Roswell Real Estate and Property Records Search

Roswell property records are maintained by Fulton County offices. You can search these public documents online. The Fulton County Board of Assessors handles property valuations. The Clerk of Superior Court maintains real estate deeds. These records show ownership history, tax assessments, and property details. Most Roswell property records are accessible through official county websites.

Where to Find Roswell Property Records

Fulton County offices maintain all property records for Roswell. The Board of Assessors provides property valuations. They assess property at 40% of fair market value. You can search their database online. The office is at 141 Pryor Street SW in downtown Atlanta.

The Fulton County Clerk of Superior Court handles deed records. Their office is in the Lewis Slaton Courthouse. Real estate documents date back to the early 1800s. You can access these through the GSCCCA statewide portal. The portal covers all Georgia counties.

The Fulton County Tax Commissioner collects property taxes. Their office processes tax payments. They mail tax bills each year. You can pay online through their website. They also handle questions about tax amounts and due dates.

Note: The Fulton County Board of Assessors conducts field reviews throughout Roswell neighborhoods.

How to Search Roswell Property Records Online

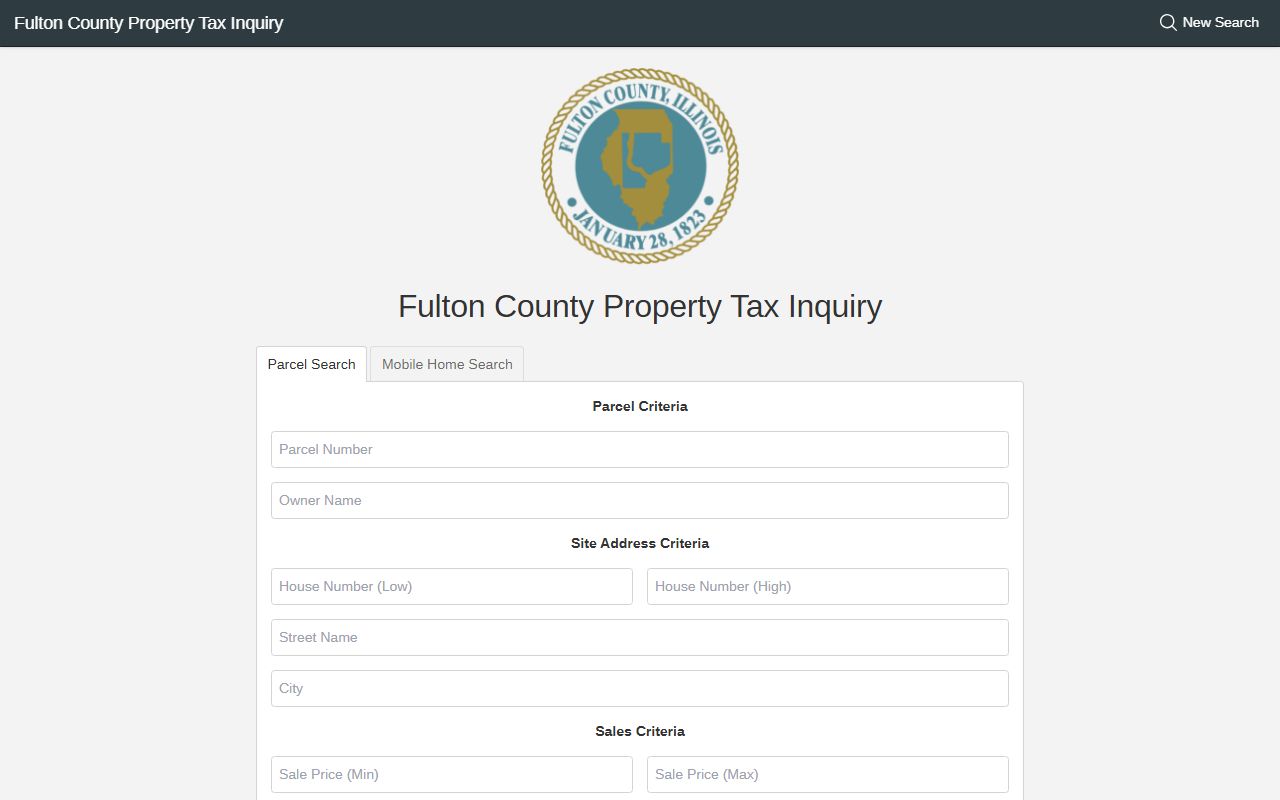

Multiple tools exist for finding Roswell property records. The Fulton County property search lets you look up parcels by address. You can search by owner name or parcel ID. Results show assessed values and tax information. You can also view property details and improvement values.

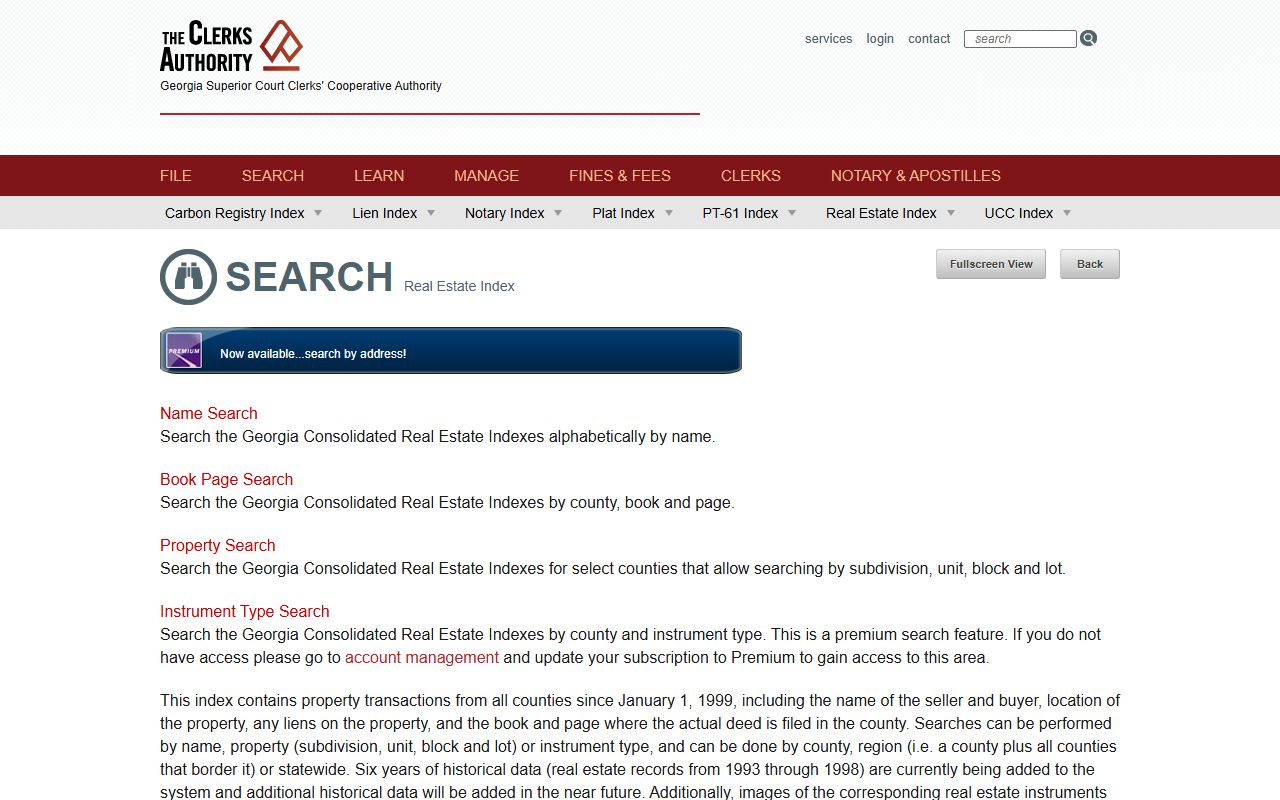

The GSCCCA real estate index covers deed records. This statewide database includes Fulton County transactions. You can search by buyer or seller name. Property searches work by subdivision and lot number. The index covers records since January 1, 1999.

To search effectively, gather key details first. You will need the property address. The owner's name helps too. A parcel identification number works best. This number appears on tax bills and assessment notices.

Here are the main ways to search Roswell records:

- Fulton County online property search by address or parcel

- GSCCCA real estate index for deeds and transactions

- Tax Commissioner website for tax bill information

- In-person visits to county offices downtown

Types of Roswell Real Estate Records Available

Roswell property records include several document types. Deeds show property ownership transfers. Warranty deeds guarantee clear title. Quitclaim deeds transfer whatever interest exists. Security deeds serve as mortgage documents. These records are filed with the Clerk of Superior Court.

Tax records show how much properties are worth. Fulton County sends assessment notices each year. These state the fair market value. Georgia law defines this value. It is what a willing buyer would pay. The assessed value equals 40% of this amount.

Property tax bills come from the Tax Commissioner. They show taxes owed based on assessed values. The bills include county and city taxes. School taxes appear separately. You can view current and past tax bills online.

Liens affect property titles in Roswell. Tax liens come from unpaid property taxes. Mechanics liens result from unpaid construction work. These attach to the property. They must be cleared before sale. UCC filings secure loans on personal property.

Fulton County Offices for Roswell Property Searches

The Fulton County Board of Assessors values all Roswell property. They follow Georgia Department of Revenue guidelines. Their mission is fair and accurate assessments. They provide customer service to property owners. You can contact them at (404) 612-6440.

Their office accepts homestead exemption applications. These reduce tax bills for primary residences. The deadline is April 1 each year. You can apply online or in person. Exemptions save Roswell homeowners money.

The Fulton County Tax Commissioner is at 141 Pryor Street SW Suite 1004. Their phone is (404) 612-6100. Office hours are Monday through Friday. They open at 8:30 AM and close at 5:00 PM. You can pay taxes online anytime.

The Clerk of Superior Court maintains recorded documents. Their real estate division handles deed filings. You can request copies of documents. Fees apply for certified copies. Most records are also online through GSCCCA.

Note: Fulton County assessment notices typically mail in late spring each year.

Roswell Property Assessment Appeals Process

Property owners can appeal assessments in Roswell. The process starts with your annual notice. You have 45 days to file an appeal. The deadline appears on your notice. Missing this date forfeits your right to appeal.

Appeals go to the Fulton County Board of Equalization. This independent board reviews cases. You can present evidence at a hearing. Comparable sales support your case. Photos of your property help too.

Other appeal options exist. You can choose arbitration. A hearing officer is another choice. Each option has different procedures. All follow Georgia law under O.C.G.A. 48-5-311. Consider consulting a tax professional.

The board may conduct field reviews. Appraisers visit properties during appeals. They verify property characteristics. Staff carry county identification badges. This ensures accurate valuations.

State Resources for Roswell Property Record Searches

Georgia state agencies support local record keeping. The Department of Revenue oversees assessment practices. They provide guidance to county assessors. Their website lists all county tax offices. You can find forms and procedures there.

The GSCCCA maintains the statewide real estate index. This covers all 159 Georgia counties. Roswell and Fulton County records are included. You can search by name or property. The database goes back to 1999.

FANS protects Roswell property owners. This free service monitors filings. It alerts you to documents with your name. You receive email notifications quickly. This helps prevent deed fraud. Sign up at fans.gsccca.org.

Related Roswell Property Record Resources

Fulton County is the primary jurisdiction for Roswell. You may also want to explore state-level databases. These provide additional property information. They complement county resources well.