Oglethorpe County Real Estate and Assessment Records

Oglethorpe County property records are maintained by the Board of Tax Assessors and Clerk of Superior Court. The county seat is Lexington. Residents can search assessments and deeds online through QPublic and the GSCCCA statewide database. Property taxes are assessed at 40% of fair market value as required by Georgia law.

Oglethorpe County Property Records Quick Facts

Oglethorpe County Tax Assessor Property Records

The Oglethorpe County Board of Tax Assessors maintains all property assessment records. This office determines the fair market value of real and personal property. Georgia law requires property to be assessed at 40% of fair market value. The assessment date is January 1 of each tax year.

You can search Oglethorpe County property records online through QPublic. This free portal provides access to parcel information, ownership details, and assessed values. Search by owner name, property address, or parcel identification number.

The Oglethorpe County Tax Assessor also processes homestead exemption applications. Property owners who occupy their home as a primary residence may qualify for tax reductions. Applications must be filed by April 1 to receive the exemption for that tax year.

Oglethorpe County Deed and Real Estate Records

The Oglethorpe County Clerk of Superior Court records and maintains all real estate documents. This includes deeds, mortgages, liens, and plats. These records are public and available for search and inspection.

Georgia law now requires electronic filing of all real estate documents. Effective January 1, 2025, all deeds, liens, and plats must be filed through the GSCCCA eFile portal. This statewide system ensures secure and efficient recording.

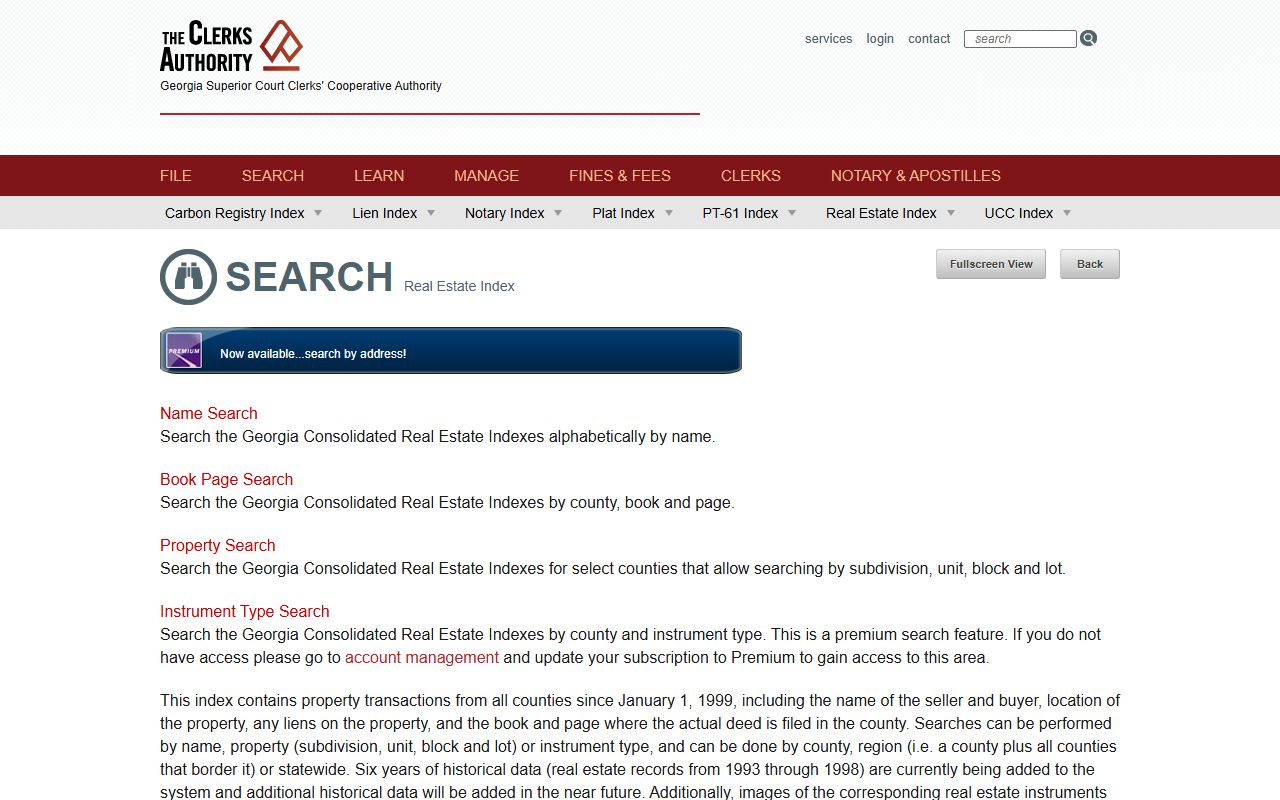

You can search Oglethorpe County real estate records through the GSCCCA Real Estate Search. This database contains property transactions from all Georgia counties since January 1, 1999. Search by grantor, grantee, property, or book and page number.

Oglethorpe County Property Tax Records

The Oglethorpe County Tax Commissioner is responsible for billing and collecting property taxes. Tax bills are typically mailed in the fall. Payment deadlines vary by county. Contact the Tax Commissioner office for specific due dates.

Property tax records show the assessed value, applicable exemptions, millage rates, and tax amount due. You can typically search and pay taxes online through the county website or tax commissioner's portal.

If property taxes are not paid on time, penalties and interest will accrue. The Tax Commissioner may file a tax lien, also known as a Fi.Fa., which can affect credit and property title.

How to Search Oglethorpe County Property Records

There are several ways to access Oglethorpe County property records. Online search is the most convenient method for most users.

For property assessments and parcel data, use the QPublic portal at qpublic.net/ga/oglethorpe. This free service shows ownership, values, and property characteristics.

For deeds and recorded documents, use the GSCCCA Real Estate Search at search.gsccca.org. This covers all Georgia counties with records dating back to 1999. Create an account to access full features.

For tax bills and payment information, contact the Oglethorpe County Tax Commissioner. Many counties offer online payment portals for convenience.

State Resources for Oglethorpe County Property Records

Georgia provides several state-level resources for property records research. These tools complement county-specific searches.

The Georgia Superior Court Clerks' Cooperative Authority (GSCCCA) operates the statewide real estate database. Their services include real estate search, eFiling, eCertification, and FANS (Filing Activity Notification System).

The Georgia Department of Revenue provides oversight of property tax administration. Their website offers guidance on tax laws and links to county tax offices.

Key state resources for Oglethorpe County property records include:

- GSCCCA Real Estate Search: Statewide deed and lien index

- GSCCCA eFile: Required electronic filing system

- FANS: Free alerts for property filings

- Georgia DOR: Tax laws and county contacts

Protect Your Oglethorpe County Property Records

Property fraud is a growing concern nationwide. Oglethorpe County property owners can take steps to protect their assets.

The FANS system from GSCCCA provides free monitoring. Sign up with your name and address. You will receive email alerts when documents are filed against your property.

This service helps detect unauthorized deed transfers or liens. Early detection can prevent costly legal battles. Visit fans.gsccca.org to register your Oglethorpe County properties.

Regularly checking your property records is also recommended. Review your Oglethorpe County records at least once per year. Verify ownership and look for any unexpected filings.

Nearby Counties

These counties are located near Oglethorpe County. You may need to search them for properties near county lines or for regional research.