Newnan Real Estate and Property Records

Newnan property records are maintained by Coweta County. The city serves as the county seat. Residents can access assessments, deeds, and tax records through county websites. The Tax Assessors office values all property in Newnan and surrounding areas.

Newnan Property Records Quick Facts

Newnan Property Assessment Records

The Coweta County Tax Assessors office values all Newnan real estate. They appraise tangible real and personal property annually. The goal is fair market value using uniform methods. Newnan homes are assessed at 40% of fair market value.

Newnan property records can be searched online through the county portal. The system shows parcel details and assessments. You can view ownership and property characteristics. Visit coweta.ga.us to search.

The Tax Assessors office is at 37 Perry Street in Newnan. Their phone number is 770-254-2680. Send faxes to 770-254-2649. Email questions to tassessors@coweta.ga.us.

Office hours are Monday through Friday from 8:00 AM to 5:00 PM. Staff can help with assessments and exemptions. They also handle non-disclosure requests for qualified individuals.

Newnan Property Field Reviews

Coweta County appraisers routinely review all Newnan properties. This includes residential and commercial parcels. The reviews verify property characteristics. Georgia law requires regular inspections under O.C.G.A. 48-5-264-1.

Notice is given that Newnan properties may be visited. Appraisers carry county identification badges. They drive marked county vehicles. Staff conduct outside inspections but respect locked gates.

The field review process helps ensure accurate Newnan property records. Appraisers note building conditions and improvements. Photos document property characteristics. This data supports fair and uniform assessments.

Key points about Newnan property reviews:

- Appraisers carry official identification

- Reviews include all property types

- Outside inspections are standard practice

- Staff respect no-trespassing boundaries

Note: Property reviews happen year-round as part of the assessment cycle.

Newnan Property Tax Records

The Coweta County Tax Commissioner handles billing for Newnan properties. Taxes are billed and collected by the county. The City of Newnan does not bill separately. All property taxes are due December 1st.

Newnan residents can pay taxes through cowetataxcom.com. The portal accepts online payments. You can view tax bills and payment history. Multiple payment options are available.

Fair market value is determined by the Board of Assessors. Assessed value equals 40% of fair market value. Property in Georgia is taxed on the assessed value. The millage rate is set by local authorities.

Non-disclosure status is available for certain Newnan property owners. Starting July 1, 2023, removal of personal information changed. This applies to individuals covered by OCGA 50-18-72 and OCGA 50-18-78. Contact the Assessors office for details.

Newnan Deed and Lien Records

The Coweta County Clerk of Superior Court maintains Newnan real estate records. Deeds, mortgages, and liens are recorded here. These documents establish ownership and financial claims. All records are public and searchable.

Newnan property transactions must be recorded to be legal. The Clerk of Court office charges recording fees. Standard documents cost $25 under HB 288. Additional fees apply for specific document types.

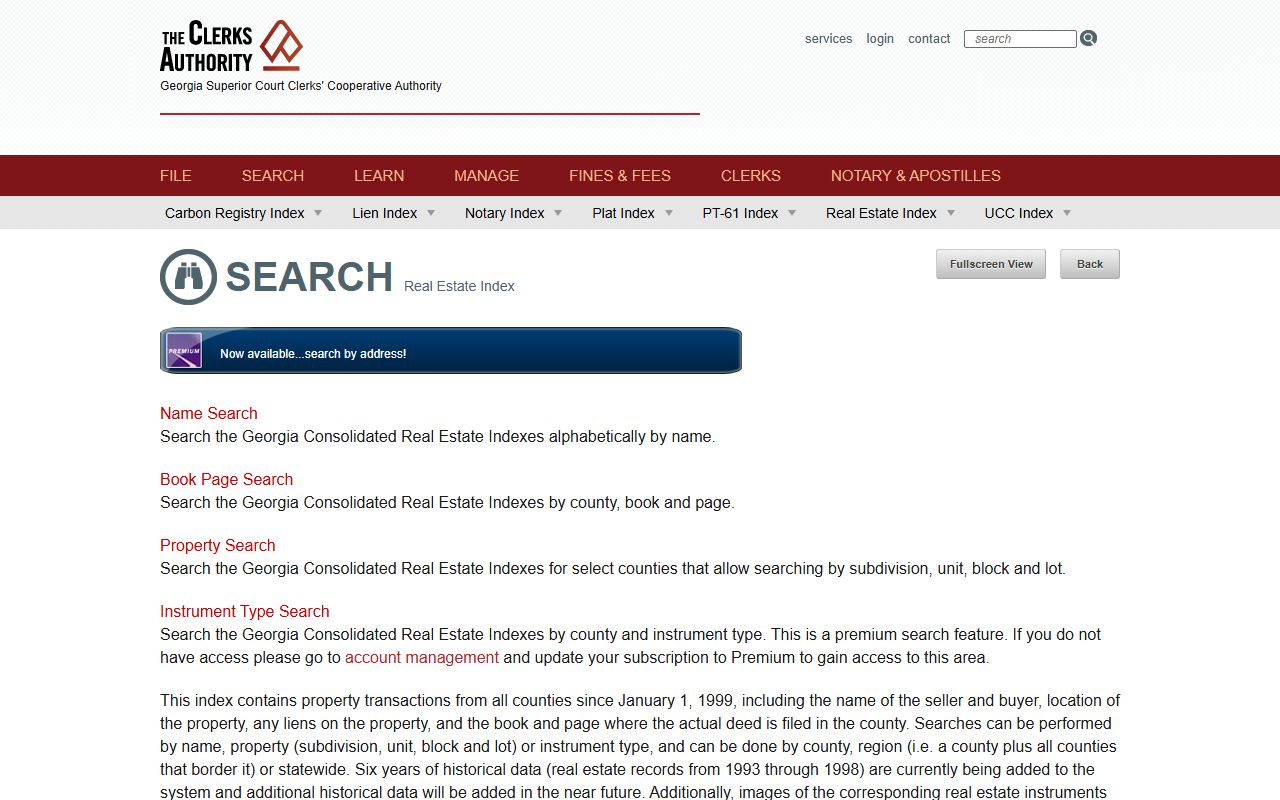

You can search Newnan deed records through GSCCCA. This statewide database covers all Georgia counties. It includes transactions since January 1, 1999. Search by name, property, or book and page.

Electronic filing is required as of January 1, 2025. All documents must be filed through GSCCCA. This includes deeds, liens, UCCs, and plats. House Bill 1952 mandates this change.

How to Search Newnan Property Records

Finding Newnan property records starts with the right resources. Coweta County provides online access to assessments. GSCCCA offers statewide deed searches. Both systems are available 24 hours a day.

For Newnan assessments, visit the Coweta County property search. Enter an address or parcel number. Results show ownership, values, and exemptions. You can also view property characteristics.

For Newnan deeds, use the GSCCCA real estate database. Search by grantor or grantee name. Book and page searches find specific documents. The system shows records from 1999 forward.

Newnan property records typically include:

- Owner name and mailing address

- Property address and legal description

- Assessed and fair market values

- Tax amounts and due dates

- Deed references and recording information

- Lien and mortgage details

The FANS system protects against deed fraud. Register at fans.gsccca.org. You receive alerts when filings match your registered information.

Newnan Homestead Exemptions

Homestead exemptions reduce taxes for Newnan homeowners. You must own and occupy the home as your primary residence. The property must be your legal domicile. Exemptions lower the taxable value of your property.

Apply for Newnan homestead exemptions through the Assessors office. Applications are due by April 1 each year. You can apply online or in person. Once granted, exemptions renew automatically.

You must occupy the home as of January 1 to qualify. The exemption applies to the tax year starting that January. New owners should file promptly after purchase. Late applications may be accepted in some cases.

Several exemption types may be available to Newnan residents. Basic homestead is the most common. Additional exemptions exist for seniors, disabled veterans, and others. Contact the Assessors office to learn what you qualify for.

Nearby Property Records

These counties border Coweta County. You may need to search them for properties near the county line or for regional comparison.