Athens-Clarke Property Records Search

Athens-Clarke property records are maintained by the unified government in Athens, Georgia. The consolidated city-county government handles all property assessments and tax collections for this area. Residents can access property records through the Tax Assessor's office and the Property Tax Division in downtown Athens.

Athens-Clarke Tax Assessor Records

The Athens-Clarke County Tax Assessor's Office appraises all property at fair market value. This ensures taxpayers pay no more than their fair share of property taxes. The office follows Georgia law and state Department of Revenue guidelines.

The Tax Assessor's Office is located at 325 E. Washington Street, Room 280, Athens, GA 30601. The phone number is 706-613-3140. Office hours are Monday through Friday from 8:00 AM to 5:00 PM. You can also visit the Tax Assessor website for online services.

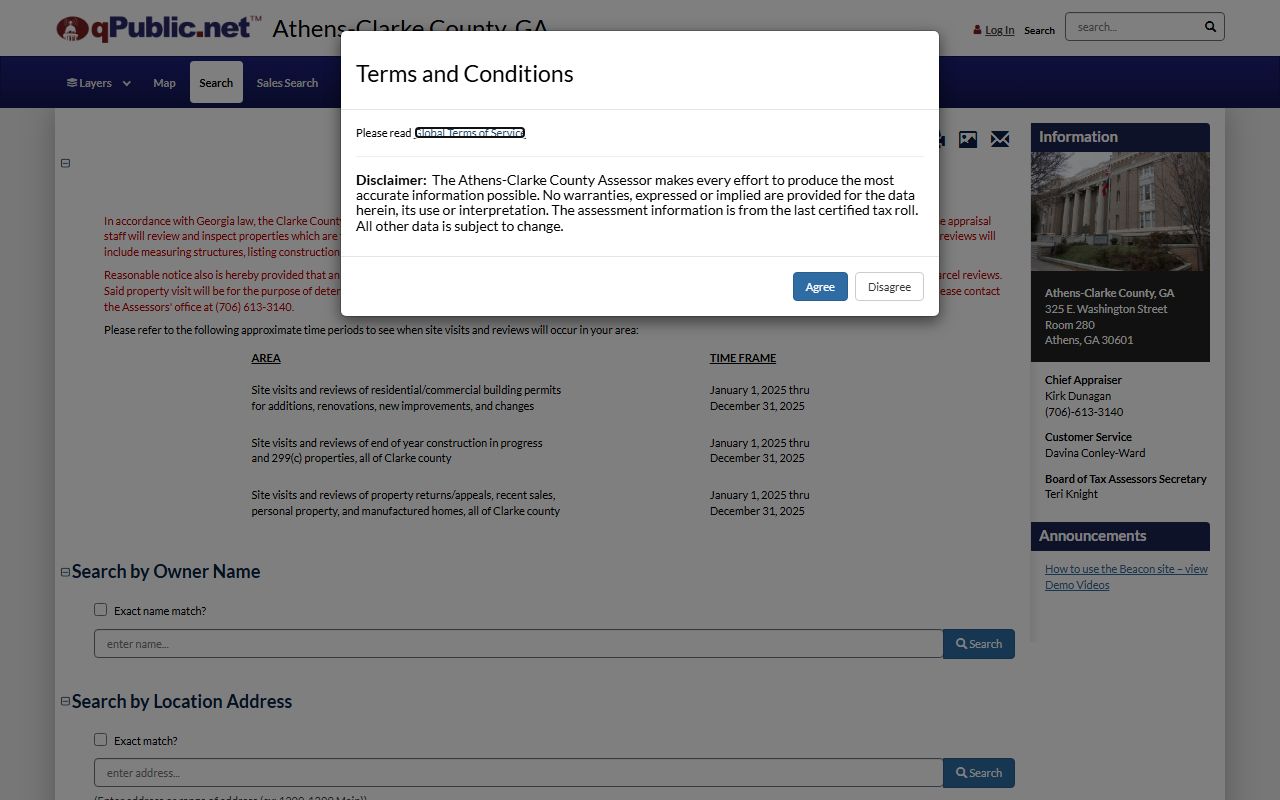

Staff may visit properties to review parcel information. Notice is given that appraisers will review properties with active building permits. They check for changes and improvements throughout the year. Staff carry proper identification at all times.

Property owners can search records online through QPublic. The system provides access to parcel data and assessment information.

Athens-Clarke Property Tax Records

The Property Tax Division handles tax bill collection in Athens-Clarke. This office mails tax bills and processes payments. They work with the Tax Assessor to ensure fair taxation.

The Property Tax Division is part of the unified government. Visit the Property Tax Division website for payment options. Tax bills are due October 20 each year.

Penalties apply for late payments. The penalty is 5% every 120 days past the due date. The maximum penalty is 20% of the total tax bill.

Note: Check for unpaid taxes before you buy property in Athens-Clarke.

Athens-Clarke Property Search Online

Athens-Clarke offers online property search tools. The QPublic system allows residents to search by address, owner name, or parcel ID. This provides current assessment data and tax status.

Access the online search at the QPublic portal. The system displays property details including assessed value and exemptions.

The online system is available at all hours. Users can search without creating an account. Current year data is always accessible.

Athens-Clarke property records include:

- Property owner name and address

- Legal description and parcel ID

- Assessed value and fair market value

- Homestead exemptions

- Property characteristics

Standing timber is not taxed until sold or harvested. Then it is taxed at 100% of fair market value.

Athens-Clarke Property Tax Exemptions

Property owners in Athens-Clarke can apply for homestead exemptions. The exemption reduces the taxable value of your home. You must own and occupy the property as your primary residence.

Applications are due by April 1 each year. Forms are available online or at the Tax Assessor's office. Late applications may be accepted during the appeal period under new state law.

The Tax Assessor's staff can explain which exemptions you may qualify for. Different exemptions apply to different situations. Age and disability exemptions are available for eligible residents.

Statewide Property Records for Athens-Clarke

The Georgia Superior Court Clerks' Cooperative Authority provides online access to real estate records. This includes Athens-Clarke property transactions from 1999 to present. The database contains seller and buyer names, property location, and liens.

Access the GSCCCA search at search.gsccca.org/RealEstate. Searches can be done by name or property. The system covers all Georgia counties.

The Filing Activity Notification System (FANS) is free. This tool alerts property owners when filings match their name or address. Register at fans.gsccca.org.

Clarke County Property Records

Athens-Clarke is a unified government covering most of Clarke County. The consolidated government handles all property records for the area. For more county resources and information, visit the Clarke County property records page.