Lowndes County Property Tax and Deed Records

Lowndes County property records cover over 50,932 parcels across 509 square miles. The county seat is Valdosta. The Board of Assessors maintains property valuations. The Tax Commissioner handles billing. Records are available online through QPublic and the county website.

Lowndes County Property Records Quick Facts

Lowndes County Board of Assessors Property Records

The Lowndes County Board of Assessors values all taxable property. Their mission is to produce a fair and uniform tax digest. They use fair market value as defined in Georgia law. The office is on North Patterson Street in Valdosta.

Lowndes County uses three approaches to value property. The cost approach looks at replacement cost minus depreciation. The income approach capitalizes net income. The market approach analyzes comparable sales. Most residential property uses the market approach.

The property tax process in Lowndes County starts with a sale. The deed is recorded at the Clerk of Court. The Tax Assessor assigns a value. Assessment notices go out in May. Owners have 45 days to appeal.

Lowndes County offers specialized assessment programs. Agricultural property gets a 30% assessment level. Conservation use property is valued at current use. Environmentally sensitive land also qualifies. Timber is taxed when sold at 100% of fair market value.

Lowndes County Property Tax Timeline and Records

Lowndes County follows a set schedule each year. Assessment notices are mailed in May. The appeal period lasts 45 days from the notice date. After appeals, the digest goes to the state. Tax bills are mailed the first week of October.

Payment is due at least 60 days after bills are mailed. Interest accrues at 1% per month after the due date. A 10% penalty applies after 90 days. The county may file a Fi.Fa. lien. This adds costs and affects credit.

The Lowndes County Tax Commissioner collects all taxes. They serve the county, cities, and schools. You can pay online, by mail, or in person. Partial payments are accepted for delinquent taxes.

Lowndes County Real Estate Records Search

The Lowndes County Clerk of Superior Court keeps deed records. All real estate transactions are filed here. This includes deeds, mortgages, and liens. Records are public and searchable.

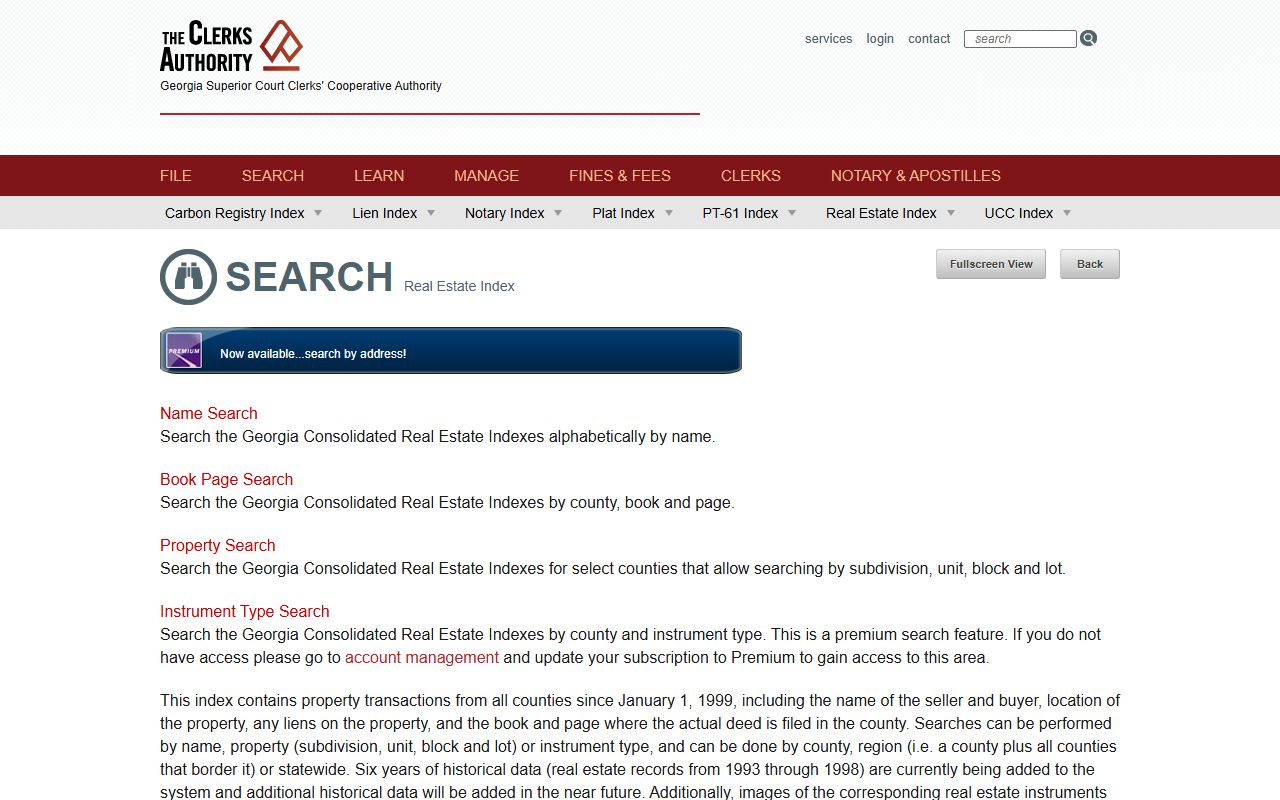

You can search Lowndes County deeds through GSCCCA. This state system has records since 1999. You can search by name, property, or instrument type. An account is required for searches.

As of January 1, 2025, all filings must be electronic. This includes deeds, plats, and UCCs. The eFile system is through GSCCCA. Paper documents are no longer accepted. This change came from House Bill 1952.

Recording requirements for Lowndes County include:

- Notarized signatures with witness

- Three-inch top margin on first page

- Legal property description

- PT-61 form for transfers

- Proper fees paid at filing

How to Search Lowndes County Property Records

Finding Lowndes County property records is easy with online tools. You can search from home or office. No need to visit in person unless you want certified copies.

For assessments, use QPublic at qpublic.net/ga/lowndes. Search by owner name, address, or parcel number. View maps and property details. See sales history and assessed values.

For deeds, use the GSCCCA Real Estate Search. This covers Lowndes County and all others. Create an account to start. Search by grantor, grantee, or book and page.

For tax bills, contact the Lowndes County Tax Commissioner. They can look up your account. You can pay online through their portal. The site shows current and past bills.

Protect Your Lowndes County Property Records

The FANS system helps protect Lowndes County property owners. FANS stands for Filing Activity Notification System. It is free through GSCCCA. You get alerts when documents are filed.

Sign up with your name and address. If someone files a deed or lien on your property, you get an email. This helps prevent deed fraud. It is a useful tool for all owners.

The service is free and easy to use. Go to fans.gsccca.org to register. Enter the properties you want to watch. You will get alerts for any filings.

Nearby Counties

These counties border Lowndes County. You may need to search them for properties near county lines or for regional research.