Evans Property Records Search

Evans property records are maintained by Columbia County. This growing community serves as the functional county seat near Augusta. Property assessments and tax records are handled by county offices in Evans. The area attracts families with its excellent schools and quality of life.

Evans Property Assessment Records

The Columbia County Board of Assessors handles Evans property valuations. They determine fair market values for all property. They prepare a fair and equitable tax digest. The Board follows Georgia law in all assessments.

The Board of Assessors can be reached at 706-312-7474. Visit columbiacountyga.gov/355/Tax-Assessor for online services. QPublic search is available for property lookups.

All Evans property is assessed at 40% of fair market value. This is required by Georgia law. The Board reviews values each year. Appraisal staff may visit properties with proper identification and marked vehicles.

Homestead exemptions can lower your tax bill. Apply by April 1 each year. You can apply online or in person. The property must be your primary residence. You must own and occupy it.

Evans Personal Property Returns

Columbia County offers Smartfile e-filing for personal property. This system is quick and easy to use. File Business or Marine personal property returns online. Returns must be filed between January 1st and April 1st each year.

Smartfile eliminates paper forms. You enter information online. The system calculates your return. You submit it electronically. This saves time and reduces errors in the filing process.

Business personal property includes equipment and inventory. Marine personal property includes boats. Owners must report these items annually. The Smartfile system makes this process simple for taxpayers.

Note: Columbia County appraisers carry photo ID and wear uniforms when visiting properties.

Evans Property Search Tools

Evans residents can access property data online. The Columbia County search portal provides tax information. Search using address, owner name, or parcel ID. The system is available 24 hours a day.

Access property records through columbiacountyga.gov. View assessed values, exemptions, and payment status. You can find ownership history and property characteristics.

The online search is free. No account needed. Information is updated regularly. Property records include sales data and building details. The QPublic system is user-friendly.

Property owners can view their assessment notices online. They can check exemption status. They can review payment history. This helps with tax planning.

Evans property records include:

- Property owner information

- Parcel ID and legal description

- Assessed and fair market values

- Homestead exemptions

- Tax payment history

- Building and land details

Evans Property Appeals Process

Property owners in Evans can appeal their assessments. You have 45 days from the notice date to file. Appeals are handled by the Columbia County Board of Assessors.

File online, by mail, or in person. Include evidence to support your appeal. Recent sales of similar homes help your case. The Board reviews appeals carefully and fairly.

If not resolved, cases go to the Board of Equalization. The appeal process follows Georgia state law. Property owners have further appeal rights if needed.

Statewide Real Estate Records for Evans

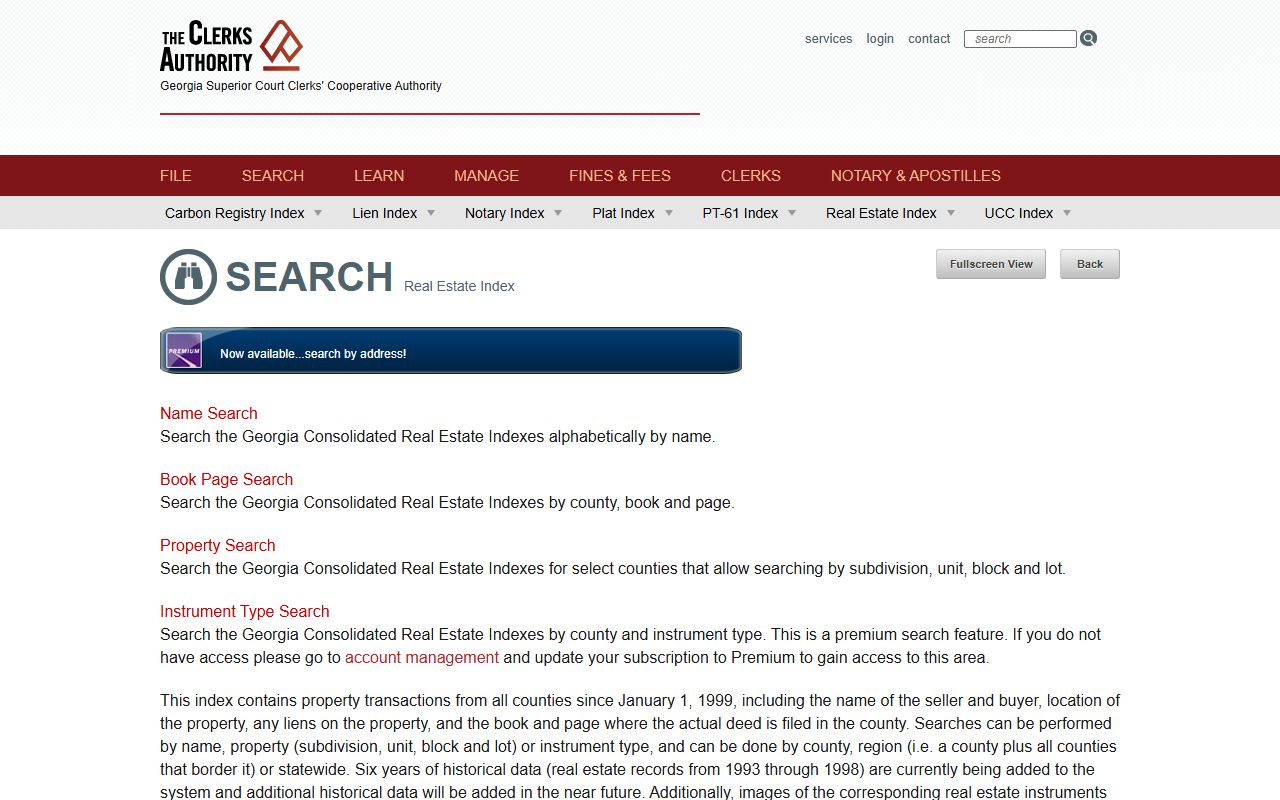

The GSCCCA maintains Evans real estate records from 1999 forward. Find deeds, mortgages, liens, and other documents. The database covers all Georgia counties.

Search at search.gsccca.org/RealEstate. Search by name, property, or instrument type. The system shows book and page references.

FANS is a free fraud prevention tool. It alerts you when filings match your information. Register at fans.gsccca.org. This helps protect against deed fraud.

Evans Property Tax Payments

Columbia County property taxes are billed by the Tax Commissioner. Bills are sent to property owners each year. The amount is based on assessed value and millage rates.

Tax bills include county taxes, school taxes, and city taxes if applicable. The bill shows each component. You can see where your tax dollars go. Payments fund local services and schools.

Payment options include online, mail, and in-person. Due dates are printed on the bill. Late payments incur penalties. Pay on time to avoid extra charges.

The Tax Commissioner's office can answer questions about your bill. They can explain payment options. They can help with payment plans if needed.

Note: Evans residents pay property taxes to Columbia County. The county handles all tax billing and collection. Contact the Tax Commissioner for any questions.

Columbia County Property Records

Evans is located in Columbia County. All property records are maintained by county offices in Evans. For more information and resources, visit the Columbia County property records page.