Gainesville Real Estate and Ownership Records

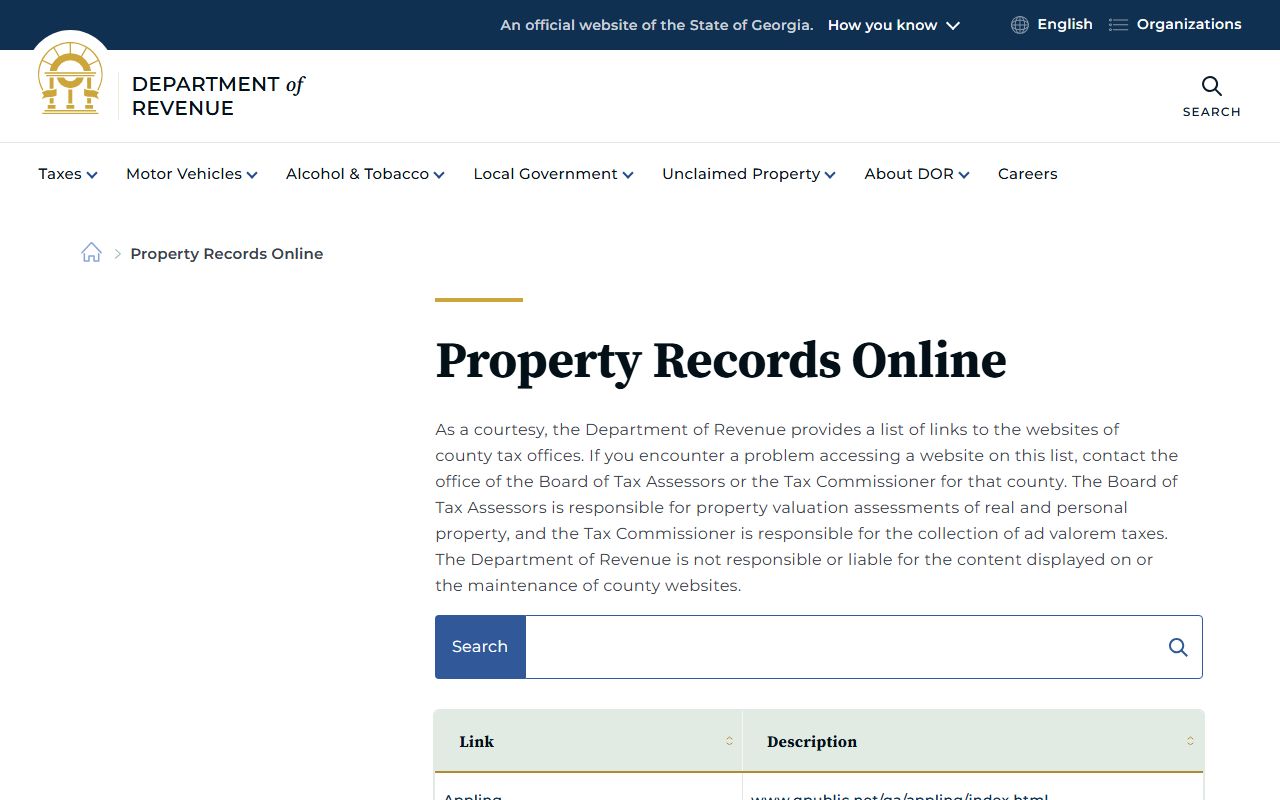

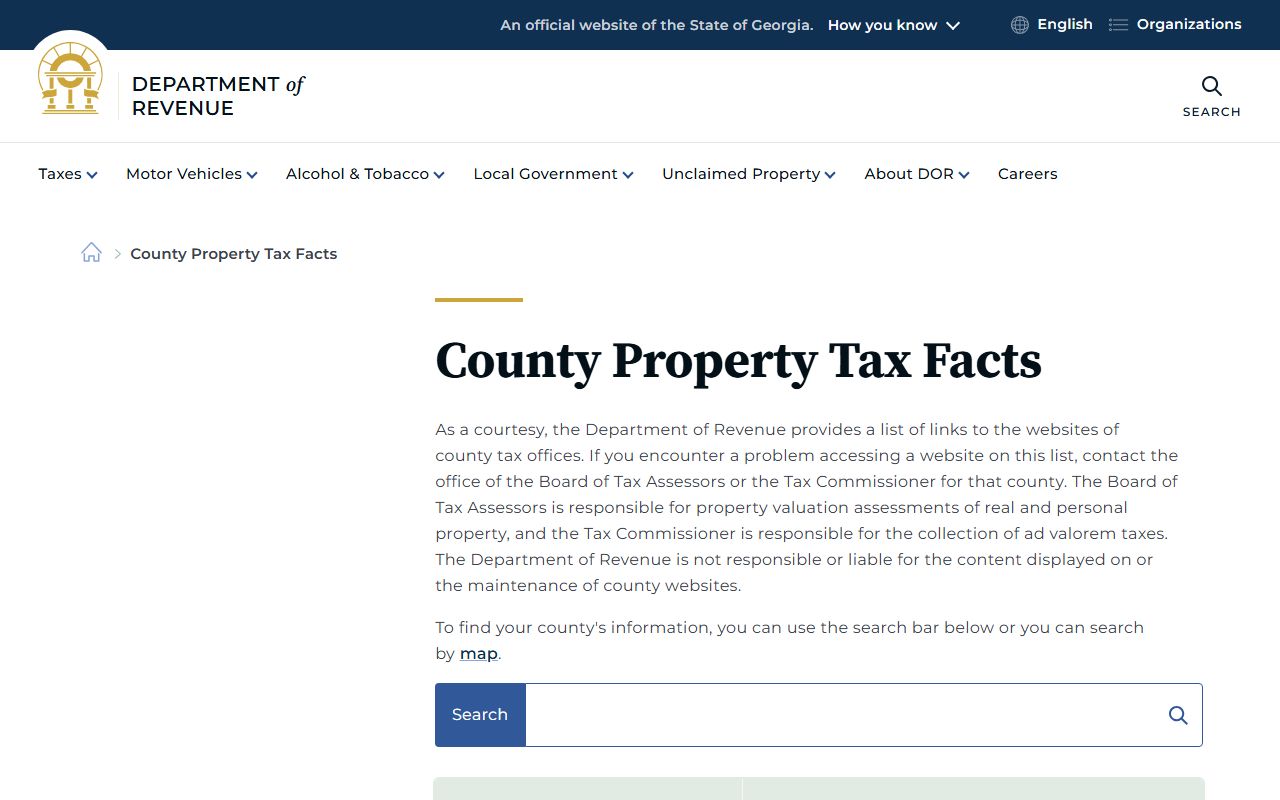

Gainesville property records are managed by Hall County. The city serves as the county seat. Residents can access assessments, deeds, and tax records through multiple online portals. The Board of Tax Assessors maintains property valuations for all Hall County including Gainesville.

Gainesville Property Records Quick Facts

Gainesville Property Assessment Records

The Hall County Board of Tax Assessors values all property in Gainesville. They work from offices on Browns Bridge Road. Chief Appraiser Steve Watson leads the department. Deputy Chief Appraiser John Smith assists with operations.

Gainesville property records can be searched through the Hall County website. The portal shows parcel details and assessed values. You can view property characteristics and ownership. Visit hallcounty.org to search online.

The Tax Assessors office is at 2875 Browns Bridge Road in Gainesville. Their phone number is 770-531-6720. Email questions to the assessor team. The office is open during regular business hours Monday through Friday.

For a $300,000 home in unincorporated Hall County, expect taxes around $3,086.52. A $750,000 home would have taxes near $7,716.30. These estimates use 2022 millage rates and include standard exemptions.

Gainesville Property Tax Timeline

Property taxes in Gainesville follow a yearly schedule. Key dates affect all Hall County property owners. January 1 marks the assessment date. April 1 is the deadline for exemption applications.

Gainesville residents can apply for homestead exemptions. These reduce taxable value for primary residences. You must own and occupy the home as of January 1. Applications are accepted from January 1 through April 1.

The property valuation determines your tax amount. Compare valuations rather than tax amounts when appealing. Different areas have different millage rates. Your value times the rate equals your tax bill.

Important dates for Gainesville property records:

- January 1: Assessment date for all property

- January 1 - April 1: Exemption application period

- April 1: Deadline for homestead applications

- May: Assessment notices typically mailed

- 45 days: Appeal period from notice date

Note: Appeals can be filed online, by mail, or in person through the Hall County system.

Gainesville Deed and Real Estate Records

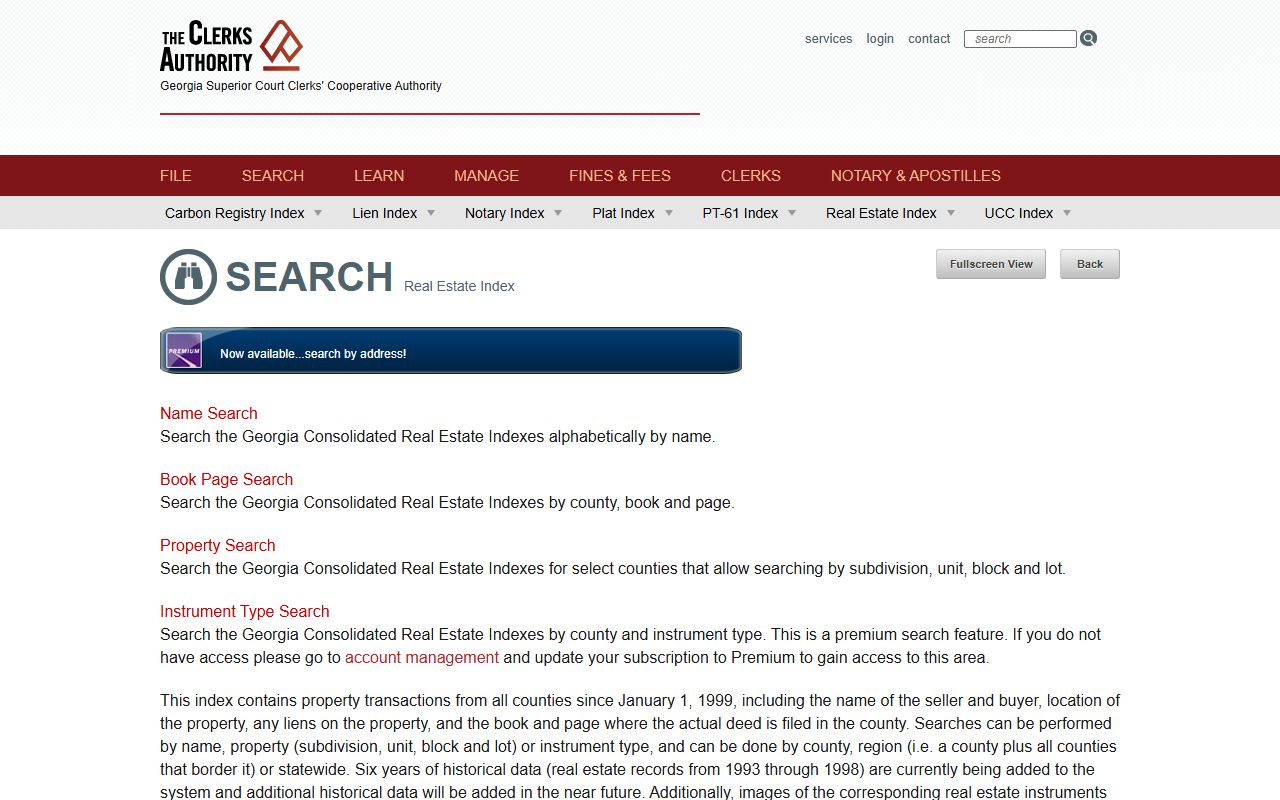

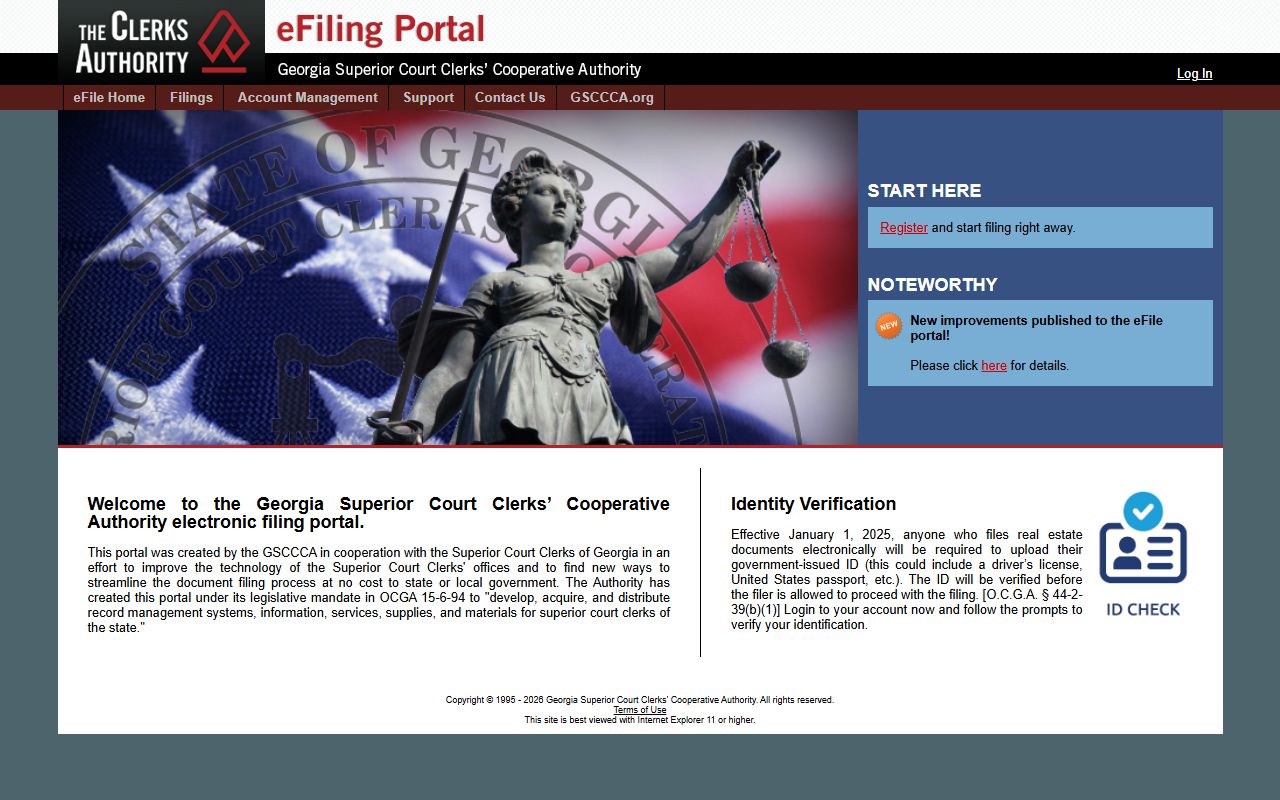

The Hall County Clerk of Superior Court maintains Gainesville real estate records. The Real Estate Division handles deeds and liens. Land records date back to 1819. UCC filings go through GSCCCA electronically.

The Real Estate Division is at the Hall County Courthouse Annex. The address is 116 Spring Street SE in Gainesville. The office is on the ground floor. Supervisor Cheryl Higgins manages the division.

You can reach the Real Estate Division at 770-531-7058. Fax documents to 770-297-3521. Email Cheryl Higgins at CHiggins@hallcounty.org. Office hours follow the courthouse schedule.

The General Execution Docket records various liens. Hospital liens attach to personal injury settlements. Tax liens are recorded for unpaid taxes. These affect property titles in Gainesville.

How to Search Gainesville Property Records

Searching Gainesville property records requires the right tools. Hall County offers multiple ways to access information. Online portals provide 24-hour access. In-person visits offer personal assistance.

For Gainesville assessments, use the Hall County property search. Enter an address or parcel number. Results show ownership, values, and property details. The system displays maps and characteristics.

For Gainesville deeds, check the GSCCCA real estate database. This covers all Georgia counties. It includes transactions since 1999. Search by name, property, or book and page.

Gainesville property records include these elements:

- Current owner name and mailing address

- Legal description and parcel boundaries

- Assessed value and fair market value

- Tax amounts and payment history

- Deed book and page references

- Outstanding liens or mortgages

The FANS system helps protect Gainesville property owners. This free service sends alerts about filings. Register at fans.gsccca.org. Enter your name and address to monitor activity.

Gainesville Property Tax Payments

The Hall County Tax Commissioner handles billing for Gainesville properties. They collect taxes based on assessed values. Payments can be made online or in person. The Tax Commissioner office shares the Browns Bridge Road location.

Gainesville residents can pay taxes at hallcountytax.org. The portal accepts credit cards and e-checks. You can view current and past tax bills. Payment history is available online.

The Tax Commissioner office is at 2875 Browns Bridge Road. This is the same building as the Assessors office. Hours are Monday through Friday during business times. Contact them for payment questions or options.

Conservation use applications are handled through the Assessors office. These provide tax breaks for qualified land. Current use value replaces fair market value. Significant savings apply to eligible Gainesville properties.

Hall County Assessment Division Contacts

The Hall County Assessors office has specialized staff for different property types. General questions go to the main number. Specific issues may need a division contact.

For general questions about Gainesville property assessments, call 770-531-6720. The main desk can handle most inquiries. They can direct you to the right staff member if needed.

Specialized assessments have dedicated contacts. Tonya Hart handles some assessments at 770-531-6738. Cher Melendez covers others at 770-531-6752. Mapping questions go to Cade Chase at 770-531-6737.

Personal property has its own line at 770-531-6749. This covers business equipment and other taxable items. All personal property must be returned by April 1. Failure to file can result in penalties.

Key contacts for Gainesville property records:

- General Questions: 770-531-6720

- Specialized Assessments: 770-531-6738 or 770-531-6752

- Mapping Services: 770-531-6737

- Personal Property: 770-531-6749

Nearby Property Records

These counties border Hall County. Properties near Lake Lanier or in the mountains may span county lines.