Rome Real Estate and Property Records

Rome property records are maintained by Floyd County. The city serves as the county seat. Residents can access assessments, deeds, and tax records online. The Tax Assessor and Clerk of Court provide property information.

Rome Property Records Quick Facts

Rome Property Assessment Records

The Floyd County Tax Assessor values all Rome real estate. They maintain property records for tax purposes. Assessments follow Georgia law requirements. Property is assessed at 40% of fair market value.

Rome property records can be searched through QPublic. Visit qpublic.net/ga/floyd to access the portal. Results show parcel details and ownership. You can view assessed values and property characteristics.

The county seat is Rome. The Tax Assessor office is located there. Staff can help with assessments and exemptions. They also handle appeals and property questions.

Rome residents can apply for homestead exemptions. These reduce taxable value for primary residences. Applications must be filed by April 1. Contact the Assessors office for details.

Rome Deed and Real Estate Records

The Floyd County Clerk of Superior Court maintains Rome real estate records. Deeds, mortgages, and liens are recorded here. These documents establish property ownership. They also show financial claims.

The Floyd County Superior Court Clerk provides online access. Visit floydsuperiorcourt.com/Deeds for deed information. You can also search through GSCCCA statewide.

Rome property transactions must be recorded. The Clerk of Court office handles recordings. Fees apply to all documents. Standard recordings cost $25 per document.

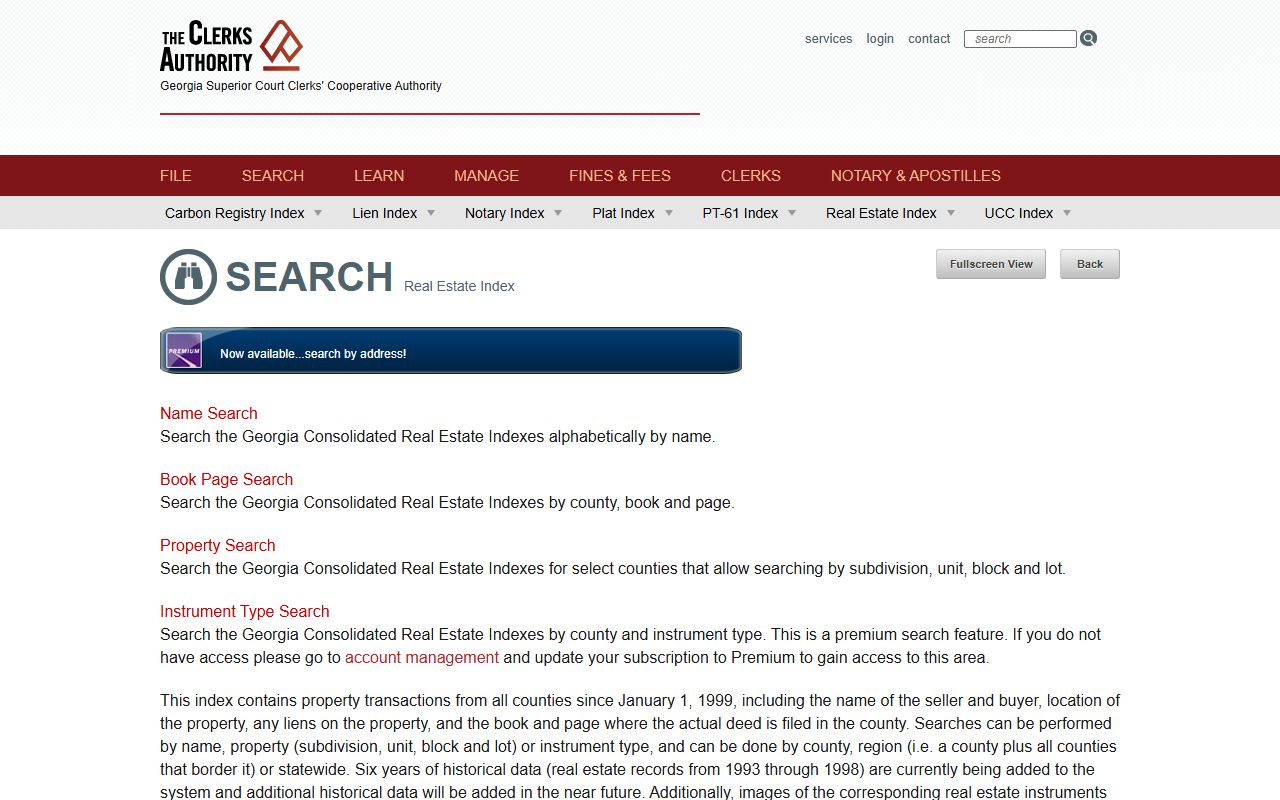

GSCCCA provides statewide access to Rome deed records. This system covers all Georgia counties. Records date back to January 1, 1999. Search by name, property, or instrument type.

Rome Property Tax Records

The Floyd County Tax Commissioner handles billing for Rome properties. Tax bills are mailed based on assessments. The Tax Commissioner collects property taxes. Payments can be made online or in person.

Rome residents can view tax information through county resources. Assessment notices go out each year. Property owners have time to appeal. Tax bills follow after the appeal period.

Property taxes fund county services in Rome. These include schools, roads, and public safety. Fair assessments ensure everyone pays their share. The Tax Commissioner distributes revenues appropriately.

Key dates for Rome property taxes:

- January 1: Assessment date

- April 1: Exemption application deadline

- Annual notices: Mailed by the Assessors

- Appeal period: Typically 45 days

Note: Contact the Tax Commissioner for specific due dates and payment options.

How to Search Rome Property Records

Finding Rome property records starts with the right tools. Floyd County offers online assessment searches. GSCCCA provides statewide deed access. Both systems are available 24 hours a day.

For Rome assessments, use the QPublic portal. Enter an address or parcel number. Results show ownership, values, and exemptions. You can also view property characteristics.

For Rome deeds, use the GSCCCA database. Search by grantor or grantee name. Book and page searches find specific documents. The Clerk of Court website also provides access.

Rome property records typically include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and payment status

- Deed references and recording dates

- Lien and mortgage information

The FANS system helps protect Rome property owners. Register at fans.gsccca.org. You receive alerts when documents are filed with your name or address.

Rome Property Appeals and Exemptions

Property owners in Rome can appeal their assessments if they disagree with the value. The appeal period begins when assessment notices are mailed. You typically have 45 days to file an appeal. This process ensures fair treatment for all taxpayers.

To appeal your Rome property assessment, contact the Floyd County Board of Tax Assessors. Include supporting documentation such as comparable sales or a recent appraisal. Appeals can be filed by mail or in person. The Board reviews all appeals and may adjust values based on evidence.

Homestead exemptions are available for Rome homeowners. These exemptions reduce your taxable property value. You must own and occupy the home as your primary residence. The property must be your legal domicile as of January 1.

Apply for homestead exemptions through the Tax Assessors office. Applications are due by April 1 each year. Once granted, exemptions renew automatically. You do not need to reapply unless your status changes.

Key points about Rome property appeals:

- File within the appeal period after notice

- Provide comparable sales or appraisal

- Appeals can go to the Board of Equalization

- Homestead applications due April 1

Note: Contact the Floyd County Tax Assessors office for exemption details and appeal procedures.

State Resources for Rome Property Records

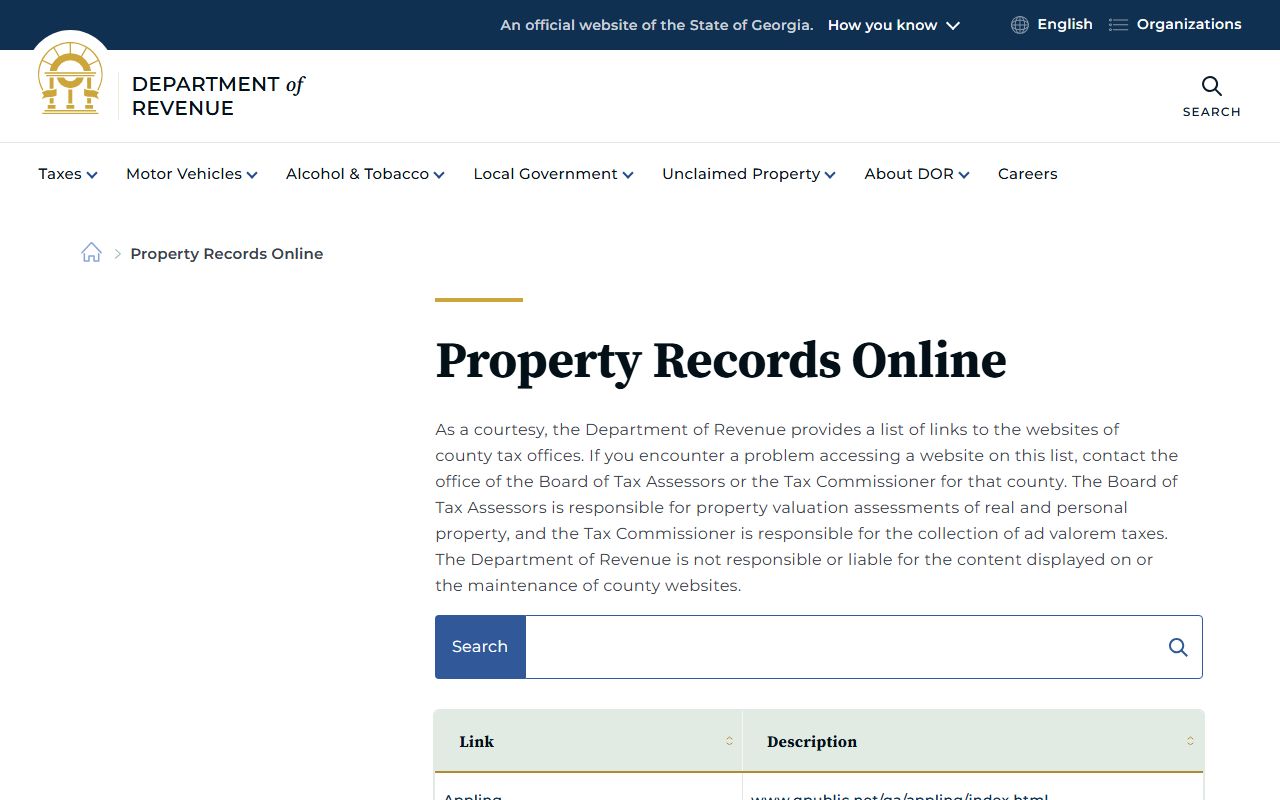

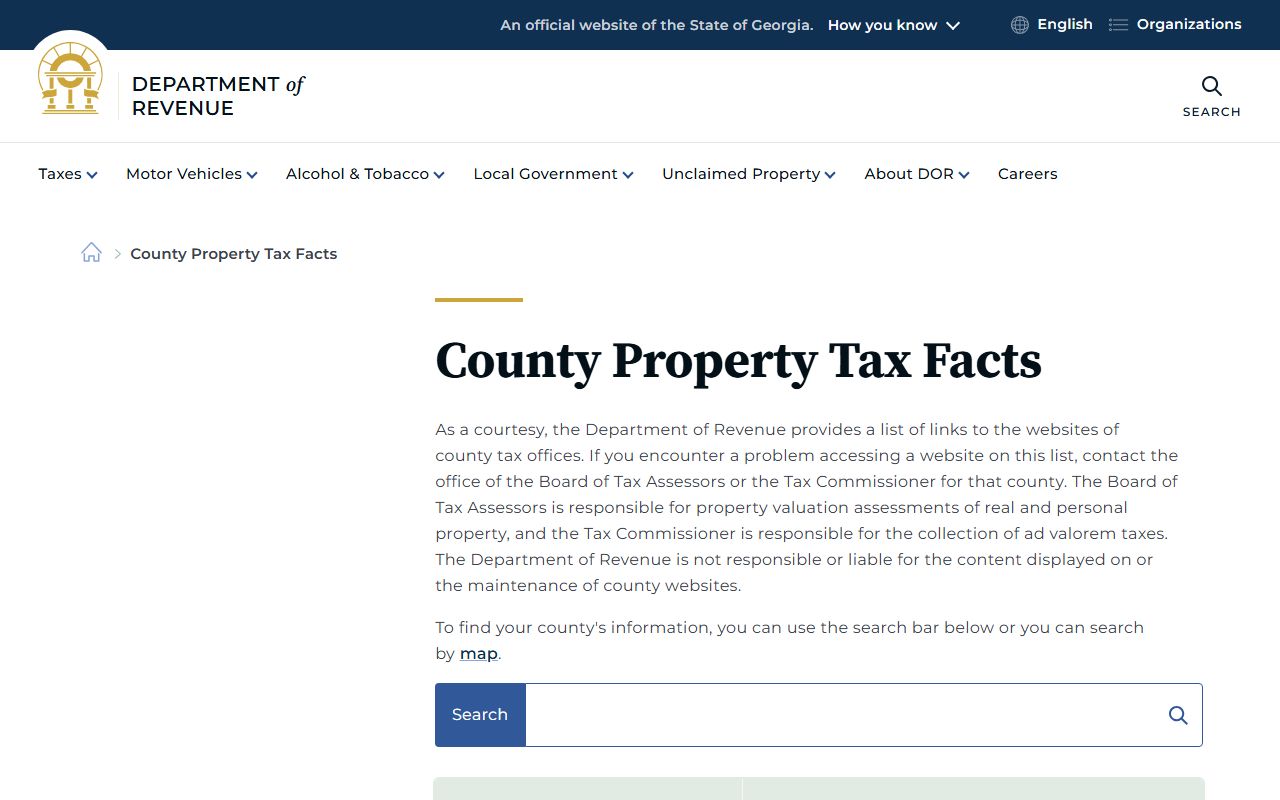

Georgia provides statewide tools for property records. These help Rome residents and researchers. The Department of Revenue lists county tax offices. They explain assessment and appeal rules.

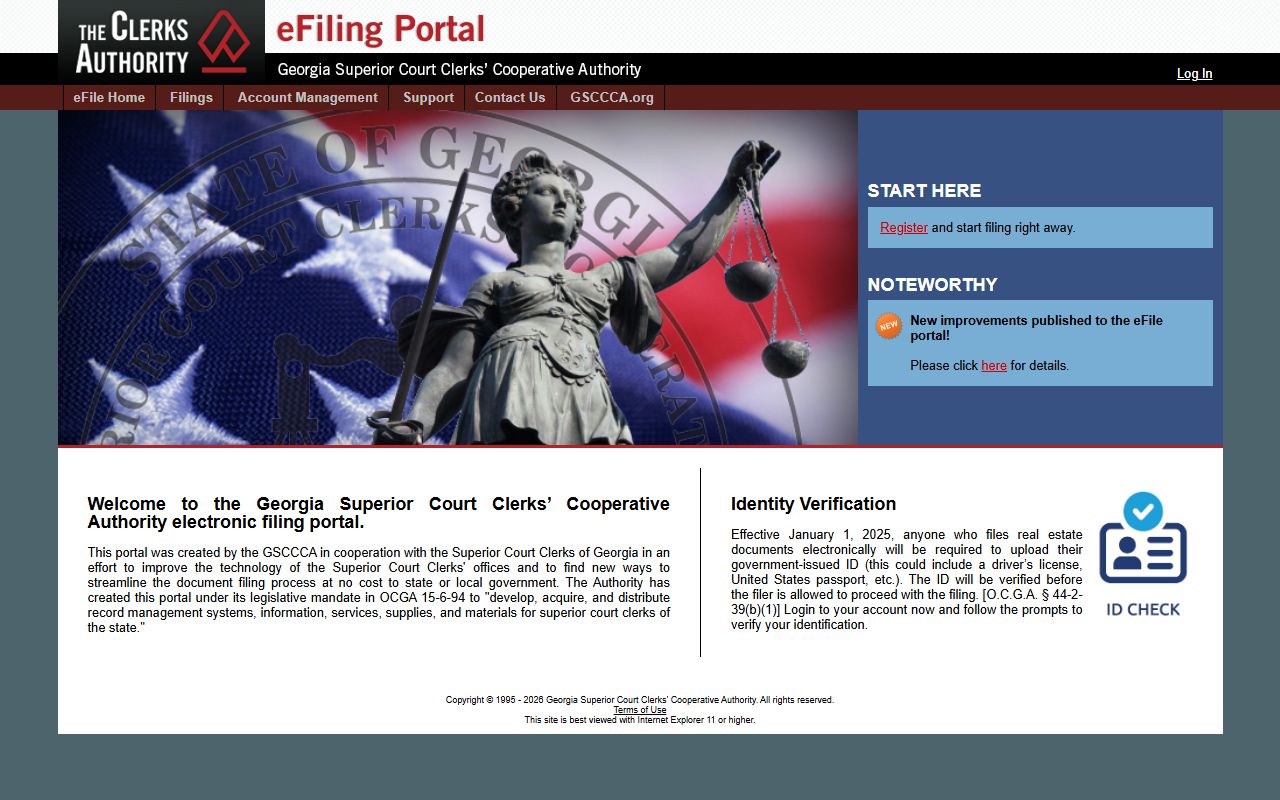

GSCCCA manages the real estate database. This covers Floyd County and Rome. Their eFile system is now required. Electronic filing started January 1, 2025.

GSCCCA accounts come in two levels. Regular accounts cost $14.95 per month. Premium accounts cost $29.95 per month. Both charge $0.50 per page for copies. Premium adds advanced search features.

Key state resources for Rome property records:

- GSCCCA Real Estate Search: Statewide deed index

- Georgia DOR: Tax rules and county contacts

- FANS: Free fraud alerts for property owners

- eCert: Digital certified document copies

Nearby Property Records

These counties border Floyd County. Properties near the county line may need searches in multiple jurisdictions.