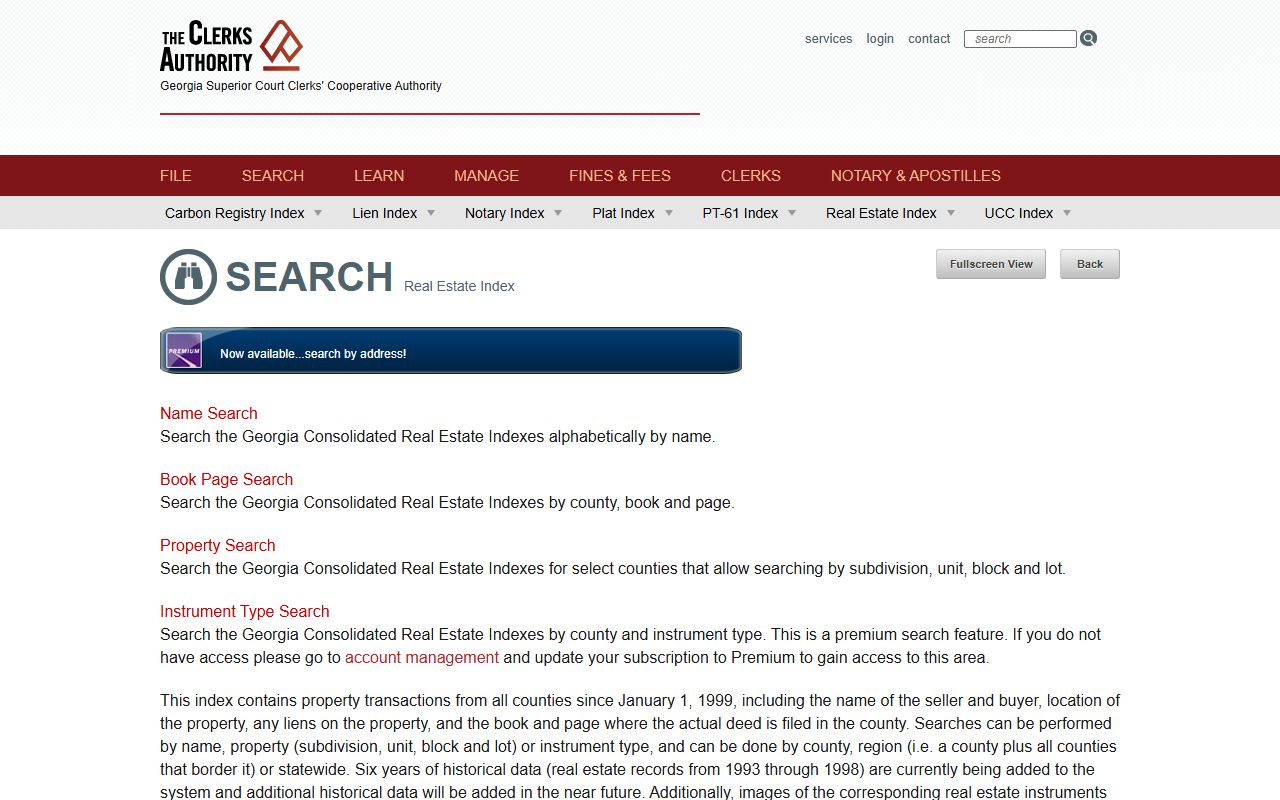

The Fayette County Clerk of Superior Court keeps all real estate records. This includes deeds, mortgages, and liens. These records date back to the founding of the county. You can search Fayette County deed records online through the Clerk's website. The real estate index lets you search by name or property.

All Fayette County property transactions must be recorded to be legal. The Clerk's office charges fees for recording. As of 2025, all documents must be filed electronically through GSCCCA. This change affects deeds, liens, and plats. The Fayette County Clerk of Court works with this state system.

To record a deed in Fayette County, you need:

- A notarized deed with proper formatting

- Completed PT-61 transfer tax form

- Recording fees paid at time of filing

Fayette County residents can also use the GSCCCA Real Estate Search. This covers all Georgia counties. It includes transactions since 1999. You can search by name, property, or book and page. The service requires an account for full access.

Fayette County Property Tax Records

The Fayette County Tax Commissioner handles tax billing and collection. They send out tax bills each year. Property taxes are due based on the county schedule. You can pay online, by mail, or in person. The Tax Commissioner also handles delinquent taxes.

Fayette County property tax records show what you owe each year. They include your assessed value and any exemptions. The millage rate is set by local officials. This rate times your taxable value equals your tax bill. You can appeal your assessment if you think it is wrong.

Important dates for Fayette County property taxes:

- January 1: Assessment date

- April 1: Exemption deadline

- May: Assessment notices mailed

- 45 days: Time to appeal values

How to Search Fayette County Property Records

Searching Fayette County property records is simple. Start with the QPublic portal for assessments. Use the Clerk of Court site for deeds. The GSCCCA system covers all records statewide. Each tool has its own use.

For Fayette County assessments, go to QPublic. Enter an address or owner name. The results show parcel maps and values. You can see sales history too. This helps when buying or selling property.

For Fayette County deeds, use the Clerk of Court Real Estate Index. Search by grantor or grantee name. You can also search by book and page. This finds the actual recorded documents. Copies cost a small fee.

The GSCCCA Real Estate Search covers Fayette County and all others. It has data since 1999. You can set up alerts for filings. This helps track properties you own. The FANS system is free to use.

State Resources for Fayette County Property Records

Georgia offers state-level tools for property records. These help Fayette County residents and buyers. The Department of Revenue lists county tax offices. They also explain Georgia tax laws.

The GSCCCA manages the real estate database. This is the main source for Fayette County deed records. Their eFile system is now required. All documents must be filed online. This started January 1, 2025.

Visit the GSCCCA website to access Fayette County records. Create an account for full features. Regular accounts cost $14.95 monthly. Premium accounts cost $29.95 monthly. Both charge per page for copies.

Key state resources for Fayette County property records:

- GSCCCA Real Estate Search: Statewide deed index

- Georgia DOR: Tax rules and county contacts

- FANS: Free alerts for filings on your property

- eCert: Digital certified copies of documents

Nearby Counties

These counties border Fayette County. You may need to search them if a property spans county lines or if you are researching nearby areas.