Warner Robins Property Records Search

Warner Robins property records are maintained by Houston County. This growing city in central Georgia is home to Robins Air Force Base. Residents can access property assessments, tax records, and deeds through county offices in Perry and Warner Robins. The city has experienced significant growth in recent years, making property records especially important for homeowners and investors.

Warner Robins Property Assessment Records

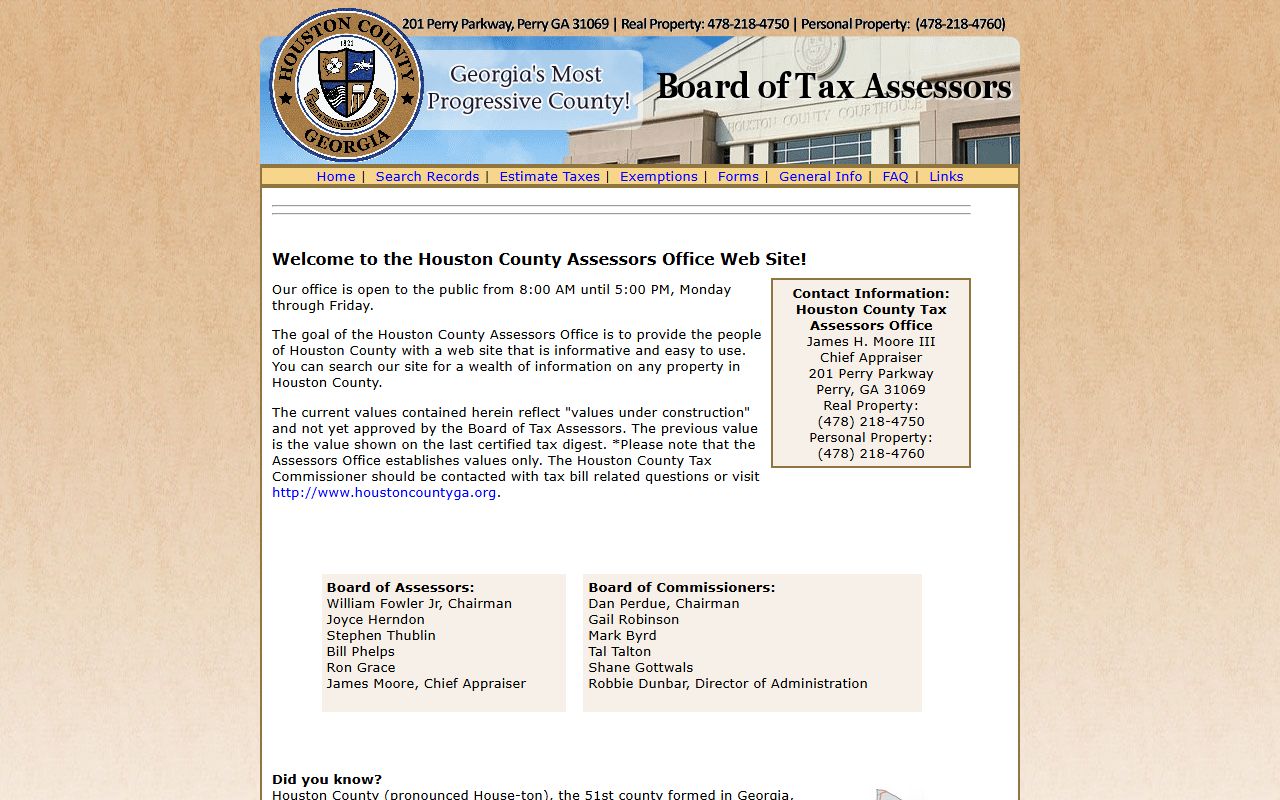

The Houston County Board of Assessors handles Warner Robins property valuations. Their goal is to provide an informative and easy-to-use website. You can search for tax information on any property in the area. The Board works to ensure fair and accurate assessments for all properties.

The Assessors Office is located at 201 Perry Parkway, Perry, GA 31069. The real property phone number is (478) 218-4750. Personal property questions go to (478) 218-4760. The Chief Appraiser is James H. Moore III. Office hours are Monday through Friday, 8:00 AM to 5:00 PM. Visit qpublic.net/ga/houston for online searches.

All Warner Robins property is assessed at 40% of fair market value. This follows Georgia state law. The Board reviews values each year. Appraisal staff may visit properties to verify information. They carry identification badges and drive marked county vehicles.

Homestead exemptions can reduce your tax bill. Apply by April 1 each year. You can apply online or in person. The exemption must be for your primary residence. You must own and occupy the property to qualify.

Warner Robins Personal Property Returns

Houston County has specific rules for personal property returns. All returns must be filed by US mail only. The postmark establishes the filing date. Postage meter stamps are not accepted as evidence of timely filing.

Returns are mailed in January. They are due by April 1. Business personal property inventory remains taxable. An exemption is figured during the billing process. Do not omit inventory values from your return. Include all taxable property to avoid penalties.

Important: Always check for unpaid taxes before buying property. People often buy businesses or equipment and find unpaid taxes later. This applies to real estate, boats, aircraft, and business equipment. Conduct due diligence before any purchase.

Note: Warner Robins residents file personal property returns through Houston County by US mail only.

Warner Robins Property Search Tools

Warner Robins residents can access property data online. The Houston County search portal provides tax information. Search using address, owner name, or parcel ID. The system is available 24 hours a day.

Access the search at qpublic.net/ga/houston. View assessed values, exemptions, and payment status. The site displays property characteristics and sales data. You can also view maps showing property boundaries.

The online search is free. No account needed. Information is updated regularly. The system provides current year assessment data. Tax payment history is also available.

Warner Robins property records include:

- Property owner information

- Parcel ID and legal description

- Assessed and fair market values

- Homestead exemptions

- Tax payment history

- Building and land details

Warner Robins Property Tax Records

The Houston County Tax Commissioner manages tax bills for Warner Robins. They send out bills and collect payments. The office has a convenient location in Warner Robins for resident access.

The Warner Robins office is at 202 Carl Vinson Parkway. The phone number is (478) 542-2110. There is also a Perry office at 201 Perry Parkway, (478) 218-4940. Hours are Monday through Friday, 8:30 AM to 5:00 PM. Visit houstoncountytax.com to pay online.

Bills are based on assessments from the Board of Assessors. Millage rates are set by local authorities. Your tax bill funds county and city services. These include schools, roads, and public safety.

Payment options include online, mail, and in-person. Check the website for current methods. Some payment methods may have service fees. Late payments incur penalties and interest.

Warner Robins Property Appeals Process

Property owners in Warner Robins can appeal their assessments. You have 45 days from the notice date to file. Appeals are handled by the Houston County Board of Assessors.

File online, by mail, or in person at the Assessors office. Include evidence to support your appeal. Recent sales of similar properties help your case. Photographs and appraisal reports are useful.

The Board reviews each appeal. They may adjust values based on evidence. If not resolved, cases go to the Board of Equalization. The appeal process follows Georgia state law. Property owners have multiple options for resolving disputes.

Statewide Real Estate Records for Warner Robins

The GSCCCA maintains Warner Robins real estate records from 1999 forward. Find deeds, mortgages, liens, and other documents. The database covers all Georgia counties. This is useful for title research.

Search at search.gsccca.org/RealEstate. Search by name, property, or instrument type. The system shows book and page references. You can obtain copies of documents.

FANS is a free fraud prevention tool. It alerts you when filings match your information. Register at fans.gsccca.org. This helps protect against deed fraud.

Houston County Property Records

Warner Robins is located in Houston County. All property records are maintained by county offices. For more information and resources, visit the Houston County property records page.