Milton Real Estate and Property Records

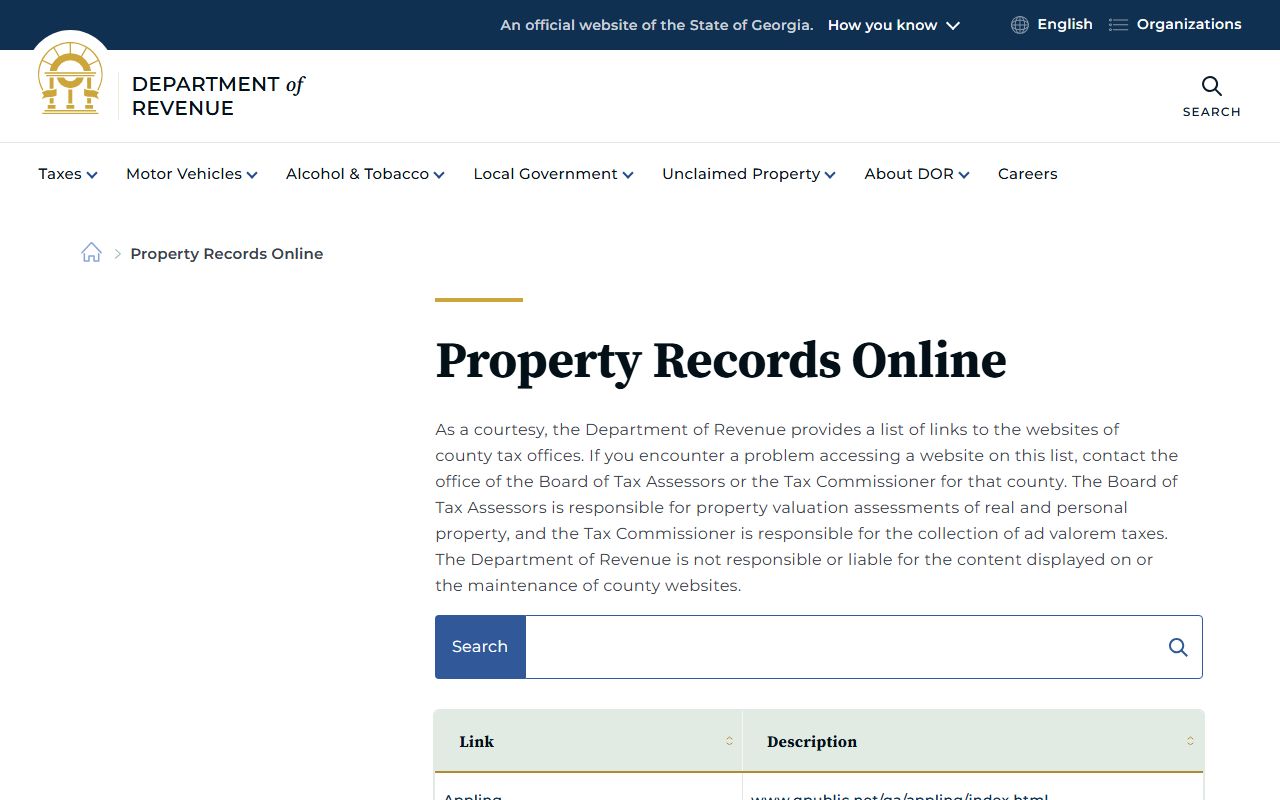

Milton property records are maintained by Fulton County. The county seat is Atlanta. Residents can access assessments, deeds, and tax records online. The Board of Assessors provides timely and accurate valuations for all Milton properties.

Milton Property Records Quick Facts

Milton Property Assessment Records

The Fulton County Board of Assessors values all Milton real estate. They provide exceptional customer service. Assessments are timely, accurate, and equitable. All work complies with Georgia law and Department of Revenue guidelines.

Milton property records can be searched through the Fulton County system. The portal shows parcel details and ownership. You can view assessed values and property characteristics. Visit fultonil.devnetwedge.com to search.

The Assessors office is at 141 Pryor Street SW in Atlanta. The office is in Suite 1009. Phone number is (404) 612-6440. Email questions to [email protected]

Office hours are Monday through Friday from 8:30 AM to 5:00 PM. Staff can help with assessments and exemptions. They also handle appeals and property returns.

Milton Homestead Exemptions

Homestead exemptions reduce taxes for Milton homeowners. A homestead exemption lowers your property tax. It applies to the home you own and occupy. Your primary residence qualifies for this benefit.

The deadline to apply for Milton homestead exemptions is April 1, 2026. Homeowners can apply now for the 2026 tax year. Applications can be submitted online. You can also apply in person at the Assessors office.

You must own and occupy the home as your primary residence. The property must be your legal domicile as of January 1. Once granted, exemptions renew automatically. You do not need to reapply each year.

Several homestead types may be available to Milton residents:

- Basic homestead for all primary residences

- Senior exemptions for residents over 65

- Disability exemptions for qualified individuals

- Veteran exemptions for service members

Note: Applications received after April 1 may be denied for that tax year.

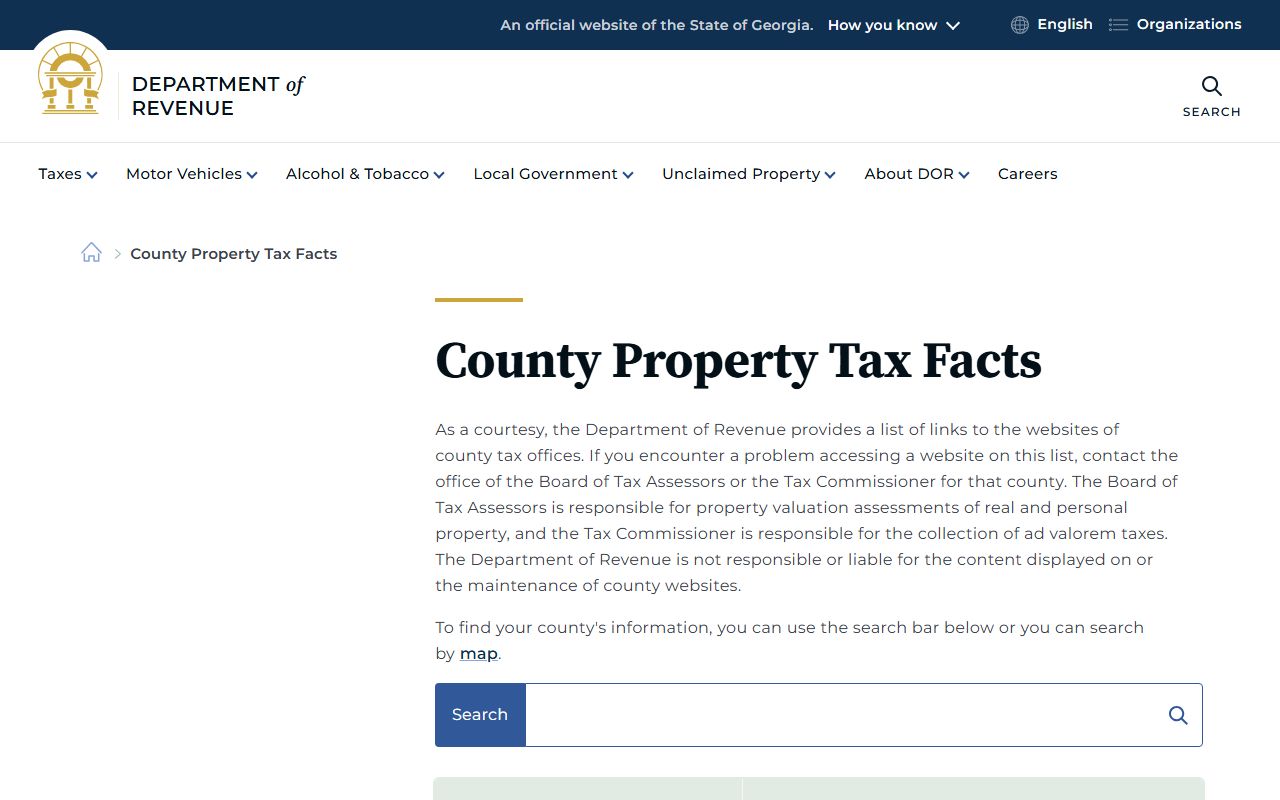

Milton Property Tax Records

The Fulton County Tax Commissioner handles billing for Milton properties. They collect taxes based on assessed values. Tax bills can be paid online or in person. The Tax Commissioner also manages motor vehicle tags.

Milton residents can access tax information through the county website. Visit fultoncountyga.gov for details. The portal shows tax bills and payment options. You can view account history online.

The Tax Commissioner office is at 141 Pryor Street SW. The office is in Suite 1004. Property tax phone is (404) 612-6100. Hours are Monday through Friday from 8:30 AM to 5:00 PM.

Property in Fulton County is assessed at 40% of fair market value. This follows Georgia law O.C.G.A. 48-5-7. The Board of Assessors sets the values. The Tax Commissioner applies the millage rates.

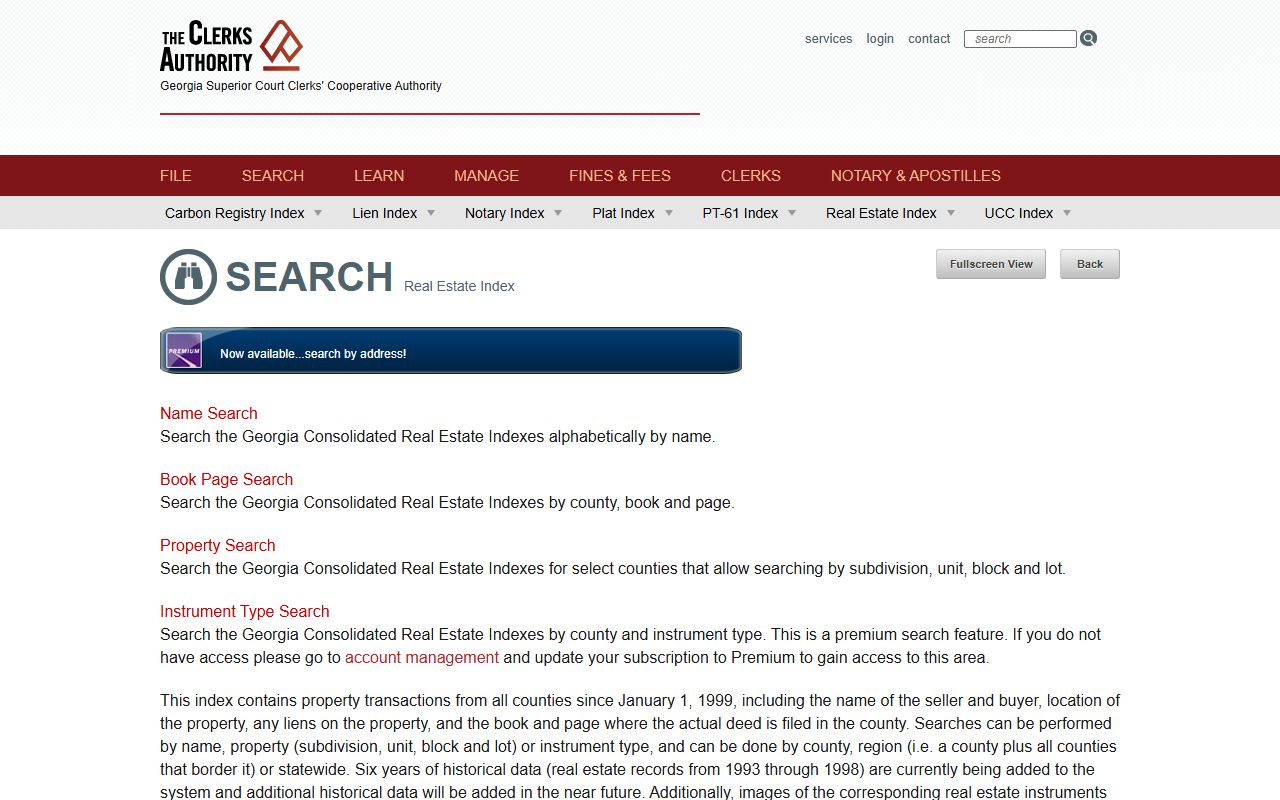

Milton Deed and Real Estate Records

The Fulton County Clerk of Superior Court maintains Milton real estate records. The Deeds and Records Room holds documents dating to the early 1800s. This includes real estate, military discharge, and trade name records.

The Real Estate Division is at 136 Pryor Street SW. This is on the ground floor of the Lewis Slaton Courthouse. The phone number is (404) 613-5313. Staff can help with recording questions.

Milton property transactions must be recorded to be valid. The Clerk of Court office charges recording fees. Standard documents cost $25. Additional fees apply to some document types.

The office cannot conduct legal research over the phone. Property questions require independent research. You may also contact a title search company. They can provide detailed chain of title research.

How to Search Milton Property Records

Finding Milton property records starts with the right tools. Fulton County offers online assessment searches. GSCCCA provides statewide deed access. Both systems work around the clock.

For Milton assessments, use the Fulton County property search. Enter an address or parcel number. Results show ownership, values, and exemptions. You can also view property characteristics and sales history.

For Milton deeds, check the GSCCCA database. Search by grantor or grantee name. Book and page searches find specific documents. The system covers all Georgia counties from 1999 forward.

Milton property records typically include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and payment status

- Deed book and page references

- Lien and mortgage information

The FANS system protects against property fraud. Register at fans.gsccca.org. You get alerts when documents are filed with your name or address.

Milton Property Appeals Process

Property owners in Milton can appeal their assessments. The appeal period starts when notices are mailed. You have 45 days to file an appeal. This ensures fair treatment for all taxpayers.

To appeal your Milton assessment, contact the Board of Assessors. Provide supporting evidence like comparable sales. Appeals can be filed online, by mail, or in person. The Board reviews all appeals carefully.

If you disagree with the Board's decision, further options exist. Appeals can go to the Board of Equalization. Hearing officers and arbitration are also available. Final appeals can be filed in Superior Court.

Key points about Milton property appeals:

- File within 45 days of assessment notice

- Provide comparable sales or appraisal

- Multiple appeal levels are available

- Legal representation is optional

Nearby Property Records

These counties and cities border or are near Milton. You may need to search them for properties near the county line.