Bartow County Real Estate and Assessment Records

Bartow County property records are maintained by the Board of Tax Assessors and the Clerk of Superior Court. The county seat is Cartersville. The Tax Assessor office is on West Cherokee Avenue. The Clerk of Court handles real estate recordings. Both offices offer online access to records.

Bartow County Property Records Quick Facts

Bartow County Tax Assessor Property Records

The Bartow County Board of Tax Assessors values all property. Board members are appointed by the county commissioners. They serve fixed terms. The Board ensures fair and equalized assessments across the county.

Bartow County property assessments use fair market value. This is what a buyer would pay a seller. The assessment level is 40% of that value. The valuation date is January 1 each year. Notices go out in the spring.

You can search Bartow County assessments online. Use QPublic at qpublic.net/ga/bartow. Search by owner, address, or parcel ID. The site shows maps and details. It is free to use.

Bartow County offers specialized programs. Agricultural property is assessed at 30%. Conservation use gets current use value. Historic properties may qualify for breaks. Brownfield properties have frozen values for ten years.

Bartow County Real Estate Records and Recording

The Bartow County Clerk of Superior Court records deeds. The Real Estate Division is on West Cherokee Avenue. They file deeds, mortgages, and liens. They also handle plats and UCCs.

Recording fees in Bartow County follow state law. Standard documents cost $25 each. This includes deeds and mortgages. Cancellations and releases are also $25. Plat recordings are $10 per page.

Documents must meet formatting rules. The first page needs a three-inch top margin. Other pages need one-inch margins. Include a return address and grantee name. All deeds need a PT-61 form.

As of January 1, 2025, eFiling is required. All documents must be filed online. Use the GSCCCA eFile portal. The Clerk no longer takes paper documents. This applies to all real estate filings.

Bartow County Mobile Home Property Records

Bartow County taxes mobile homes separately. They are personal property, not real estate. Owners must get permits each year. Taxes are due by April 1.

Mobile home bills are mailed January 2. The decal must be displayed on the home. Late payments get a 10% penalty. Appeals must be filed within 45 days. Contact the Tax Assessor for value questions.

Key mobile home dates in Bartow County:

- January 2: Bills mailed to owners

- April 1: Taxes due deadline

- 45 days: Time to appeal assessments

- Year-round: Permit applications accepted

Bartow County Tax Commissioner Records and Payments

The Bartow County Tax Commissioner collects property taxes. They bill for the county, cities, and schools. The office is on West Cherokee Avenue. You can pay online at tax.bartowpay.com.

Bartow County tax records show your bill details. This includes assessed value and exemptions. It shows the millage rate and tax due. You can view payment history online.

Taxes are due when bills are issued. Penalties apply for late payment. The Tax Commissioner can file tax liens. These are recorded at the Clerk of Court. They stay for seven years.

How to Search Bartow County Property Records

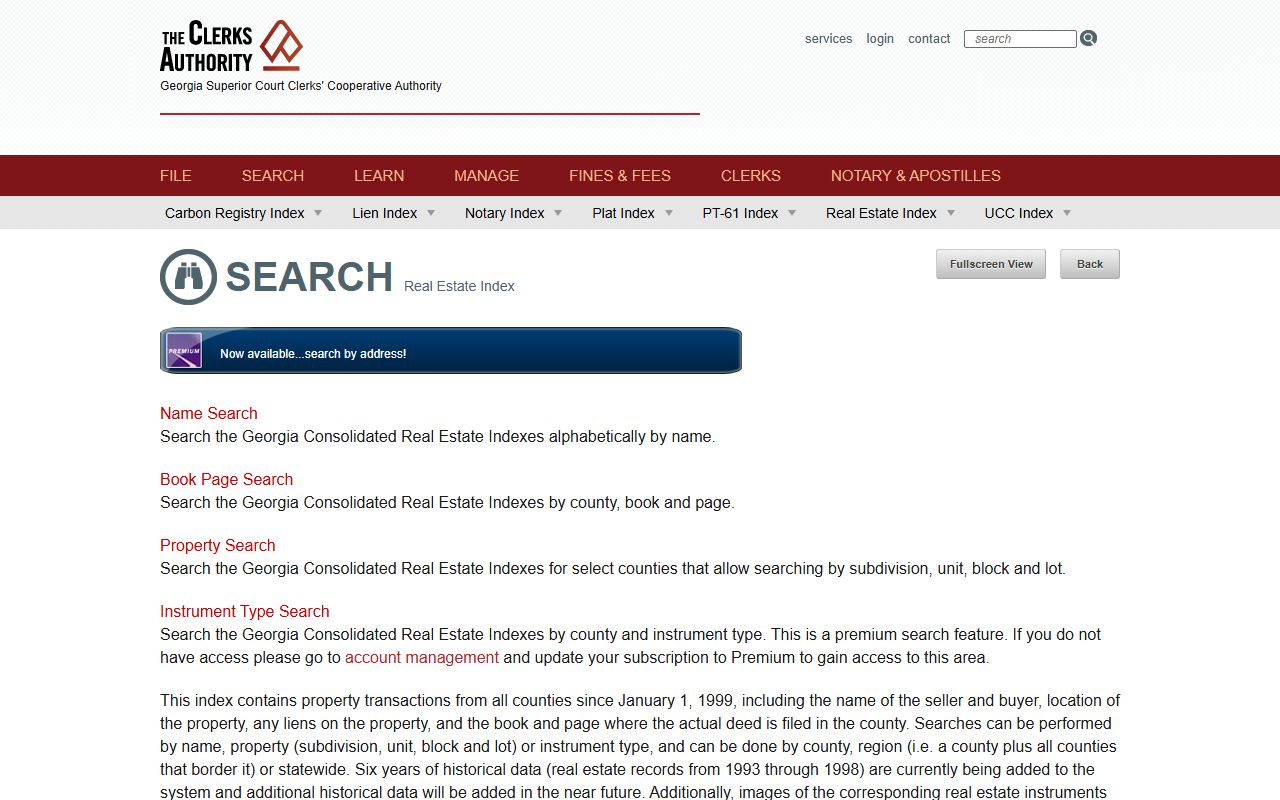

There are three main ways to find Bartow County records. Each serves a different purpose. Use the right tool for your needs.

For assessments, use QPublic. Search by name or address. View parcel maps and values. See sales history for the area.

For deeds, use GSCCCA. This state database has all counties. Search by name or property. Get copies of recorded documents.

For tax bills, use the Tax Commissioner site. Look up your account. Pay online or see your balance. View past payments.

Bartow County Freeport Exemption for Businesses

Bartow County offers Freeport exemptions. These help manufacturers. They reduce taxes on inventory. Three types qualify for breaks.

Raw materials are exempt. Goods in process qualify too. Finished goods held for shipment are covered. Apply with the Tax Assessor. This can save businesses money.

The exemption applies to certain property. It must be held for trade. It cannot be retail inventory. Contact the Bartow County Tax Assessor for details.

Nearby Counties

These counties border Bartow County. You may need to search them for properties near county lines.