Dunwoody Real Estate and Property Records

Dunwoody property records are maintained by DeKalb County. The county seat is Decatur but Dunwoody residents access records online. The Property Appraisal Department handles assessments for all DeKalb County including Dunwoody. You can search records and pay taxes through county portals.

Dunwoody Property Records Quick Facts

Dunwoody Property Assessment Records

The DeKalb County Property Appraisal Department values all Dunwoody real estate. They produce annual assessments that meet state law. The goal is fair and uniform valuations across all properties. Dunwoody homes are assessed at 40% of fair market value.

Dunwoody property records can be accessed through the DeKalb County public access portal. This system shows assessments and ownership details. You can view parcel maps and property characteristics. The portal is available at publicaccess.dekalbtax.org.

The Property Appraisal office is at 120 West Trinity Place in Decatur. Their phone number is (404) 371-2901. Email questions to boa@dekalbcountyga.gov. Office hours are Monday through Friday from 8:30 AM to 5:00 PM.

Georgia law allows appraisal staff to visit Dunwoody properties. They may enter during normal hours with proper identification. This helps ensure accurate property data for assessments.

Dunwoody Property Appeals Process

Property owners in Dunwoody can appeal their assessments. The appeal period begins when notices are mailed. You have 45 days to file an appeal. The process ensures fair valuations for all DeKalb County properties.

DeKalb County was granted additional time for 2025 appeals. Under O.C.G.A. 48-5-311(e)(3)(B), the Board of Assessors has 180 extra days. This applies when appeals exceed 3% of total parcels. Dunwoody property owners should expect longer response times.

To appeal your Dunwoody property assessment, file with the Board of Assessors. Include supporting documentation like comparable sales. You can appeal online, by mail, or in person. The appeal can go to the Board of Equalization if needed.

Appeal options for Dunwoody property owners include:

- Board of Equalization hearing

- Hearing officer review

- Binding arbitration

Note: Appeals must be filed by the deadline. Late appeals are generally not accepted without extraordinary circumstances.

Dunwoody Property Tax Records

The DeKalb County Tax Commissioner handles billing for Dunwoody properties. They mail tax bills based on assessed values. Taxes can be paid online, by mail, or in person. The Tax Commissioner also provides motor vehicle services.

Dunwoody residents can access their tax records at dekalbtax.org. This portal shows current and past tax bills. You can view payment history and outstanding balances. The system accepts online payments with credit cards or e-checks.

The Tax Commissioner office is open Monday through Friday. Hours are 8:00 AM to 4:30 PM. Property tax questions go to (404) 298-4000. Motor vehicle questions use the same number.

Homestead exemptions lower tax bills for Dunwoody homeowners. You must own and occupy the home as your primary residence. Apply through the Property Appraisal Department by April 1. Once granted, exemptions renew automatically each year.

Dunwoody Deed and Lien Records

The DeKalb County Clerk of Superior Court maintains Dunwoody real estate records. This includes deeds, mortgages, and liens. These documents establish ownership and financial claims. All records are public and searchable.

Dunwoody property transactions must be recorded to be legal. The Clerk of Court office handles recordings. Fees are set by state law under O.C.G.A. § 15-6-98. Standard recordings cost $25 per document as of January 2020.

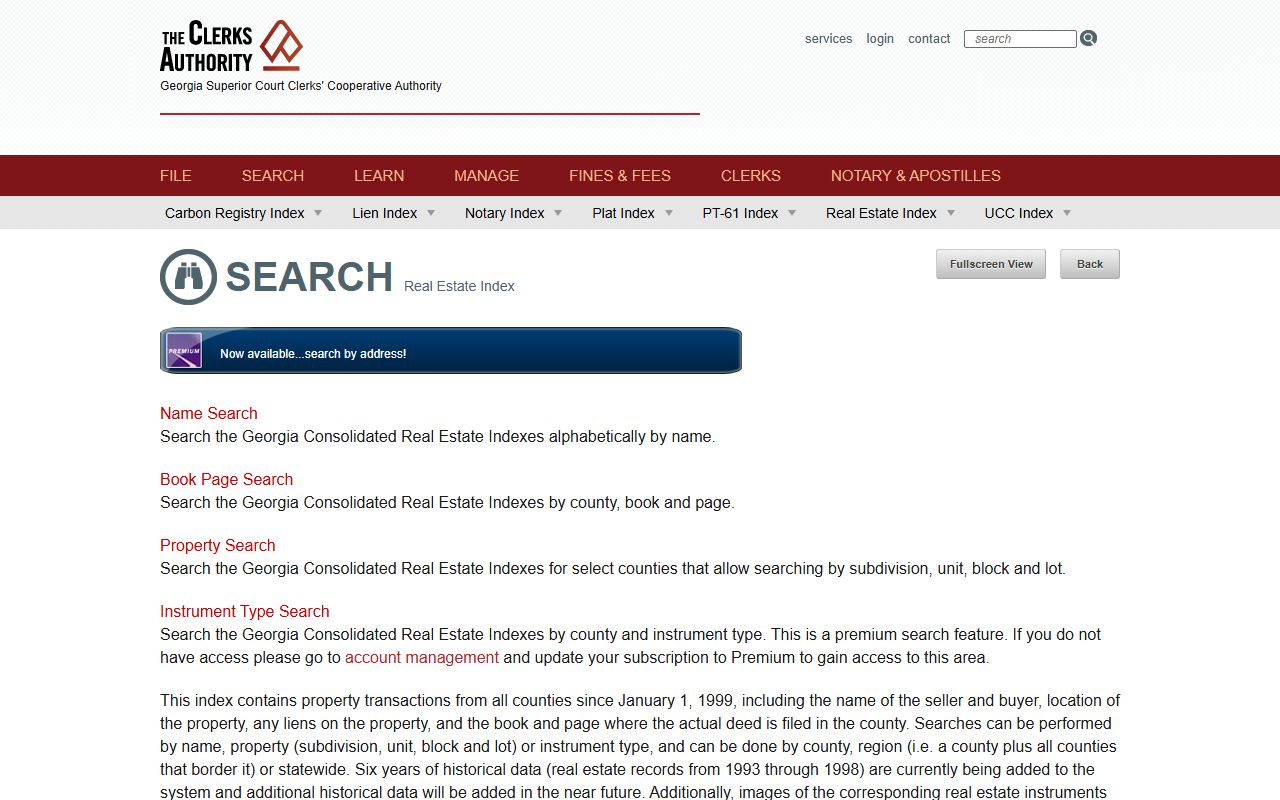

You can search Dunwoody deed records through GSCCCA. This statewide system covers all Georgia counties. It includes transactions from 1999 to present. Search by name, property, or instrument type.

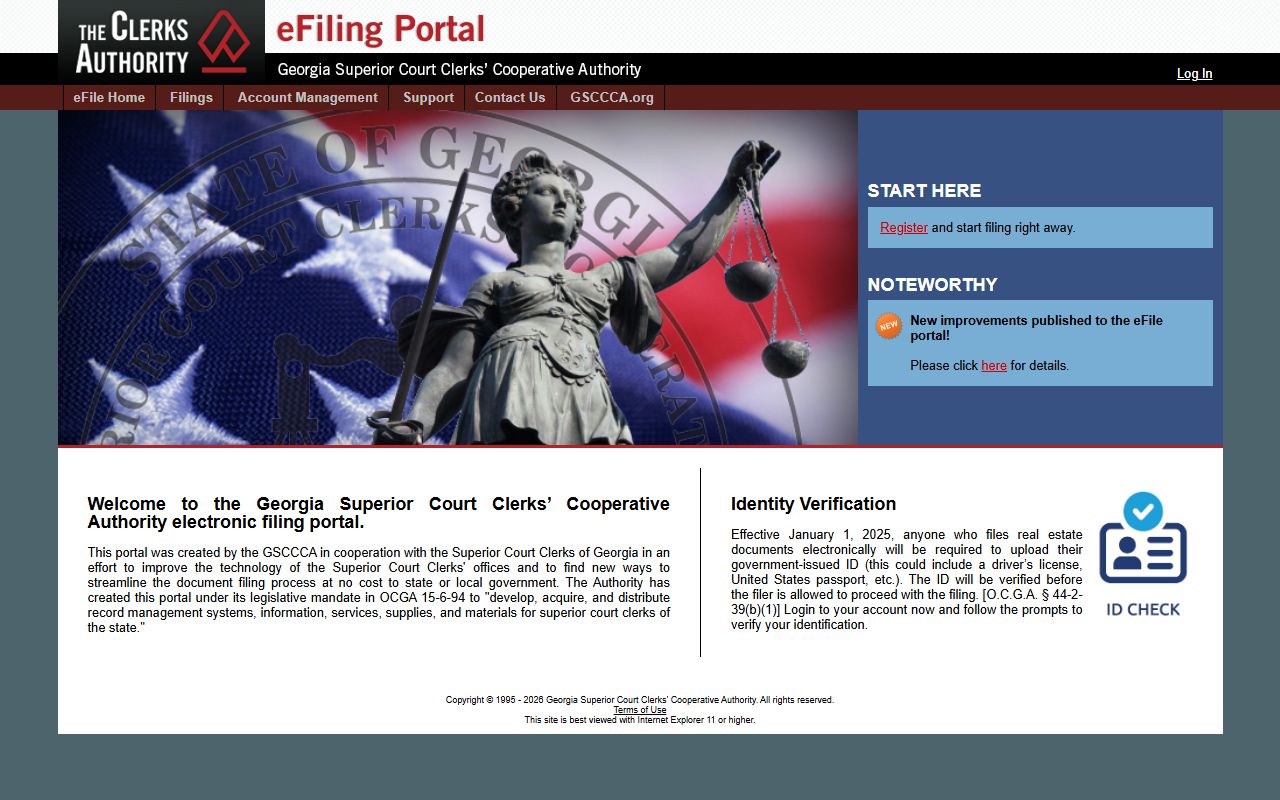

Effective January 1, 2025, all documents must be filed electronically. This requirement comes from House Bill 1952. Electronic filing is done through the GSCCCA portal.

How to Search Dunwoody Property Records

Finding Dunwoody property records starts with the right tools. Use the DeKalb County portal for assessments. Check GSCCCA for deeds and liens. Both systems are available online around the clock.

For Dunwoody assessments, visit publicaccess.dekalbtax.org. Enter an address or parcel number. Results show ownership, values, and exemptions. You can also view property maps.

For Dunwoody deed records, use search.gsccca.org. Search by grantor or grantee name. You can also search by book and page. This finds recorded documents statewide.

Dunwoody property records typically contain:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and payment status

- Deed references and recording dates

- Lien and mortgage information

The FANS system protects Dunwoody property owners from fraud. Register at fans.gsccca.org. You get alerts when documents are filed with your name or address.

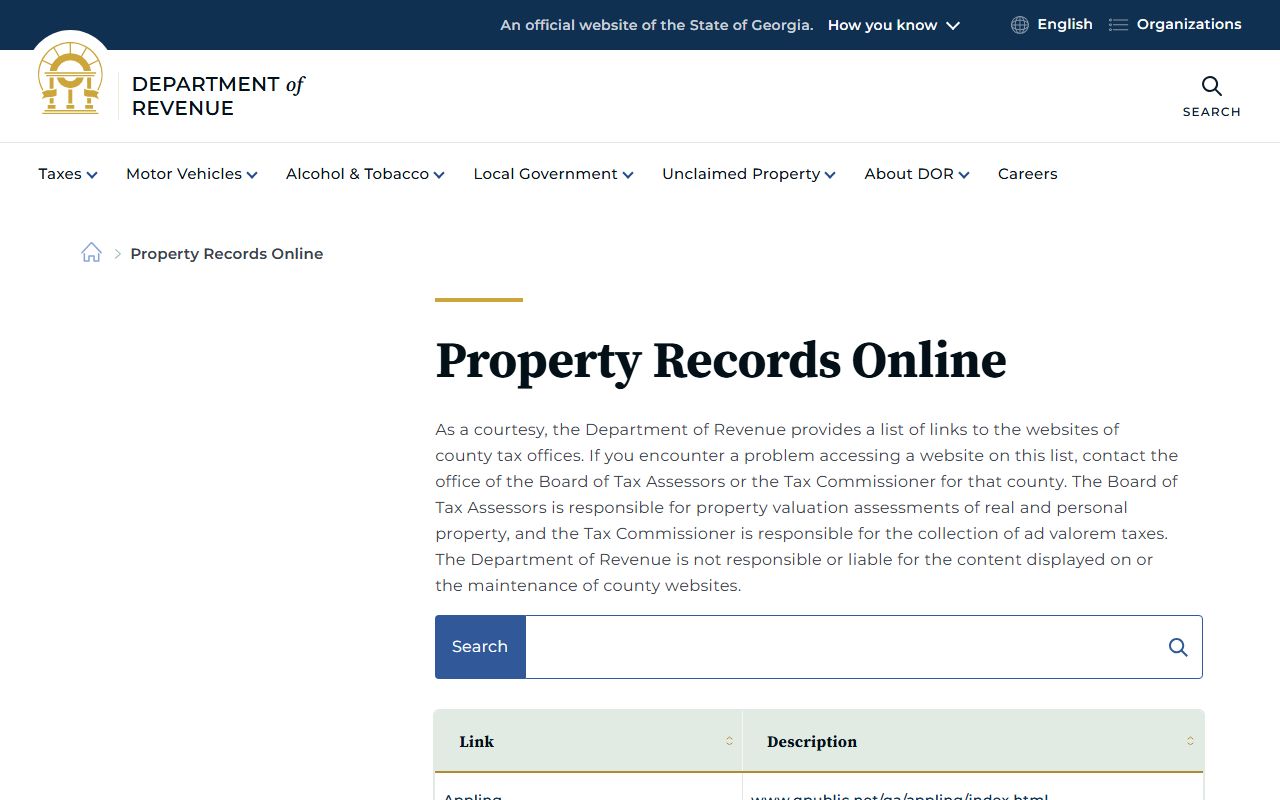

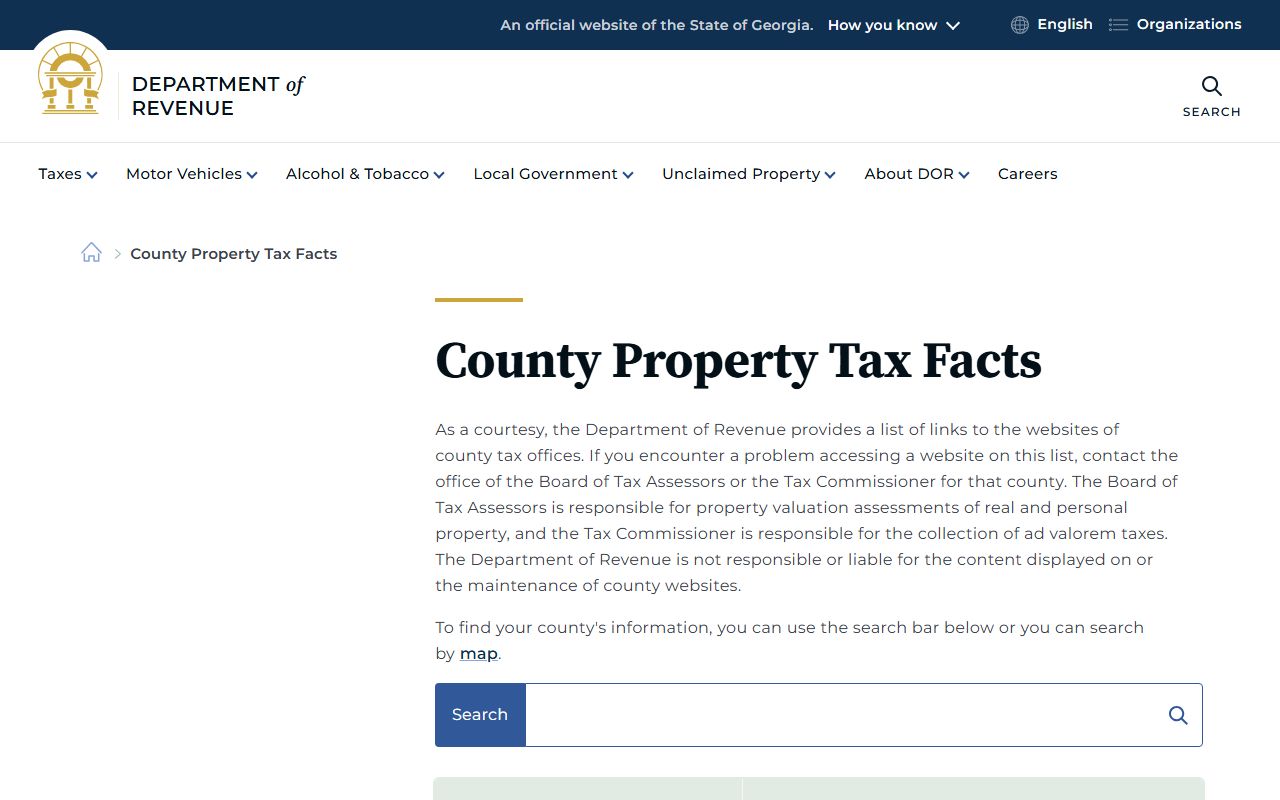

State Resources for Dunwoody Property Records

Georgia provides statewide tools for property records. These help Dunwoody residents and buyers. The Department of Revenue lists county tax offices. They explain assessment and appeal rules.

GSCCCA manages the real estate database for all counties. This includes DeKalb County and Dunwoody. Their eFile system is now required for all documents. Electronic filing started January 1, 2025.

GSCCCA accounts come in two levels. Regular accounts cost $14.95 per month. Premium accounts cost $29.95 per month. Both charge $0.50 per page for copies. Premium adds instrument type searches.

Key state resources for Dunwoody property records:

- GSCCCA Real Estate Search: Statewide deed index

- Georgia DOR: Tax rules and county contacts

- FANS: Free fraud alerts for property owners

- eCert: Digital certified document copies

Nearby Property Records

These nearby counties and cities border Dunwoody. You may need to search them for properties near the perimeter or for regional research.