Find Henry County Property Records

Henry County property records are managed by the Tax Assessor and Tax Commissioner in McDonough. The county provides online property searches through Appraisal Research Corporation. Residents can view assessments, tax bills, and property characteristics online.

Henry County Tax Assessor

The Henry County Tax Assessor is responsible for the annual valuation of all taxable real and personal property. The office produces a timely and equitable tax digest that meets all state statutes and legal requirements of the Georgia Department of Revenue.

The Tax Assessor office is located in McDonough. The Auditor is Elizabeth Fruchey. The office provides property assessment services and processes exemption applications.

Visit henrycountyga.gov/782/Tax-Assessor for assessment information and online services. The website provides property search tools and exemption application forms.

The Tax Assessor handles property assessments, appeals, homestead exemptions, and property returns. Staff can answer questions about valuation methods and assessment procedures.

Note: The Tax Assessor and Tax Commissioner are separate offices with different responsibilities.

Henry County Tax Commissioner

The Henry County Tax Commissioner collects property taxes and provides motor vehicle services. This office mails tax bills based on assessments from the Tax Assessor. The Tax Commissioner accepts various payment methods.

Visit henrycountytax.com for online tax payments and property tax searches. The website provides access to current tax bills and payment options.

The Tax Commissioner accepts payments by phone through an interactive voice response system. Call 1-855-255-6196 to make payments by phone. This automated system is available 24 hours a day.

Government Windows is the third party automated payment service. They accept Visa, MasterCard, Discover, and debit cards. A 2.5% fee applies to card payments. E-check payments incur a $1.50 fee.

Payment limits apply to online and phone transactions. The daily credit card limit is $20,000. The daily e-check limit is $60,000.

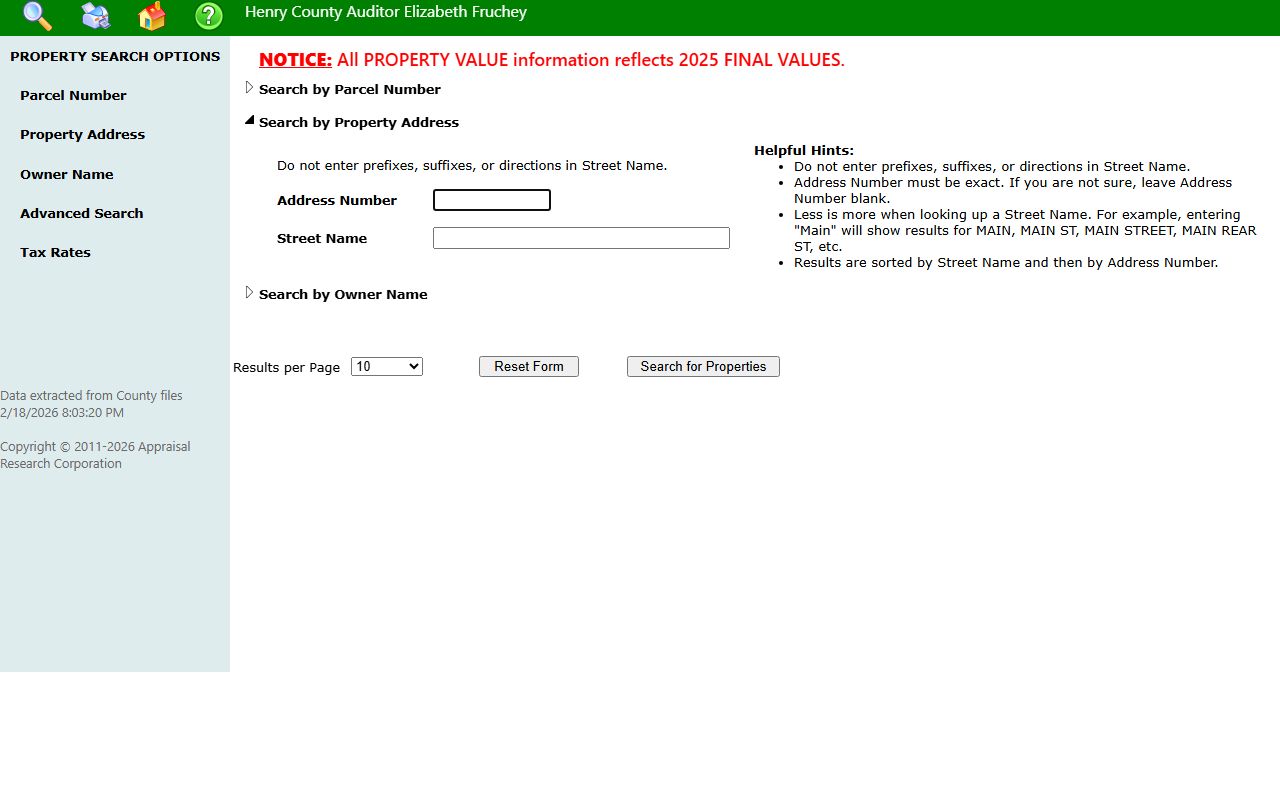

Henry County Property Search

Henry County provides online property search through Appraisal Research Corporation. This system allows users to search by property address, owner name, or parcel identification number. The portal displays current assessment values and property details.

Access the property search at henryparcelsearch.appraisalresearchcorp.com. The system is available 24 hours a day for property searches. No account registration is required to view basic property information.

The online system displays detailed property information including land value, building value, and total assessed value. Users can view property maps and neighborhood characteristics. The portal also shows exemption information and tax payment status.

Henry County property records include:

- Property owner name and mailing address

- Property address and legal description

- Current assessed value and fair market value

- Land and building breakdown

- Homestead exemptions applied

- Property characteristics and improvements

Property owners can verify their assessment information through the online search portal.

Henry County Property Appeals

Property owners in Henry County can appeal their assessments if they disagree with the value. The appeal period begins when annual assessment notices are mailed. Property owners have 45 days from the notice date to file an appeal.

To file an appeal, complete the appeal form included with your assessment notice. Submit the form to the Tax Assessor by mail or in person. Include supporting documentation such as comparable sales data or appraisal reports.

The Tax Assessor reviews appeals and may adjust values based on evidence provided. If the property owner disagrees with the decision, the appeal can proceed to the Board of Equalization or to arbitration.

The appeal process ensures fair and equitable assessments across Henry County. All property owners have equal rights to challenge their valuations.

Henry County Homestead Exemptions

Henry County offers homestead exemptions for property owners who occupy their homes as primary residences. These exemptions reduce the taxable value of the property. Lower taxable values result in lower tax bills.

Property owners must occupy their home as of January 1 to qualify for that tax year. The home must be the owner's primary residence. Exemptions renew automatically each year once granted.

Applications for homestead exemptions must be submitted by April 1 each year. Property owners can apply through the Tax Assessor office in McDonough. Staff can explain available exemptions and qualification requirements.

Contact the Tax Assessor office for information about homestead exemptions and other property tax relief programs.

Henry County Real Estate Records

Real estate records for Henry County are maintained by the Clerk of Superior Court. Deeds, mortgages, liens, and plats are recorded at the courthouse. These documents establish ownership and identify claims against properties.

Henry County real estate records are available online through the Georgia Superior Court Clerks' Cooperative Authority. The GSCCCA system provides access to records from 1999 to present. Visit search.gsccca.org/RealEstate to search statewide.

Effective January 1, 2025, all documents must be filed electronically through GSCCCA per House Bill 1952. This electronic filing requirement applies to deeds, liens, UCCs, and plats.

The GSCCCA database contains property transactions from all Georgia counties including Henry. Search by grantor or grantee name, property description, or instrument type. The system shows book and page references for recorded documents.

Statewide Records Access for Henry County

The Georgia Superior Court Clerks' Cooperative Authority provides statewide access to real estate records. This system includes Henry County property transactions from January 1, 1999 to present. The database shows property transfers, mortgages, and other recorded instruments.

GSCCCA offers free basic searches and premium subscription accounts. Premium accounts provide advanced search features including instrument type searches. Regular accounts offer basic name and property searches.

The Filing Activity Notification System (FANS) helps combat deed fraud. This free service alerts property owners when filings match their registered name or address. Register at fans.gsccca.org to monitor your property records.

The eFile system allows electronic filing of documents. Effective January 1, 2025, electronic filing is required for all real estate documents in Georgia.

Henry County Property Records Contact

Henry County residents can contact the appropriate office for property record assistance. The Tax Assessor handles assessments and is located in McDonough. The Tax Commissioner manages tax bills and can be reached at henrycountytax.com.

Visit henrycountyga.gov/782/Tax-Assessor for assessment information. Visit henryparcelsearch.appraisalresearchcorp.com for online property searches.

The McDonough location provides convenient access to county government services. The historic downtown area offers parking near the government offices.